Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In recent years, this market has witnessed significant changes and challenges. Emerging risks, such as cybersecurity threats and climate change-related events, have forced insurers to adapt and develop new coverage options. The COVID-19 pandemic added further complexity, highlighting the need for business interruption coverage and pandemic-specific policies.

Technological advancements have also transformed the commercial insurance landscape. Insurtech startups are leveraging data analytics, artificial intelligence, and automation to streamline underwriting processes, improve risk assessment, and enhance customer experiences. These innovations are reshaping how policies are priced, purchased, and managed.

Additionally, changing customer demands have pushed insurers to offer more flexible and customizable solutions. Businesses seek tailored coverage that aligns with their unique needs, leading to a shift away from one-size-fits-all policies.

Despite these challenges, the global commercial insurance market remains a vital component of the global economy, providing businesses with the protection they need to thrive and grow. Insurers are continually adapting to meet evolving demands and ensure the resilience of industries worldwide. The market's future will likely be shaped by ongoing technological advancements, regulatory changes, and the ever-evolving landscape of risks faced by businesses.

Key Market Drivers

Emerging Risks and Evolving Coverage Needs

One of the primary drivers in the commercial insurance market is the emergence of new and evolving risks. In recent years, businesses have had to contend with a range of emerging threats, including cybersecurity breaches, climate change-related events, and pandemics like COVID-19. These risks have underscored the need for insurance products that provide coverage tailored to these specific challenges.Cybersecurity, in particular, has become a major concern for businesses of all sizes. The increasing frequency and sophistication of cyberattacks have made it essential for companies to secure robust cyber insurance policies. These policies help mitigate financial losses and reputational damage caused by data breaches and cyber incidents.

Similarly, the pandemic highlighted the importance of business interruption insurance, as many companies faced severe disruptions and revenue losses due to lockdowns and supply chain interruptions. Insurers are adapting by developing pandemic-specific coverage options and enhancing existing business interruption policies to better address such situations.

Technological Advancements and Insurtech

The rapid advancement of technology has had a profound impact on the commercial insurance sector. Insurtech (insurance technology) startups are leveraging innovations like artificial intelligence (AI), data analytics, and automation to transform various aspects of the insurance value chain.Underwriting processes have been streamlined through the use of predictive analytics and machine learning algorithms. These technologies enable insurers to assess risks more accurately and efficiently, leading to more precise pricing and improved risk selection.

Customer experiences are also being enhanced through digital platforms and user-friendly interfaces, making it easier for businesses to purchase and manage insurance policies. Chatbots and virtual assistants are increasingly used for customer support and claims processing, providing quicker and more convenient service.

Additionally, telematics and IoT (Internet of Things) devices are revolutionizing the way insurers assess risk in areas such as commercial auto insurance. These devices track real-time data on vehicle behavior, enabling insurers to offer usage-based insurance policies that reward safe driving habits.

Changing Regulatory Landscape

Regulations play a critical role in shaping the commercial insurance market. Governments and regulatory bodies worldwide impose rules and requirements that insurers must adhere to, affecting their operations and the types of products they can offer.Regulatory changes can impact areas such as capital requirements, solvency standards, and reporting obligations. For example, the implementation of the Solvency II framework in Europe has had significant implications for insurers operating in the region, requiring them to hold adequate capital to cover their risks.

Additionally, changes in laws and regulations can influence the availability and pricing of insurance coverage. Environmental regulations and climate-related disclosure requirements, for instance, are prompting insurers to develop new products that address climate-related risks and offer incentives for environmentally responsible practices.

Globalization and International Business

As businesses expand globally, the demand for international commercial insurance coverage continues to grow. Companies with operations in multiple countries require insurance solutions that can provide seamless coverage across borders.Multinational insurance programs, known as "global insurance" or "multinational pooling," allow businesses to consolidate their insurance needs across various countries. These programs provide centralized management, cost efficiencies, and compliance with local insurance regulations.

The globalization of supply chains has also led to increased interest in trade credit insurance, which protects businesses from the financial impact of non-payment by customers or suppliers. In uncertain economic times, such as during a global recession, the importance of trade credit insurance becomes even more pronounced.

Environmental and Sustainability Considerations

Environmental, social, and governance (ESG) factors are increasingly influencing the commercial insurance market. Businesses are facing pressure from stakeholders, including investors, customers, and regulators, to demonstrate their commitment to sustainability and responsible business practices.Insurers are responding by developing ESG-focused products and integrating sustainability criteria into their underwriting processes. For example, there is a growing market for insurance products related to renewable energy projects, green buildings, and climate risk mitigation.

Furthermore, insurers are recognizing the potential impact of climate change on their portfolios and are working to manage climate-related risks. This includes assessing the exposure of their investments to climate risks and integrating climate risk modeling into their underwriting and pricing strategies.

Key Market Challenges

Pandemic-Induced Uncertainties and Business Interruption Coverage

The COVID-19 pandemic has introduced unprecedented challenges for the commercial insurance market. The widespread business disruptions, lockdowns, and supply chain issues have highlighted gaps in traditional insurance coverage, particularly concerning business interruption.Many standard business interruption policies were not designed to cover losses resulting from a global pandemic, leading to disputes between insurers and policyholders. The ambiguity in policy language and the unprecedented nature of the pandemic have made it challenging to establish clear guidelines for claims.

The insurance industry is grappling with the need to reassess and redefine business interruption coverage to account for such widespread and prolonged disruptions. Insurers are working to develop more comprehensive policies that address pandemics explicitly, and there is an ongoing dialogue between the industry and policymakers to create a framework that balances the interests of insurers and the needs of businesses.

Cybersecurity Threats and Coverage Gaps

The increasing frequency and sophistication of cyberattacks pose a significant challenge to the commercial insurance market. Cybersecurity threats have evolved beyond simple data breaches to sophisticated ransomware attacks and supply chain vulnerabilities. Insurers face the challenge of keeping pace with rapidly evolving cyber risks and ensuring that coverage options remain relevant and effective.One key challenge is the assessment and quantification of cyber risks. The intangible nature of data and the dynamic cyber threat landscape make it difficult for insurers to accurately predict and price cyber insurance policies. Insurers are investing in advanced risk modeling and data analytics to enhance their understanding of cyber risks and improve underwriting processes.

Additionally, there are concerns about potential coverage gaps in standard commercial insurance policies. Businesses may assume that their existing policies adequately cover cyber risks, only to discover that specific cyber incidents require specialized coverage. Insurers are working to educate businesses about the need for dedicated cyber insurance and developing innovative products to address emerging cyber threats comprehensively.

Regulatory Complexity and Compliance Challenges

The commercial insurance market operates within a complex regulatory framework that varies across jurisdictions. Complying with diverse and evolving regulatory requirements poses a challenge for insurers, particularly those with a global footprint.The implementation of new regulations, such as data protection laws and climate-related disclosure requirements, adds layers of complexity to compliance efforts. Insurers must invest in systems and processes that can adapt to changing regulatory landscapes while ensuring that their products and operations align with legal requirements.

Solvency and capital adequacy regulations are critical considerations for insurers, with compliance often requiring substantial financial resources. Striking a balance between regulatory compliance and business efficiency is an ongoing challenge for insurers navigating a landscape of diverse and sometimes conflicting regulatory demands.

Climate Change and Environmental Risks

Climate change poses a multifaceted challenge to the commercial insurance market. The increasing frequency and severity of extreme weather events, such as hurricanes, wildfires, and floods, are leading to higher insurance claims and losses. Insurers are grappling with the need to reassess and recalibrate risk models to account for the evolving climate-related risks.The impact of climate change is not limited to property and casualty insurance; it extends to various sectors, including agriculture, energy, and transportation. Insurers face the challenge of developing specialized products that address the unique risks associated with climate change, such as parametric insurance for extreme weather events.

Furthermore, there is an increased emphasis on integrating environmental, social, and governance (ESG) factors into underwriting processes and investment strategies. Insurers are pressured to align their portfolios with sustainable practices and demonstrate a commitment to mitigating climate-related risks.

Key Market Trends

Digital Transformation and Insurtech Innovations

Digital transformation is at the forefront of trends shaping the commercial insurance market. Insurtech, a portmanteau of insurance and technology, is driving significant changes in how insurers operate, interact with customers, and manage risks.Advanced data analytics and artificial intelligence (AI) are being harnessed for streamlined underwriting processes and more accurate risk assessments. Insurers are leveraging big data to gain insights into customer behaviors, allowing for more personalized and dynamic pricing models.

Customer interactions are being revolutionized through digital platforms, chatbots, and mobile applications. Policyholders can now access information, initiate claims, and communicate with insurers seamlessly, fostering a more responsive and user-friendly experience.

Blockchain technology is making inroads into the insurance sector, offering enhanced security, transparency, and efficiency. Smart contracts on blockchain facilitate automated claims processing and reduce administrative complexities.

Parametric Insurance for Climate and Catastrophic Risks

Parametric insurance is gaining prominence, particularly in addressing climate-related risks and catastrophic events. Unlike traditional insurance, which reimburses actual losses, parametric insurance pays out predetermined amounts based on predefined triggers.For climate risks, parametric insurance can be designed to respond to specific weather events, such as hurricanes, droughts, or floods. This approach enables quicker disbursement of funds to affected parties, helping businesses and communities recover more efficiently.

Catastrophe bonds, a form of parametric insurance in the financial markets, allow investors to provide capital for insurers in exchange for high returns, with payouts triggered by predefined catastrophic events. This innovative financial instrument diversifies risk and provides an alternative source of capital for insurers.

Focus on Cyber Insurance and Cybersecurity

With the increasing frequency and sophistication of cyberattacks, cyber insurance has become a focal point in the commercial insurance market. Businesses are recognizing the critical need for coverage that addresses the financial and reputational impacts of data breaches and cyber incidents.Insurers are continually evolving their cyber insurance products to keep pace with emerging cyber risks. Coverage now extends beyond data breaches to include ransomware attacks, business interruption due to cyber events, and even reputational damage.

Underwriting cyber risk is a complex task, given the ever-changing nature of cyber threats. Insurers are investing in advanced risk modeling, threat intelligence, and partnerships with cybersecurity experts to enhance their ability to assess and price cyber risks accurately.

Evolving Regulatory Landscape and Insurtech Collaboration

The regulatory landscape is undergoing significant changes, influenced by factors such as consumer protection, data privacy, and climate-related considerations. Insurers must navigate complex regulatory environments, and this has led to increased collaboration between traditional insurers and insurtech startups.Insurtech firms are often more agile in adapting to regulatory changes and leveraging technology to ensure compliance. Collaborations and partnerships between insurtechs and established insurers facilitate knowledge exchange, innovation, and the development of solutions that meet evolving regulatory requirements.

Regulatory technology, or Regtech, is playing a crucial role in helping insurers automate compliance processes, manage regulatory reporting, and ensure adherence to the ever-evolving legal frameworks.

Rise of ESG (Environmental, Social, and Governance) Considerations

Environmental, social, and governance (ESG) factors are gaining prominence in the commercial insurance market. Insurers are integrating ESG considerations into their underwriting processes, investment decisions, and risk management strategies.Climate change risks are prompting insurers to assess and disclose their exposure to environmental risks. The development of green insurance products, which provide coverage for renewable energy projects and environmentally sustainable initiatives, is on the rise.

Social considerations, such as diversity and inclusion, are also becoming integral to insurance practices. Insurers are evaluating the social impact of their policies and seeking ways to contribute positively to communities.

Governance factors involve assessing the governance practices of the companies insurers invest in or provide coverage for. Strong governance practices are seen as indicators of a company's resilience and risk management capabilities.

Customization and Personalization of Insurance Products

The demand for personalized and customizable insurance products is growing as businesses seek coverage that aligns precisely with their unique risks and needs. Traditional one-size-fits-all policies are giving way to tailored solutions that provide more relevant and comprehensive coverage.Insurers are leveraging data analytics and technology to understand individual businesses' risk profiles better. This allows for the creation of bespoke insurance products that address specific challenges faced by different industries and companies.

Telematics and the Internet of Things (IoT) are playing a role in the customization of insurance, particularly in areas like commercial auto insurance. IoT devices in vehicles can provide real-time data on driving behavior, allowing insurers to offer usage-based insurance that reflects the actual risk exposure of the insured.

Segmental Insights

Type Insights

Commercial motor insurance has emerged as a growing segment within the broader insurance industry. This expansion can be attributed to several key factors.Firstly, the global economy's continued growth has led to an increase in commercial activities, resulting in a higher demand for commercial vehicles. With more vehicles on the road, there is a corresponding rise in the need for insurance coverage to protect these assets and businesses from potential risks.

Secondly, advancements in technology have played a significant role in the growth of commercial motor insurance. Telematics and IoT (Internet of Things) devices have enabled insurers to collect real-time data on vehicle usage and driver behavior, allowing for more accurate pricing and risk assessment. This has also paved the way for innovative coverage options, such as usage-based insurance, which rewards safe driving practices.

Thirdly, the evolving regulatory landscape and a heightened emphasis on safety standards have made insurance a critical requirement for businesses operating commercial vehicles. Compliance with legal requirements, along with a desire to mitigate financial risks associated with accidents and liabilities, has driven more companies to invest in commercial motor insurance.

Overall, as businesses continue to expand and adapt to changing technology and regulations, commercial motor insurance is expected to remain a robust and growing segment of the insurance market, providing essential protection for the assets and operations of companies relying on commercial vehicles.

Sales Channel Insights

Insurance agents are experiencing a resurgence as a growing and crucial segment within the insurance industry. Several factors contribute to this resurgence.Firstly, despite the proliferation of digital channels, many customers still value the personalized guidance and expertise provided by insurance agents. Agents can offer a human touch, explaining complex policies, assessing individual needs, and providing tailored recommendations. This human element remains highly valued, especially for more intricate insurance products like life insurance or commercial coverage.

Secondly, the increasing complexity of insurance products, particularly in areas like health insurance and retirement planning, has created a demand for knowledgeable intermediaries. Insurance agents bring a wealth of industry knowledge to the table, helping customers navigate intricate policies and select the right coverage for their specific circumstances.

Additionally, regulatory changes and evolving insurance markets have made it essential for customers to stay informed about their insurance options. Agents play a crucial role in keeping clients up to date with the latest industry trends, policy changes, and compliance requirements.

Moreover, the digitization of the insurance industry has empowered agents with advanced tools and platforms that streamline their operations. Agents can now leverage technology to provide quicker quotes, expedite claims processing, and enhance customer service.

In conclusion, insurance agents are thriving as a growing segment due to their ability to offer personalized guidance, navigate complex insurance landscapes, and adapt to digital advancements. Their expertise and customer-centric approach make them indispensable in an evolving insurance ecosystem, meeting the diverse needs of clients seeking trusted advice and comprehensive coverage solutions.

Regional Insights

North America is a burgeoning and dynamic segment in the global insurance industry. Several factors contribute to the region's growth and prominence within the insurance sector.Firstly, the North American insurance market benefits from a robust economy, characterized by a large and diverse business landscape. The United States, in particular, serves as a major hub for insurance activities, with a multitude of domestic and international insurers operating within its borders. This economic stability and diversity generate substantial demand for insurance products, including property and casualty, life, health, and commercial insurance.

Secondly, technological advancements and the rise of insurtech in North America have played a pivotal role in shaping the industry's growth. Insurers in the region have embraced digital innovations to enhance customer experiences, streamline underwriting processes, and develop data-driven pricing models. This embrace of technology has allowed insurers to stay competitive in a rapidly evolving landscape.

Additionally, regulatory changes and consumer demands for more transparent and accessible insurance products have driven innovation in North America. The introduction of new regulations, such as the Affordable Care Act in the United States, has spurred insurance companies to adapt their offerings and processes to comply with evolving legal frameworks.

Moreover, North America is witnessing increased interest in insurance products related to emerging risks, such as cybersecurity, climate change, and parametric insurance for catastrophic events. As these risks become more prominent, insurers in the region are developing specialized coverage solutions to address them.

In conclusion, North America's insurance market is thriving due to its strong economy, technological innovation, regulatory adaptability, and a growing focus on emerging risks. This region is poised to remain a vital and expanding segment within the global insurance industry, providing essential coverage solutions to individuals and businesses alike in an ever-changing risk landscape.

Report Scope:

In this report, the Global Commercial Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Commercial Insurance Market, By Type:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Commercial Insurance Market, By Sales Channel:

- Agents

- Brokers

- Direct

- Others

Commercial Insurance Market, By Industry:

- Manufacturing

- Construction

- IT & Telecom

- Healthcare

- Transportation

- Others

Commercial Insurance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Argentina

- Colombia

- Brazil

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial Insurance Market.Available Customizations:

Global Commercial Insurance market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Allianz SE

- American International Group Inc.

- Aon plc

- Aviva plc

- Axa S.A.

- Chubb Limited

- Direct Line Insurance Group plc

- Marsh & McLennan Companies Inc.

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | November 2023 |

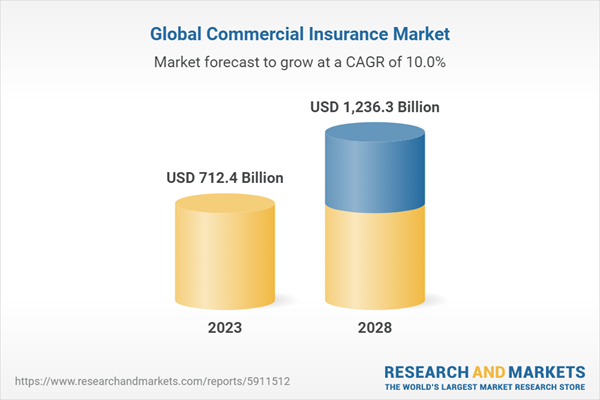

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 712.4 Billion |

| Forecasted Market Value ( USD | $ 1236.3 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |