Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global construction boom, especially in countries like China, the United States, and India, is accelerating demand for durable and high-performance coatings, subsequently driving fluorosurfactant consumption. As construction output is projected to rise from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, the need for quality coatings will intensify, further strengthening the market outlook. Additionally, a shift toward short-chain fluorosurfactants - considered more environmentally sustainable than long-chain variants - reflects growing emphasis on regulatory compliance and eco-conscious product development.

Despite this momentum, the market faces headwinds such as high production costs and health concerns linked to long-chain compounds. Price volatility in raw materials and increasing regulatory pressure also pose challenges. However, opportunities remain strong, particularly through R&D investments and the rising adoption of eco-friendly alternatives, supported by industrial expansion in Asia-Pacific and Latin America.

Key Market Drivers

Growing Demand of Fluorosurfactants from Paints & Coatings Industry

The surge in construction activity and infrastructure development globally is significantly boosting demand for paints and coatings, consequently driving the use of fluorosurfactants. These surfactants improve application properties such as wetting, anti-cratering, and leveling, making them essential in high-performance formulations. In India, for example, the real estate sector is expected to reach USD 5.8 trillion by 2047, contributing around 15.5% to GDP. Government-led investments, such as the USD 133 billion capital expenditure allocation for 2024-25, aim to strengthen infrastructure, which directly benefits the coatings industry. Similar growth trends in the U.S., China, and other nations are reinforcing the need for high-quality surfactants in coatings applications.Key Market Challenges

Volatility in Cost and Availability of Raw Materials

Fluctuating raw material prices present a key challenge for fluorosurfactant manufacturers. The production of these chemicals relies on components derived from crude oil and other processed inputs, which are highly sensitive to market disruptions, geopolitical factors, and regulatory shifts. Supply chain instability can lead to production delays, higher input costs, and increased pricing for finished goods. These dynamics not only strain operational margins but also impact competitiveness, especially in a market where alternative, lower-cost surfactants are readily available.Key Market Trends

Shift Towards Bio-Based Surfactants

A growing emphasis on sustainability is driving the adoption of bio-based surfactants in the fluorosurfactants market. Derived from renewable sources like plant oils and animal fats, these alternatives offer benefits such as low toxicity, higher biodegradability, and reduced environmental impact. Recent advancements in solvent-free, biocatalytic production processes have enabled scalable, eco-friendly manufacturing of panthenol esters and similar compounds. As demand rises for safer, environmentally responsible chemicals, key players are investing in R&D to develop bio-based fluorosurfactants that can meet performance expectations while aligning with global regulatory standards.Key Players Profiled in this Fluorosurfactants Market Report

- 3M Company

- Alfa Chemicals Ltd.

- Chemguard Inc

- DIC CORPORATION

- Geocon Co Ltd

- Innovative Chemical Technologies, Inc.

- MAFLON S.p.A

- Merck KGaA

- OMNOVA Solutions Inc.

- TCI EUROPE N.V.

Report Scope

In this report, the Global Fluorosurfactants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fluorosurfactants Market, by Type:

- Anionic Fluorosurfactants

- Non-Ionic Fluorosurfactants

- Amphoteric Fluorosurfactants

- Cationic Fluorosurfactants

- Others

Fluorosurfactants Market, by Application:

- Paints & Coatings

- Specialty Detergents

- Oilfield & Mining

- Others

Fluorosurfactants Market, by Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fluorosurfactants Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Fluorosurfactants market report include:- 3M Company

- Alfa Chemicals Ltd.

- Chemguard Inc

- DIC CORPORATION

- Geocon Co Ltd

- Innovative Chemical Technologies, Inc.

- MAFLONS.P. A

- Merck KGaA

- OMNOVA Solutions Inc.

- TCI EUROPE N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

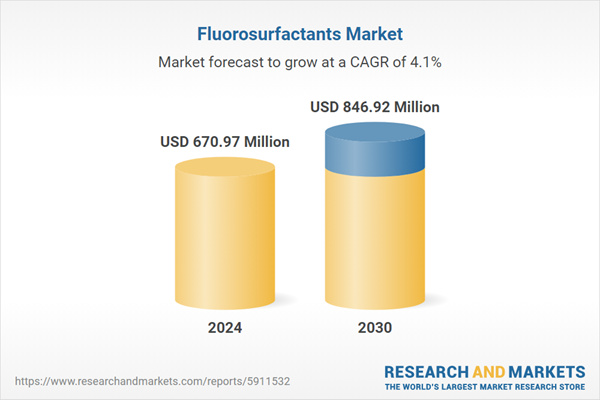

| Estimated Market Value ( USD | $ 670.97 Million |

| Forecasted Market Value ( USD | $ 846.92 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |