Besides, significant progress is being made toward a digitalized scenario as the traditional clinical trial has increased the cost of running trials and the commercial risk of failure. Thereby, clinical studies are driven by the rising adoption of advanced technologies that rapidly accelerate the digital transformation of their processes. In addition, increasing mergers & acquisitions in the cell and gene therapy industry fuels market growth. For instance, in August 2022, Marken acquired Cedra Express’s medical courier business. This acquisition expanded the company as a clinical trial and logistics provider services for cells & gene therapies.

Globally, oncology (cancers) remain the leading cause of death, which has gained the increased attention of biotechnology and pharmaceutical companies to develop new cell and gene therapy. This led to the rise in the innovation of cell and gene therapy, creating immense demand for clinical trial services. Moreover, an increase in favorable government initiatives and innovations in the field of oncology is driving the market for oncology cells and gene therapy clinical trials. Likewise, growing R&D activities for oncology, an increase in favorable government initiatives, and innovations in the field of oncology are driving the market for oncology cell and gene therapy clinical trials. In addition, a growing pipeline of drug candidates for cancer is expected to fuel the segment growth over the forecast period.

The COVID-19 pandemic has impacted the clinical trial supply and logistics market due to a slowdown of overall clinical trial activity in the early stages of the pandemic. The pandemic has led to massive disruption in supply chain management, which became the primary factor restraining the market growth. However, with the adoption of virtual technologies, the CGT clinical trial industry was able to revamp its revenues post-2020.

Furthermore, the key participants are engaged in strategies such as collaboration, partnership, acquisition, agreements, collaborations, and launches, among others, to expand their global footprints and product portfolio. These players offer quality logistics services to strengthen manufacturing, storage, & distribution workflows. For instance, in May 2023, CSafe and Modality Solutions partnered to provide cold chain solutions for cell & gene therapies. The integrated solution will include Modality Solution’s cold chain engineering capabilities and CSafe’s shipping solutions to offer quality, predictability, and regulatory compliance to the CGT supply chain.

U.S. Cell and Gene Therapy Clinical Trial Services Market Report Highlights

- Based on service, the regulatory services segment held the largest share of 21.8% in 2023, owing to increased support for safety, study design, and cell and gene therapy manufacturing, further contributing to the segment growth. These services add major value to clinical trials during the product clinical trials and production

- Based on phase, the phase II segment dominated the market with a revenue share of 48.4% in 2023. Segment growth can be attributed to emerging clinical trial projects and increasing investments in R&D by industry & non-industry sponsors

- Based on therapeutic areas, the oncology segment dominated the market in 2023 with a revenue share of 56.4%. The key factors contributing to the growth include the growing burden of cancer, rising R&D activities for oncology, surging demand for new cell & gene therapy, adoption of personalized medicine, and preclinical studies for cancer immunotherapy

- Based on therapy type, the gene-modified cell therapy segment is anticipated to register the fastest CAGR of 23.6% over the forecast period. High growth is attributed to the increased pipeline for gene-modified cell therapies and innovations in treating cancer, autoimmune conditions, & neurological diseases.

Table of Contents

Companies Profiled

- Novartis AG

- Takeda Pharmaceutical Company Limited.

- Gilead Sciences, Inc.

- Amgen Inc.

- bluebird bio, Inc.

- Regeneron Pharmaceuticals Inc.

- CRISPR Therapeutics

- Pfizer

- Biocair

- Modality Solutions LLC

- BioLife Solutions, Inc.

- Marken

- Yourway

- Almac Group

- Catalent, Inc

- Quick International Courier (QuickStat (Kuehne + Nagel Company)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2023 |

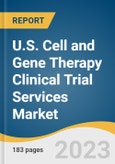

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 6.87 Billion |

| Forecasted Market Value ( USD | $ 28.58 Billion |

| Compound Annual Growth Rate | 22.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 16 |