Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, geopolitical instability presents a major obstacle to market growth, often disrupting supply chains and complicating financing for cross-border projects. Such political tensions frequently result in project delays or cancellations, elevating the risk for potential investors. Despite these challenges, the sector remains resilient in meeting consumption demands. For instance, the Gas Exporting Countries Forum reported that pipeline gas exports rose by 15.06 billion cubic meters in 2024, underscoring the enduring demand for pipeline infrastructure even amidst a volatile global market landscape.

Market Drivers

The increasing global appetite for natural gas as a transitional energy resource is a primary engine for market growth, particularly as countries aim to align decarbonization targets with the necessity for consistent baseload power. Governments and utilities are actively favoring natural gas to replace carbon-intensive coal generation, creating a pressing need for robust transmission networks to transport fuel from producers to consumers. This transition toward lower-carbon fossil fuels is fueling significant volume growth in pipeline throughput across diverse markets. As noted by the International Energy Agency in its January 2024 'Gas Market Report, Q1-2024', global gas demand is anticipated to rise by 2.5% in 2024, a resurgence largely fueled by the industrial and power sectors in rapidly developing Asian economies and colder conditions in established markets.Parallel to this demand is the strategic development of cross-border trade infrastructure, which enables the efficient transport of resources over long distances to bolster energy security. Energy firms are investing heavily in extending transmission lines to link landlocked reserves with international export hubs, thereby reducing supply chain vulnerabilities.

This emphasis on infrastructure expansion is highlighted by significant capital deployment; for example, TC Energy’s '2023 Annual Report' from February 2024 indicates the company placed roughly $5.3 billion of assets into service, demonstrating a sustained financial commitment to network growth. Such infrastructure is vital for managing large extraction volumes, as the U.S. Energy Information Administration's March 2024 'Short-Term Energy Outlook' forecasts U.S. dry natural gas production will average 103.3 billion cubic feet per day in 2024, requiring a network capable of handling this capacity.

Market Challenges

Geopolitical instability poses a significant hurdle to the continued advancement of the Global Gas Pipeline Market, introducing a level of unpredictability that threatens the financial and operational stability essential for cross-border projects. When diplomatic ties between energy-producing and consuming countries worsen, long-term transmission agreements are often suspended or voided due to security apprehensions. The increased threat of sanctions, regulatory barriers, or physical sabotage deters institutional investors from funding these capital-intensive initiatives, leading to the indefinite postponement or cancellation of vital network expansions.This instability disrupts established supply chains and compels dependent regions to seek more flexible but frequently more expensive alternatives, resulting in the underutilization of existing pipeline capacities. The breakdown of traditional trade routes severely restricts the volume of gas moved through fixed infrastructure, thereby limiting the market's reach. As reported by the International Energy Agency in 2024, the proportion of Russian piped gas in the European Union's total demand stayed below 10%, demonstrating how enduring regional conflicts can permanently sever key transmission links and reduce market liquidity. This structural alteration emphasizes the susceptibility of static pipeline networks to evolving political environments.

Market Trends

The incorporation of hydrogen blending capabilities is fundamentally transforming the market as operators retrofit existing infrastructure to handle low-carbon fuels. This trend is motivated by the need to minimize stranded asset risks, enabling traditional transmission systems to transition into multi-molecule networks that support the energy shift. By upgrading compressor stations and pipeline coatings, companies can transport hydrogen-natural gas mixtures or repurpose lines for pure hydrogen, drastically cutting the capital expenditure needed for new construction. This strategic adaptation is becoming integral to long-term planning; for instance, Gas Infrastructure Europe’s November 2024 report, 'European Hydrogen Backbone: Boosting EU Resilience and Competitiveness', outlines a goal to establish a 58,000 km hydrogen network by 2040, with approximately 60% of this infrastructure comprised of repurposed natural gas pipelines.Concurrently, the deployment of AI-driven predictive maintenance systems is revolutionizing operational integrity and emissions control. Operators are increasingly applying machine learning algorithms and satellite monitoring to identify minor leaks and forecast equipment issues before they happen, moving maintenance strategies from reactive to proactive. This adoption of technology not only improves safety and reliability but also directly responds to regulatory mandates to reduce methane leakage across extensive networks. The environmental benefit of these digital tools is quantifiable; according to The Williams Companies, Inc.'s '2023 Sustainability Report' released in July 2024, the firm achieved a 26% decrease in greenhouse gas emissions intensity since 2018, a milestone largely credited to the use of technologies like methane-monitoring satellites and AI-based leak detection.

Key Players Profiled in the Gas Pipeline Market

- Enbridge Inc.

- TC Energy Corporation

- Williams Companies, Inc.

- Kinder Morgan, Inc.

- Chevron Corporation.

- Shell International B.V

- Total Energies SE

- Lumine Group Inc.

- Public Joint Stock Company Gazprom

- Duke Energy Corporation

Report Scope

In this report, the Global Gas Pipeline Market has been segmented into the following categories:Gas Pipeline Market, by Operation:

- Gathering

- Transmission

- Distribution

Gas Pipeline Market, by Application:

- Compressor

- Metering

Gas Pipeline Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Gas Pipeline Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Gas Pipeline market report include:- Enbridge Inc

- TC Energy Corporation

- Williams Companies, Inc

- Kinder Morgan, Inc

- Chevron Corporation.

- Shell International B.V

- Total Energies SE

- Lumine Group Inc

- Public Joint Stock Company Gazprom

- Duke Energy Corporation

Table Information

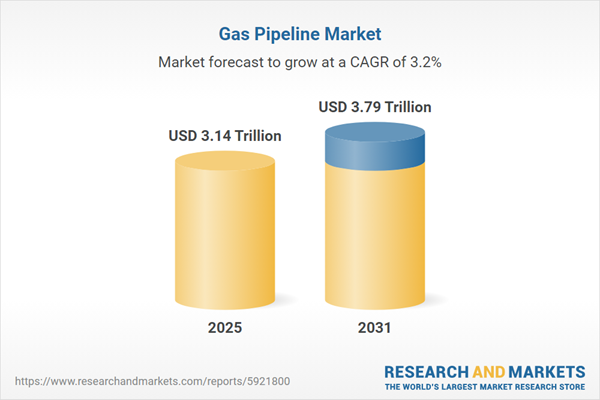

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.14 Trillion |

| Forecasted Market Value ( USD | $ 3.79 Trillion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |