Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The nitrogen market consists of the sales of industrial nitrogen and related services used in a variety of applications, including steel manufacture to stop oxidation and food packaging in the food sector to avoid food spoiling.The market for nitrogen is expanding in part because of the expanding food and beverage sector. In the food and beverage business, nitrogen gas is frequently utilized to package food products. Nitrogen gas prevents oxygen from coming into touch with the food item, extending the shelf life of the food by preventing oxidation. This helps to retain the quality of the food by preventing food deterioration. The need for nitrogen has significantly increased as a result of the expansion of the food and beverage sector. Consequently, this will help the nitrogen industry flourish.

Mechanical severance or fractional refining of air yields industrial nitrogen, a very pure element. It is frequently found in gaseous or liquid form and is utilized in a wide range of end-use processes, including those in the manufacture of metal, food, beverages, chemicals, and agrochemicals. The requirement to maintain the quality and safety of processed food items has increased significantly as a result of the expanding population, especially in developing countries.

Rising applications

The increased use of nitrogen in the food and beverage sector is driving growth in the worldwide industrial nitrogen market. The growing food and beverage industry is one factor driving the growth of the nitrogen market. Nitrogen gas is commonly used in the food and beverage industry to package food goods. By preventing oxygen from coming into contact with the food item, nitrogen gas increases the shelf life of the meal. Halting food degradation, this preserves the food's quality. Moreover, the market is being boosted by the quick advancements achieved in this end-use industry in different areas of the world. A prominent trend that is projected to be crucial in the market's growth dynamics is the rise in the use of nitrogen in the healthcare sector and the manufacture of pharmaceuticals in both emerging and developed areas.Rising demand of nitrogen

Over the next few years, the increased demand for industrial nitrogen in the chemical sector is anticipated to present possibilities for the worldwide market. The market is anticipated to be driven by ongoing developments in cryogenic fraction distillation technology. The market is anticipated to see growth throughout the forecast period as demand for improved food preservation technologies increases.Key Market Challenges

Drawbacks of nitrogen

Liquid nitrogen, which has a boiling point of -196C, is used for a number of things, including a coolant for machinery, treatment to get rid of extra skin, pre-cancerous cells, and cryogenics. The vapor of liquid nitrogen has the potential to quickly freeze skin tissues and even result in cold burns. If someone swallows some of it, it may result in the expansion of liquid nitrogen in the stomach. Since liquid nitrogen may cause frostbite and cryogenic burns which are similar to those caused by steam or hot oil appropriate safety precautions must be taken when handling it due to its extreme coldness. These elements are impeding the expansion of the liquid nitrogen industry.Market Oversupply and Price Volatility:

One of the primary challenges in the industrial nitrogen market is the issue of oversupply. The production of nitrogen often outpaces demand, leading to fluctuations in prices. This oversupply can be attributed to the increased capacity of nitrogen production facilities worldwide. The market dynamics, influenced by factors like global economic conditions and energy prices, contribute to price volatility, making it difficult for both producers and consumers to plan for stable costs

Solution: Implementing effective demand forecasting mechanisms and optimizing production capacities can help align supply with actual market needs. Additionally, diversifying end-use industries and exploring new applications for nitrogen can mitigate the impact of oversupply.Energy Intensive Production Processes:

The production of industrial nitrogen typically involves energy-intensive processes such as the Haber-Bosch method. This method, while effective in producing large quantities of nitrogen, requires a significant amount of energy, mainly derived from fossil fuels. As global concerns about climate change and sustainable practices intensify, the environmental impact of nitrogen production becomes a critical challenge for the industry.

Solution: Research and development efforts focused on developing more energy-efficient production methods, such as alternative nitrogen fixation technologies, can help reduce the industry's carbon footprint. Embracing renewable energy sources for nitrogen production is another avenue to explore.

Dependency on Feedstock Prices:

Nitrogen production is heavily dependent on feedstock prices, especially for natural gas, which is a primary raw material for ammonia production. Fluctuations in natural gas prices can have a direct impact on the overall production cost of nitrogen-based products. This dependency creates vulnerability in the supply chain, affecting both producers and consumers.

Solution: Long-term contracts and strategic partnerships with natural gas suppliers can provide stability in the face of price fluctuations. Additionally, exploring alternative feedstocks and production processes less reliant on specific raw materials can offer resilience to market changes.

Stringent Regulatory Compliance:

The industrial nitrogen sector is subject to various regulations related to environmental emissions, workplace safety, and product quality. Meeting and adhering to these regulations can be challenging for companies, especially smaller ones, due to the costs associated with implementing necessary technologies and processes.

Solution: Investing in research and technology to develop environmentally friendly production methods and ensuring strict compliance with existing regulations are essential. Proactive engagement with regulatory bodies can help in shaping policies that are realistic and conducive to the industry's growth.

Global Economic Uncertainties:

The industrial nitrogen market is highly influenced by global economic conditions. Economic downturns or uncertainties can lead to decreased demand for nitrogen-based products across industries, affecting market growth. The COVID-19 pandemic, for example, highlighted the vulnerability of industries to external shocks.

Diversifying markets and applications for nitrogen products can help mitigate the impact of economic uncertainties. Developing resilient supply chain strategies and maintaining financial flexibility are also crucial in navigating volatile economic conditions.

Technological Advancements and Innovation:

Rapid technological advancements pose both challenges and opportunities for the industrial nitrogen market. On one hand, adopting new technologies can enhance production efficiency and product quality. On the other hand, keeping up with the pace of technological change requires significant investments and poses a risk for companies slow to adapt.

Solution: Continuous investment in research and development is essential for staying competitive in the market. Collaboration with technology providers and fostering a culture of innovation within the industry can help companies stay ahead of the curve.

Global Supply Chain Disruptions:

The interconnectedness of the global economy makes the industrial nitrogen market susceptible to supply chain disruptions. Events such as natural disasters, geopolitical tensions, or pandemics can disrupt the production and transportation of nitrogen products, leading to shortages and price spikes.

Solution: Building robust and diversified supply chains, strategic stockpiling of critical raw materials, and developing contingency plans for various scenarios can enhance the industry's resilience to supply chain disruptions

The global industrial nitrogen market faces a range of challenges that require proactive and innovative solutions. From market oversupply and price volatility to environmental concerns and technological advancements, industry players must navigate a complex landscape to ensure sustained growth. While challenges are inherent, they also present opportunities for collaboration, research, and development to create a more resilient and sustainable nitrogen industry. Addressing these challenges collectively will be crucial for the industry to adapt to evolving market dynamics and contribute positively to global industrial development.Key Market Trends

Industrial nitrogen is a high-purity element obtained through mechanical severance or fractional refinement of air. It is commonly found in gaseous or liquid form and is used in a variety of end-use processes including healthcare, food and beverage, automotive, chemicals, agrochemicals, and metal production. The growing population, particularly in developing nations, has resulted in a significant increase in the consumption of processed food products, as well as the need to preserve their quality and safety. Additionally, the product helps to reduce the chance of rotting and discoloration. Pharmaceutical, food packing, metal production, petroleum, materials, and chemical plants are some of the key industries that use industrial nitrogen. The market is being driven by nitrogen gas’s ability to displace or eliminate oxygen, most notably in mining, food packing, and chemical facilities. Nitrogen can be manufactured for industrial use in a variety of ways, including fractional distillation, polymeric membranes, and pressure swing adsorption. Industry players are working to improve the efficiency of these processes, which will aid in the constant evolution of the Industrial Nitrogen Market.Adoption of Industrial Nitrogen

The Industrial Nitrogen Market has grown substantially in recent times because of its widespread use as a retention agent in the food and beverage industries. Industrial nitrogen contributes to the creation of a dry atmosphere, which prevents food from spoiling due to oxygen and moisture. Furthermore, it is utilized to extend the shelf life of foods and keep them fresh, which increases the need for industrial nitrogen and is expected to drive demand in the Industrial Nitrogen Market in the forecasted period.Segmental Insights

Form Insights

Compressed nitrogen gas is one of the major components of industrial gas system. High purity and low purity gases are used in the system of cryogenic fractional distillation, pressure swing adsorption, and membrane separation. As compressed nitrogen gas is a cost-effective and economical process for high-production-rate facilities, cryogenic fraction distillation is a widely used technology in the production of high-purity industrial gases. The need for compressed nitrogen gas is predicted to rise in cylinder systems of cryogenic fractional distillation, pressure swing adsorption, and membrane separation throughout the forecast period.Application Insights

On the basis of application, the food & beverages segment dominated the global industrial nitrogen market in 2021. Nitrogen is used in modified atmosphere packaging to keep commercially made food items fresher for longer. It is also used to extend product shelf life and retain freshness, which aids in the packing and storage of food and drinks.Country Insights

On the basis of geography, Asia-Pacific is expected to continue to be among the most alluring markets, and this region is accounted for the majority revenue share in the market throughout the projection period. The major portion of the global nitrogen market is located in Asia Pacific. This can be a result of the area's quick growth and expanding population. Furthermore, it is anticipated that this region's healthcare system would improve over the next years, which will increase demand for nitrogen.Asia-Pacific is projected to register a robust growth during the forecast period. Nitrogen gas may be obtained and used in a variety of applications, ranging from food packaging to medicines in the region. China is the largest consumer of nitrogen, followed by India. Asia-Pacific accounted for the largest share of the Industrial Nitrogen Market in 2020. This can be attributed to rapid industrialization and expanding population in the region. Moreover, the advancements in the healthcare sector in this region are likely to boost the demand for industrial nitrogen in the coming years. Also, the increasing use of ammonia-based fertilizers in agrarian countries to increase the fertility of the land is expected to drive market growth during the forecast period.

Report Scope:

In this report, the Global Industrial Nitrogen Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Industrial Nitrogen Market, By Form:

- Compressed Gas

- Liquid Nitrogen

Global Industrial Nitrogen Market, By Application:

- Metal Manufacturing and Fabrication

- Oil and Gas

- Pharmaceutical and Healthcare

- Chemical

- Food and Beverages

- Electronics

- Others

Global Smart Waste Management Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Nitrogen Market.Available Customizations:

Global Industrial Nitrogen Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- nexAir

- Universal Industrial Gases, Inc.

- Praxair, Dubai Industrial Gases

- Ellenbarrie Industrial Gases Ltd

- Parker Hannifin Corp.

- Omega Air

- Messer Group

- Yingde Gases Group

- Gulf Cyro

- Air Products and Chemicals, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

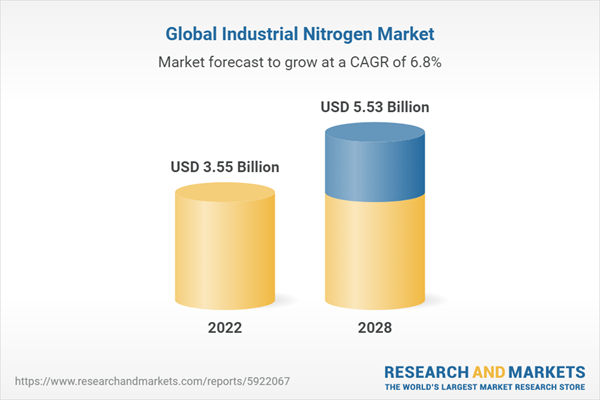

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.55 Billion |

| Forecasted Market Value ( USD | $ 5.53 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |