Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

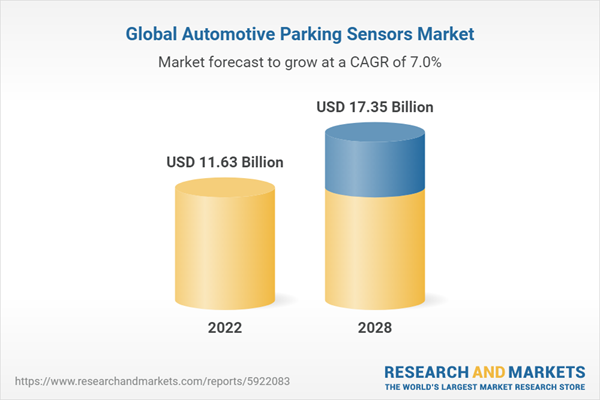

The Global Automotive Parking Sensors Market is experiencing a robust growth trajectory, driven by the escalating demand for advanced driver assistance systems (ADAS) and the increasing focus on vehicular safety. These parking sensors have emerged as essential components in modern vehicles, particularly in urban environments where parking spaces are limited. As of [current date], the market is witnessing heightened adoption due to stringent safety regulations and a surge in consumer awareness regarding the benefits of parking assistance technologies.

The automotive parking sensors market encompasses a variety of sensor technologies, including ultrasonic, electromagnetic, and camera-based systems. Ultrasonic sensors, utilizing sound waves, are widely deployed for their accuracy in detecting obstacles during parking maneuvers. Electromagnetic sensors provide proximity-based alerts, while camera-based solutions offer visual assistance, enhancing precision during parking. The integration of these technologies underscores the industry's commitment to providing comprehensive and reliable parking solutions to cater to diverse consumer needs.

The demand for parking sensor systems is not limited to passenger cars but extends to commercial vehicles, contributing to the market's overall growth. As automakers increasingly prioritize safety features, parking sensors have become integral components of new vehicle models, influencing consumer purchasing decisions. The market's trajectory is further shaped by ongoing research and development initiatives, aimed at enhancing the efficiency, accuracy, and integration of parking sensor technologies.

The Automotive Parking Sensors Market is characterized by a competitive landscape, with key players continually innovating to gain a competitive edge. Collaborations and partnerships between sensor manufacturers and automotive OEMs are becoming commonplace, fostering technological advancements and market expansion. With the global automotive industry's sustained focus on safety and the gradual integration of autonomous driving capabilities, the Automotive Parking Sensors Market is poised for continued growth, offering a glimpse into the future of safer and more convenient parking experiences for drivers worldwide.

Key Market Drivers

Mandatory Safety Regulations

The stringent implementation of safety regulations globally is a primary driver for the Global Automotive Parking Sensors Market. Governments and regulatory bodies across regions have mandated the inclusion of safety features in vehicles to reduce accidents and enhance road safety. Parking sensors, offering collision avoidance capabilities, align with these regulations, compelling automakers to integrate these systems into their vehicles to meet compliance standards.Increasing Consumer Demand for Advanced Safety Features

The growing awareness among consumers regarding vehicle safety has significantly contributed to the uptake of automotive parking sensors. As drivers seek enhanced safety features in their vehicles, parking sensors have become a crucial aspect of the overall safety package. The market is driven by consumer preferences for vehicles equipped with advanced driver assistance systems (ADAS), including parking assistance technologies that mitigate the risks associated with parking and low-speed maneuvers.Urbanization and Limited Parking Spaces

The rise in urbanization and the consequent scarcity of parking spaces have intensified the need for effective parking solutions. Automotive parking sensors address the challenges posed by crowded urban environments, enabling drivers to navigate and park in tight spaces with greater ease. The market is driven by the urban lifestyle trends that necessitate smart parking technologies to optimize vehicle parking in densely populated areas.Integration with Connected Car Technologies

The integration of parking sensors with connected car technologies is a notable driver. The automotive industry's evolution toward connected and autonomous vehicles has spurred the integration of parking sensors with in-car connectivity systems. This integration not only enhances the functionality of parking sensors but also contributes to the overall connected driving experience, driving market growth as consumers increasingly seek seamless and technologically advanced solutions.Rising Incidence of Accidents During Parking

The increasing frequency of accidents that occur during parking maneuvers has elevated the importance of parking sensors. These sensors provide real-time alerts and assistance, reducing the likelihood of collisions with objects or pedestrians. The market is propelled by the imperative to address the specific safety challenges associated with parking, making parking sensors indispensable in preventing accidents and minimizing damage.Automotive OEMs' Emphasis on Safety Innovation

Original Equipment Manufacturers (OEMs) in the automotive industry are placing a strong emphasis on safety innovation to differentiate their vehicle models. Parking sensors have become a focal point of safety feature portfolios, with automakers incorporating advanced sensor technologies to enhance the safety credentials of their vehicles. The competitive landscape is characterized by OEMs vying to offer cutting-edge safety features, intensifying market growth.Rise in Commercial Vehicle Segment

The demand for parking sensors extends beyond passenger cars to include commercial vehicles. The commercial vehicle segment is experiencing growth, driven by increased logistics and transportation activities. Fleet operators and businesses prioritize safety in their commercial vehicle fleets, contributing to the adoption of parking sensors to mitigate the risks associated with maneuvering larger vehicles in diverse environments.Technological Advancements in Sensor Technologies

Continuous advancements in sensor technologies, including ultrasonic, electromagnetic, and camera-based systems, propel market growth. Innovations in sensor capabilities, such as improved accuracy, wider detection ranges, and integration with other ADAS functionalities, contribute to the appeal of parking sensors. The market is influenced by ongoing research and development initiatives aimed at enhancing the performance and reliability of parking sensor technologies, driving adoption across diverse vehicle segments.Key Market Challenges

Cost Implications and Affordability Concerns

Despite the growing demand for automotive parking sensors, one significant challenge revolves around cost implications. The integration of advanced sensor technologies can increase the overall manufacturing cost of vehicles, potentially impacting affordability for certain consumer segments. Striking a balance between offering advanced safety features and maintaining cost-effectiveness remains a challenge for automakers.Complexity of Integration

The seamless integration of parking sensor technologies into diverse vehicle models poses a considerable challenge. Each vehicle type may require a tailored approach to ensure optimal sensor placement and functionality. This complexity can result in challenges for automotive manufacturers in streamlining the integration process, potentially leading to variations in performance and reliability across different vehicle models.Sensor Calibration and Maintenance

Ensuring accurate calibration and ongoing maintenance of parking sensors are critical challenges. Environmental factors, normal wear and tear, or even minor impacts can affect sensor accuracy over time. Calibration procedures must be precise, and regular maintenance is essential to guarantee the continued reliability of the parking sensor system. The challenge lies in establishing user-friendly calibration processes and educating vehicle owners on the importance of maintenance.False Alarms and Sensor Sensitivity

The risk of false alarms and sensor sensitivity issues can undermine the effectiveness of parking sensors. Environmental conditions, such as inclement weather or the presence of reflective surfaces, may trigger false alerts. Striking the right balance between sensor sensitivity and mitigating false alarms is a persistent challenge, as overly sensitive sensors may lead to unnecessary alerts, causing driver frustration and potentially reducing user confidence in the system.Limited Effectiveness in Certain Environments

Parking sensors may face limitations in certain environmental conditions, such as extremely crowded or irregularly shaped parking spaces. The effectiveness of sensors can be compromised in scenarios where unconventional obstacles or challenging terrains are prevalent. Addressing these limitations and ensuring consistent performance across diverse parking scenarios present ongoing challenges for the automotive industry.Data Security and Privacy Concerns

The integration of parking sensors, especially those linked to connected car technologies, raises data security and privacy concerns. Collecting and transmitting data related to parking behaviors and vehicle movements could make vehicles vulnerable to cybersecurity threats. Balancing the benefits of connectivity with robust security measures to safeguard sensitive information is a challenge faced by manufacturers as they strive to deliver advanced parking sensor solutions.Global Regulatory Variations

The global automotive market is subject to varying safety and regulatory standards across regions. Adhering to diverse regulatory requirements poses a challenge for manufacturers aiming to offer standardized parking sensor systems worldwide. Navigating these variations requires a nuanced approach to compliance, which can be resource-intensive for multinational automotive companies.Integration with Autonomous Driving Technologies

As the automotive industry moves toward autonomous driving capabilities, integrating parking sensors seamlessly with these advanced technologies poses a challenge. The coordination between parking sensors and autonomous features necessitates sophisticated software and hardware integration. Ensuring a smooth transition from parking assistance to autonomous driving modes without compromising safety remains a complex challenge for automakers investing in both technologies.Key Market Trends

Integration of Artificial Intelligence (AI) and Machine Learning (ML)The Global Automotive Parking Sensors Market is witnessing a prominent trend towards the integration of AI and ML technologies. This trend goes beyond traditional proximity sensing, allowing parking sensors to adapt and learn from various parking scenarios. AI-driven parking sensors can enhance accuracy, predict user preferences, and optimize parking maneuvers in real-time, contributing to a more intelligent and efficient parking experience.

Advanced Sensor Technologies

A key trend in the market is the continuous evolution of sensor technologies. Manufacturers are investing in advanced sensor types, including ultrasonic, electromagnetic, and camera-based systems. Ultrasonic sensors excel in detecting obstacles, electromagnetic sensors provide proximity-based alerts, and camera-based systems offer visual assistance. This diversified approach caters to different user preferences and specific parking scenarios, driving innovation in the automotive parking sensor landscape.Connected Car Technologies

The increasing trend of connected cars is influencing parking sensor developments. Parking sensors are becoming an integral part of connected car ecosystems, allowing for seamless communication between the vehicle and external infrastructure. This connectivity enhances functionalities such as remote parking assistance, smart parking management, and real-time data sharing, contributing to a more connected and efficient parking experience.Rise of Electric and Hybrid Vehicles

The growing adoption of electric and hybrid vehicles is impacting parking sensor trends. Manufacturers are developing parking sensors specifically tailored to the unique acoustic characteristics of electric vehicles. Additionally, the integration of parking sensors into electric and hybrid powertrains requires considerations for energy efficiency and optimal utilization, reflecting a trend driven by the shift towards greener automotive solutions.Enhanced User Interfaces and Displays

The trend towards user-centric design is shaping the development of parking sensors. Manufacturers are focusing on creating intuitive user interfaces and displays that provide real-time feedback and visualizations. Enhanced displays not only improve user experience during parking maneuvers but also contribute to overall vehicle aesthetics. This trend reflects the importance of user-friendly design in ensuring broader consumer acceptance of parking sensor technologies.Expansion of Automated Parking Systems

Automated parking systems are gaining traction as a significant trend in the automotive parking sensor market. These systems go beyond traditional parking assistance by automating the entire parking process. Users can delegate parking tasks to the vehicle, which relies on advanced parking sensors and control systems to navigate and park autonomously. The expansion of automated parking systems aligns with the broader trend towards autonomous driving technologies.Integration with Augmented Reality (AR)

The incorporation of augmented reality (AR) into parking sensor systems is emerging as a notable trend. AR overlays digital information onto the real-world environment, providing users with enhanced visual guidance during parking maneuvers. Parking sensors, in conjunction with AR, can offer dynamic visualizations, highlighting obstacles and optimal parking paths. This trend showcases the industry's commitment to leveraging innovative technologies to improve the precision and ease of parking.

Focus on Sustainable and Eco-Friendly Solutions

Sustainability is becoming a growing trend in the automotive industry, influencing parking sensor developments. Manufacturers are exploring eco-friendly materials for sensor components and incorporating sustainable practices in the manufacturing process. This trend aligns with broader environmental initiatives in the automotive sector, reflecting a commitment to responsible and sustainable technology development in the parking sensor market.Segmental Insights

By Type

Reverse sensors, also known as rear parking sensors, constitute a significant segment in the automotive parking sensor market. These sensors are strategically placed at the rear of the vehicle and are designed to detect obstacles or objects in the vehicle's path while reversing. The primary goal of reverse sensors is to enhance safety during parking maneuvers, particularly in tight spaces where visibility may be limited. These sensors typically utilize ultrasonic or electromagnetic technology to detect objects behind the vehicle and provide audible alerts to the driver. The reverse sensor segment is witnessing continuous advancements in technology to improve accuracy, responsiveness, and integration with other safety features.Front sensors represent another crucial segment in the automotive parking sensor market. Positioned at the front of the vehicle, these sensors serve to detect obstacles or objects in the vehicle's path when moving forward. While front sensors may not be as prevalent as reverse sensors, they play a significant role in enhancing overall parking safety and maneuverability. Front sensors are particularly valuable in urban environments with crowded spaces, helping drivers navigate through traffic and avoid collisions with objects in the vehicle's forward path. Similar to reverse sensors, front sensors leverage various technologies, including ultrasonic and electromagnetic, to provide real-time feedback to the driver.

The choice between reverse and front sensors often depends on the specific parking challenges faced by drivers. Some vehicles may feature a comprehensive parking sensor system that includes both front and rear sensors for comprehensive coverage. As the automotive industry continues to prioritize safety and convenience features, the development and adoption of advanced reverse and front sensors are expected to remain integral to the evolution of parking assistance technologies. Manufacturers are likely to focus on refining the capabilities of both types of sensors, ensuring seamless integration into modern vehicles for an enhanced driving experience.

Regional Insights

North America, the adoption of automotive parking sensors is driven by a strong emphasis on road safety and the incorporation of advanced driver assistance systems (ADAS) in vehicles. Stringent safety regulations and the increasing consumer demand for innovative safety features contribute to the growth of the parking sensor market. Urbanization, particularly in densely populated cities, has fueled the need for parking assistance technologies. Additionally, the presence of key automotive manufacturers and the early adoption of connected car technologies further boost the market in this region.Europe is a prominent market for automotive parking sensors, owing to the region's commitment to stringent safety standards and environmental sustainability. The European automotive industry places a strong emphasis on integrating safety features into vehicles, and parking sensors align with this focus. The trend towards electric vehicles (EVs) and the rise of smart cities contribute to the demand for parking sensors that facilitate efficient and eco-friendly parking. European consumers, known for their affinity towards advanced automotive technologies, are driving the adoption of parking sensors with features like autonomous parking assistance.

The Asia-Pacific region is a dynamic and rapidly growing market for automotive parking sensors. Factors such as increasing urbanization, a rising middle class, and the growing number of vehicles on the road contribute to the demand for parking assistance technologies. In densely populated cities across countries like China and India, where parking spaces are limited, parking sensors play a crucial role in enhancing parking efficiency and preventing collisions. The adoption of connected car technologies is also on the rise, further propelling the growth of the market in the Asia-Pacific region.

Latin America exhibits a growing interest in automotive parking sensors, influenced by improving economic conditions and a rising awareness of vehicle safety. As consumers in the region seek advanced features in their vehicles, parking sensors become a desirable technology. The Latin American market is characterized by a mix of established and emerging automotive markets, with regional variations in the adoption of parking sensor technologies.

In the Middle East and Africa, the automotive parking sensor market is influenced by factors such as urban development, increasing vehicle ownership, and a focus on luxury vehicles equipped with advanced features. The market dynamics vary across different countries in the region, with some nations witnessing a higher adoption rate due to infrastructure development and a preference for premium vehicles.

Overall, the global automotive parking sensor market reflects a regional diversity shaped by economic conditions, regulatory landscapes, and the evolving preferences of consumers in each geographical area. Manufacturers and suppliers in the industry strategically tailor their offerings to align with the specific needs and trends prevalent in each region.

Report Scope:

In this report, the Global Automotive Parking Sensors Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Parking Sensors Market, By Type:

- Reverse sensors

- Front Sensors

Automotive Parking Sensors Market, By Sales Channel:

- OEM

- Aftermarket

Automotive Parking Sensors Market, By Technology:

- Ultrasonic

- Electromagnetic

- Infrared

- Laser

Automotive Parking Sensors Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Automotive Parking Sensors Market.Available Customizations:

Global Automotive Parking Sensors Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Aptiv PLC

- Denso Corporation

- NXP Semiconductors N.V.

- Valeo

- Autoliv Inc.

- Gentex Corporation

- Continental AG

- TGS Group

- Murata Manufacturing Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 11.63 Billion |

| Forecasted Market Value ( USD | $ 17.35 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |