The automotive parking sensor market is experiencing robust growth, driven by the increasing demand for advanced driver assistance systems (ADAS) and smarter parking solutions. Parking sensors, critical proximity devices, assist drivers by detecting obstacles during parking, enhancing safety and convenience. These sensors are typically installed at the front, rear, or both ends of vehicles. The rising incidence of parking-related accidents has heightened the need for such technologies, fueling their adoption across various car manufacturers and models. Continued investments in ADAS are expected to further propel market expansion during the forecast period.

Market Segmentation

By Sensor Type

The market is divided into front and reverse parking sensors. Reverse parking sensors dominate, holding a significant share due to their critical role in simplifying the parking process, particularly in tight spaces. Their widespread use reflects their importance in enhancing driver confidence and vehicle safety.By Technology

The market segments technologies into ultrasonic and electromagnetic sensors. Electromagnetic sensors lead the market, favored for their ability to provide a broader field of view and ease of installation within vehicle bumpers. This makes them a preferred choice for manufacturers aiming to integrate seamless parking solutions.By End-User

The market is categorized into original equipment manufacturers (OEMs) and aftermarket segments. OEMs currently hold a dominant share, as major automakers increasingly integrate parking sensors into new vehicles as standard features. However, the aftermarket segment is poised for growth as older vehicles are retrofitted with advanced parking solutions to meet rising consumer demand for safety features.By Vehicle Type

The market is segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles account for the largest share, driven by high consumer demand for personal cars equipped with advanced parking aids. This segment’s dominance reflects the growing emphasis on safety and convenience in personal transportation.By Geography

Geographically, the market is divided into North America, Europe, the Middle East & Africa, Asia-Pacific, and South America. The Americas currently lead, with expectations of continued growth due to strong automotive production and consumer demand for ADAS-equipped vehicles. Europe also holds a substantial share, supported by stringent safety regulations and widespread adoption of advanced automotive technologies, with further growth anticipated.Competitive Landscape

The global automotive parking sensor market is highly competitive, featuring a mix of established global players and regional competitors. Key players include Robert Bosch GmbH, Valeo, Continental AG, Xvision Ltd, Scorpion Automotive Ltd, Aptiv plc, and Murata Manufacturing Co., Ltd. These companies drive innovation, focusing on enhancing sensor accuracy and integration with broader ADAS platforms to maintain market leadership.Conclusion

The automotive parking sensor market is poised for significant growth, driven by safety demands, ADAS investments, and technological advancements. With reverse and electromagnetic sensors leading their respective segments, and OEMs dominating end-user adoption, the market reflects a strong push toward safer, smarter parking solutions. The Americas and Europe remain key regions, while competitive dynamics underscore the importance of innovation in sustaining market position.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Segmentation

By Sensor Type

- Front Parking

- Reverse Parking

By Technology

- Ultrasonic

- Electromagnetic

By Sales Channel

- OEMs

- Aftermarket

By Vehicle Type

- Passenger

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Valeo

- Continental AG

- Xvision Ltd

- Scorpion Automotive Ltd

- Aptiv plc

- Murata Manufacturing Co., Ltd.

- Nedap

- Rydeen Mobile Electronics

- FABTEC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

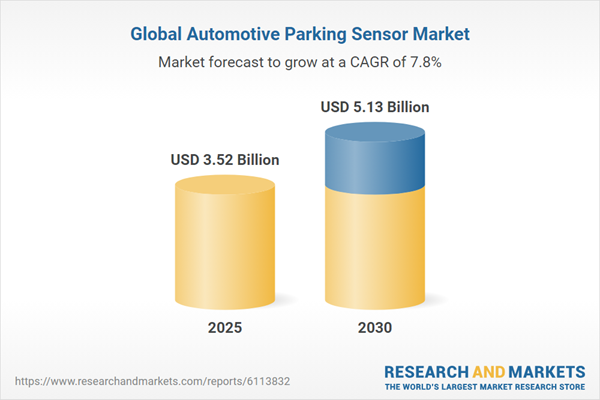

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.52 Billion |

| Forecasted Market Value ( USD | $ 5.13 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |