Speak directly to the analyst to clarify any post sales queries you may have.

Senior executives steering procurement and strategy in the bus market face a period of rapid transformation driven by advances in technology, evolving policy landscapes, and complex operational demands. Maximizing value today means embracing innovation while maintaining agility in sourcing and fleet management decisions.

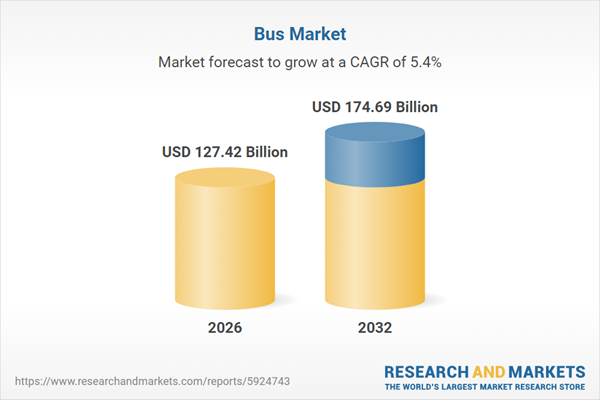

Market Snapshot: Bus Market Size, Growth, and Outlook

The global bus market grew from USD 121.16 billion in 2025 to USD 127.42 billion in 2026, with a projected CAGR of 5.36% that is set to propel the market to USD 174.69 billion by 2032. Key growth drivers include ongoing electrification initiatives, developing regulatory frameworks, and concentrated investments in both public and private mobility infrastructure. The market’s diversity fosters opportunities for fleet renewal, supported by the accelerating integration of sustainable technologies and government-driven modernization programs.

Scope & Segmentation of the Bus Market

- Vehicle Types: City buses, coach buses, minibuses, and school buses—each segment defined by chassis design, accessibility features, and varying levels of passenger comfort.

- Fuel and Propulsion Technologies: Diesel, compressed natural gas (CNG), battery electric, fuel cell, and hybrid models—options that enable deployment across urban, intercity, and tourism applications.

- Applications: Public transit, private fleet operations, school transportation, and tourism—each with distinct operational and policy frameworks influencing service and capacity needs.

- Seating Capacities: Up to 30 seats, 31–50 seats, and above 51 seats—configurations that impact maintenance demands, spare part procurement, and suitability for specific routes or duty cycles.

- Regional Coverage: Americas, Europe, Middle East & Africa, and Asia-Pacific—regions marked by varying regulatory standards, infrastructure maturity levels, and commercial conditions.

Key Takeaways for Senior Decision-Makers

- Electrification and alternative powertrain adoption are advancing, with hydrogen and battery technologies reshaping fleet strategies and long-term cost frameworks.

- Regulatory tightening fuels demand for cleaner buses, prompting investments in compliant fleets and influencing procurement priorities, particularly in metropolitan and intercity routes.

- Digitalization, especially the use of telematics and advanced fleet management tools, enhances service efficiency, asset longevity, and data-driven maintenance.

- Procurement strategies benefit from energy-focused partnerships and the adoption of modular vehicle platforms, facilitating adaptation to evolving infrastructure capabilities and route-specific needs.

- Cross-functional collaboration among procurement, engineering, and commercial teams remains essential to mitigate supply chain risks and respond to local content mandates or tariff exposures.

Tariff Impact: Adjusting Procurement and Sourcing Strategies

Amendments to United States tariff policy in 2025 have reshaped approaches to component sourcing and procurement. Higher tariffs on vehicle parts and assemblies trigger a shift toward nearshoring and localized assembly, compelling operators and manufacturers to revise supplier agreements and manage costs more strategically. Closer regional supplier relationships support business continuity and offset inflationary pressures from tariffs, while fleet planning increasingly emphasizes options that optimize both import content and total lifecycle value.

Competitive & Regional Landscape

Regional Perspectives on Modernization

- In the Americas, public funding and collaboration with energy providers support fleet electrification efforts and address infrastructure bottlenecks.

- Across Europe, the Middle East, and Africa, the adoption of low-emission technologies is expanding, reflecting regulatory mandates and ambitious renewal objectives in markets with varying infrastructure development.

- Asia-Pacific advances large-scale electric bus deployment in metropolitan areas, combining robust manufacturing capacity with policy-driven incentives, while emerging economies focus on affordability and improved environmental performance.

Competitive Dynamics & Value Propositions

- Vehicle manufacturers prioritize modular engineering to quickly adapt platforms for emerging propulsion systems, responding to regulatory and operational shifts.

- Specialist suppliers offer expertise in battery integration, advanced power electronics, and hydrogen solutions, enabling retrofits and turnkey system deliveries that accelerate fleet modernization.

- Service models now place increased emphasis on predictive maintenance, aftermarket support, and localized parts distribution to optimize vehicle uptime and customer retention.

Methodology & Data Sources

This research integrates structured interviews with key stakeholders—including operators, OEMs, infrastructure partners, and regulators—with comprehensive industry report analysis and review of technical specifications. Technology benchmarking, scenario modeling, and holistic supply chain mapping have shaped actionable guidance for procurement and operational strategy.

Why This Report Matters for Bus Market Stakeholders

- Advances evidence-based strategic planning by clarifying the impact of technology, policy, and operational trends that redefine competitive positioning.

- Reinforces resilience in sourcing and modernization initiatives with targeted analysis of risks and emerging opportunities within diverse global regions.

- Assists senior leaders in aligning investments and procurement decisions with regulatory timelines, market-specific demands, and sustainability goals.

Conclusion

The bus market is undergoing dynamic transition anchored by technology adoption, regional strategic responses, and growing demand for flexible, sustainable fleet solutions. Stakeholders who adapt their approaches to procurement, partnerships, and modular platforms will capture substantial long-term value and enhance their competitive positioning.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Bus Market

Companies Mentioned

The key companies profiled in this Bus market report include:- Alexander Dennis Limited

- Anhui Ankai Automobile Co., Ltd.

- Blue Bird Corporation

- BYD Company Limited

- Ebusco B.V.

- Eicher Motors Limited

- EvoBus GmbH

- Fujian King Long United Automotive Industry Co., Ltd.

- Hyundai Motor Company

- Irizar S. Coop.

- IVECO S.p.A.

- JBM Auto Limited

- Mahindra & Mahindra Limited

- Marcopolo S.A.

- NFI Group Inc.

- Otokar Otomotiv ve Savunma Sanayi A.Ş.

- Proterra Inc.

- Scania CV AB

- Solaris Bus & Coach S.A.

- Temsa Skoda Sabancı Ulaşım Araçları A.Ş.

- Volvo Bus Corporation

- Xiamen Golden Dragon Bus Co., Ltd.

- Zhengzhou Yutong Bus Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 127.42 Billion |

| Forecasted Market Value ( USD | $ 174.69 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |