Rising Popularity of Clean-Label and Organic Meat Snacks Fuels South & Central America Meat Snacks Market

People are getting highly concerned about the food they consume, paying more attention to product labels and ingredients used in processed food products. Organic products are becoming increasingly popular due to their perceived health benefits. They are free of pesticides, chemical fertilizers, and genetically modified organisms (GMOs) that increase their appeal and convince consumers to pay more. The rising concern over the use of synthetic or chemical additives, such as preservatives, flavor enhancers, and colors, increases the preference of clean-labeled products. Therefore, meat snacks producers are developing products with all natural and minimally processed ingredients.Clean-label trend is gaining popularity across the meat industry. Consumers are preferring all-natural and less-processed meat products that offer high nutritional benefits. Organic and clean-label meat snacks are made from organically raised beef, chicken, or pork. These snacks are free of synthetic additives, such as colors, anti-caking agents, stabilizers, and preservatives. The rising demand for clean-label and organic meat snacks is expected to provide lucrative growth opportunities in the South & Central America meat snacks market during the forecast period.

South & Central America Meat Snacks Market Overview

The South & Central America meat snacks market is segmented into Brazil, Argentina, and the Rest of South & Central America. High consumption of meat-based products and a shift in consumer lifestyle and dietary patterns are the major factors driving the market growth in South & Central America, especially in Brazil. The production of Brazilian beef is increasing with the flourishment of exports. According to Agriculture and Horticulture Development Board (AHDB), in June 2022, Brazil became the largest beef exporter and exported 469,000 tons of fresh and frozen beef in 1st quarter of 2022, an increase of 37% (~126,000 tons) from 1st quarter of 2021. Moreover, as per projections by the US Department of Agriculture, Brazil is likely to reach 2.9 million metric tons of beef exports by 2028, accounting for 23% of the total beef exports worldwide. Meat snack products such as jerky, sausages, and meat strips & sticks sourced from beef are a major part of people’s diets due to the taste and nutritional content of such products. These products are enriched with vital micronutrients such as vitamins, protein, and iron. Moreover, the presence of prominent players such as Conagra Brands, Inc.; Organic Valley; Bridgford Food Corporation; and Tyson Foods Inc. are actively operating across the region, which is anticipated to fuel the meat snacks market across South & Central America.South & Central America Meat Snacks Market Revenue and Forecast to 2028 (US$ Million)

South & Central America Meat Snacks Market Segmentation

The South & Central America meat snacks market is segmented into type, source, category, distribution channel, and country.Based on type, the South & Central America meat snacks market is segmented into jerky, meat sticks, sausages, and others. The jerky segment registered the largest South & Central America meat snacks market share in 2022.

Based on source, the South & Central America meat snacks market is segmented into beef, chicken, pork, and others. The beef segment held the largest South & Central America meat snacks market share in 2022.

Based on category, the South & Central America meat snacks market is segmented into plain and flavored. The flavored segment held a larger South & Central America meat snacks market share in 2022.

Based on distribution channel, the South & Central America meat snacks market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hyper markets segment held the largest South & Central America meat snacks market share in 2022.

Based on country, the South & Central America meat snacks market has been categorized into South Africa, Saudi Arabia, the UAE, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America meat snacks market in 2022.

General Mills Inc, Hormel Foods Corporation, Link Snacks Inc, and Tyson Foods Inc are some of the leading companies operating in the meat snacks market in the region.

Table of Contents

Executive Summary

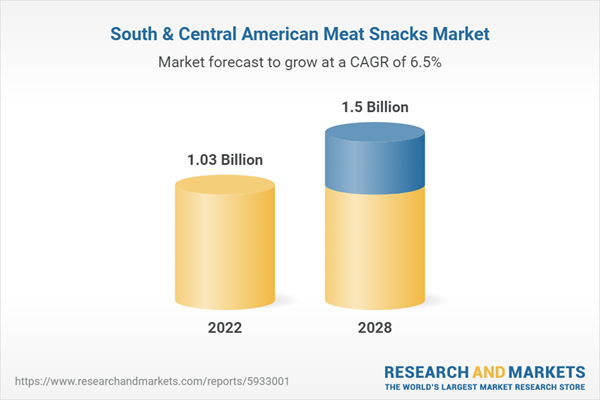

At 6.5% CAGR, the South & Central America Meat Snacks Market is Speculated to be Worth US$ 1,500.95 million by 2028.According to this research, the South & Central America meat snacks market was valued at US$ 1,026.87 million in 2022 and is expected to reach US$ 1,500.95 million by 2028, registering a CAGR of 6.5% from 2022 to 2028. Increasing demand for high-protein snacks, surging popularity of chicken-based meat snacks, advent of lab-grown or cultured meat are among the critical factors attributed to the South & Central America meat snacks market expansion.

Since the past few years, the awareness toward animal cruelty has been increasing, as they are heavily tortured and abused in slaughterhouses. Although veterinary standards and the meat industry prohibit several abusive practices in factory farming, there are cases of animal cruelty documented by the animal rights groups that need serious attention. Hence, people are rigorously seeking for products that do not support animal cruelty and are made of ethically sourced ingredients. However, some people cannot quit meat consumption easily and switch to meat analogs or plant-based meat products due to their distinguished organoleptic properties. Such alternatives and practices surge the demand for cell-cultured or lab-grown meat among consumers.

Cell-cultured meat is produced by vitro cultivation of animal cells and does not involve slaughtering. With the rising awareness, the cell-cultured or lab-grown meat is expected to witness tremendous growth in the coming years. A large number of companies are expanding their production infrastructure with technological assistance to develop lab-grown meat, a sustainable alternative to the conventional one. Mosa Meat offers lab-grown meat burgers made using beef produced from cow cells. Similarly, Aleph Farms produces beef steaks using cow cells. Thus, the demand for meat snacks made from cell-cultured meat is anticipated to surge tremendously during the forecast period.

On the contrary, increasing vegan population hurdles the growth of South & Central America meat snacks market.

Based on type, the South & Central America meat snacks market is segmented into jerky, meat sticks, sausages, and others. The jerky segment held 42.2% share of South & Central America meat snacks market in 2022, amassing US$ 432.91 million. It is projected to garner US$ 635.30 million by 2028 to expand at 6.6% CAGR during 2022-2028.

Based on source, the South & Central America meat snacks market is segmented into beef, chicken, pork, and others. The beef segment held 69.2% share of South & Central America meat snacks market in 2022, amassing US$ 711.03 million. It is projected to garner US$ 1,033.42 million by 2028 to expand at 6.4% CAGR during 2022-2028.

Based on category, the South & Central America meat snacks market is segmented into plain and flavored. The flavored segment held 87.5% share of South & Central America meat snacks market in 2022, amassing US$ 899.01 million. It is projected to garner US$ 1,348.01 million by 2028 to expand at 7.0% CAGR during 2022-2028.

Based on distribution channel, the South & Central America meat snacks market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hyper markets segment held 61.3% share of South & Central America meat snacks market in 2022, amassing US$ 629.24 million. It is projected to garner US$ 913.39 million by 2028 to expand at 6.4% CAGR during 2022-2028.

Based on country, the South & Central America meat snacks market has been categorized into Brazil, Argentina, and the Rest of South & Central America. Our regional analysis states that the Rest of South & Central America captured 49.5% share of South & Central America meat snacks market in 2022. It was assessed at US$ 508.42 million in 2022 and is likely to hit US$ 725.48 million by 2028, exhibiting a CAGR of 6.1% during 2022-2028.

Key players operating in the South & Central America meat snacks market are Conagra Brands, Inc, General Mills Inc, Hormel Foods Corporation, Link Snacks Inc, and Tyson Foods Inc, among others.

Companies Mentioned

- Conagra Brands, Inc.

- General Mills Inc.

- Hormel Foods Corporation

- Link Snacks Inc.

- Tyson Foods Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | December 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value in 2022 | 1.03 Billion |

| Forecasted Market Value by 2028 | 1.5 Billion |

| Compound Annual Growth Rate | 6.5% |

| No. of Companies Mentioned | 5 |