North America is the largest producer of feed for horses, cattle, turkeys, pets, and other animals, so there is a high demand for brewer's yeast there. Consequently, North America region acquired $1,675.0 million revenue in 2022. Aside from that, the US has the lowest feed prices of any economy, which is anticipated to create new expansion opportunities for major market participants over the course of the forecast period. In the United States, ruminant feed is the second most produced feed product. Some of the factors impacting the market are increased use in the food & beverage sector, rising adoption of vegan and vegetarian diets, and availability of synthetic vitamins and nutritional supplements.

Brewer's yeast is a powerhouse of nutrients, particularly B-complex vitamins (such as B1, B2, B3, B6, and B9), proteins, minerals, and amino acids. It's commonly incorporated into health foods due to its nutritional content. It's used in products like energy bars, protein powders, and nutritional shakes to enhance their nutritional value and offer a natural source of essential vitamins and minerals. Brewer's yeast, whether in tablet, capsule, or powder form, is employed in dietary supplements because of its substantial amount of B-complex vitamins. These supplements are popular for individuals seeking to boost their vitamin intake naturally. Additionally, vegan and vegetarian diets are often perceived as healthier choices due to their lower saturated fat content and higher intake of fiber, vitamins, and antioxidants. This heightened health consciousness has led to more individuals choosing these diets, contributing to the surge in demand for brewer's yeast. For moral grounds like environmental sustainability and animal welfare, many people adopt vegan and vegetarian diets. As these factors continue to influence dietary choices, the market is expected to thrive and expand in response to the growing demand from individuals adopting vegan and vegetarian lifestyles. Therefore, these factors pose lucrative growth prospects for the market.

However, many consumers prefer the convenience, standardized dosages, and perceived purity of synthetic supplements over natural sources like brewer's yeast. This preference could limit the demand for natural alternatives. Synthetic supplements are often considered more reliable in consistency and purity than natural sources like brewer's yeast, which might impact the market demand for the latter. The extensive research and clinical studies on synthetic supplements may lead to more established health claims and scientific backing, influencing consumer trust and preference for these products. Some individuals may have allergies or sensitivities to natural sources like brewer's yeast, pushing them toward synthetic alternatives, which are often formulated to be allergen-free. Thus, these aspects can limit the growth of the market.

Product Outlook

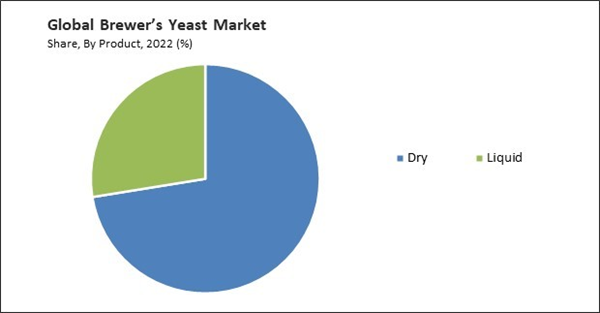

Based on product, the market is bifurcated into dry and liquids. The liquids segment procured a considerable growth rate in the market in 2022. The most widely used yeast for beer fermentation is Saccharomyces cerevisiae, or conventional brewer's yeast, which is available from liquid yeast suppliers in a variety of strains. They also supply bacterial cultures (Pediococcus and Lactobacillus) used in the production of sour ales, as well as wild yeast strains (Brettanomyces) that can give distinct and complex flavors to certain beer styles.Application Outlook

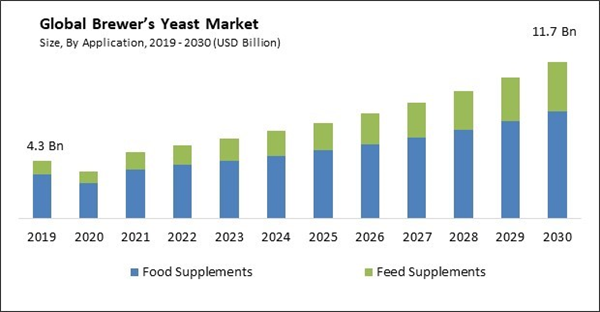

On the basis of application, the market is divided into food supplements and feed supplements. The food supplements segment acquired the largest revenue share in the market in 2022. As a rich source of B vitamins, minerals, and protein, brewer's yeast is also frequently used as a nutritional supplement. It comes in a variety of forms, including tablets, capsules, flakes, and powder. Minerals such as chromium and selenium have numerous health benefits, and B vitamins are necessary for various metabolic processes. Brewer's yeast is also a desirable choice for people who want to consume more protein for general health, muscle growth, and repair due to its high protein content. For instance, brewer's yeast is an ingredient in the nutritional supplement B-complex vitamin, which is essential for energy production and metabolism and aids in the body's conversion of food into energy.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed the maximum revenue share in the market in 2022. Demand for brewer's yeast is expected to increase as more people realize how important it is to feed their pets a balanced diet. In Europe, there has been a growing trend in recent years of consumers becoming more health-conscious and looking for better, more sustainable food options. Brewer's yeast is becoming more and more in demand in the feed and food supplement industries, which is expected to fuel market growth in the UK in the upcoming years. It is anticipated that the major industry participants will prioritize product development and innovation in order to hold onto their market share.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Associated British Foods PLC, Leiber GmbH, Lallemand, Inc., Archer Daniels Midland Company, Chr. Hansen Holding A/S, Lesaffre Group, White Labs Inc., Cargill, Incorporated, Kerry Group plc, and LAFFORT.

Scope of the Study

Market Segments Covered in the Report:

By Product (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Dry

- Liquid

- Food Supplements

- Feed Supplements

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Associated British Foods PLC

- Leiber GmbH

- Lallemand, Inc.

- Archer Daniels Midland Company

- Chr.Hansen Holding A/S

- Lesaffre Group

- White Labs Inc.

- Cargill, Incorporated

- Kerry Group plc

- LAFFORT

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Associated British Foods PLC

- Leiber GmbH

- Lallemand, Inc.

- Archer Daniels Midland Company

- Chr. Hansen Holding A/S

- Lesaffre Group

- White Labs Inc.

- Cargill, Incorporated

- Kerry Group plc

- LAFFORT