Key Highlights

- From USD 3.78 trillion in 2019, total retail sales climbed 6.9% to USD 4.04 trillion in 2020. Given the negative impact of the coronavirus epidemic on in-store buying, the significant increase in total retail sales may come as a surprise. However, digital sales accounted for the majority of retail growth. In 2020, e-commerce accounted for over three-quarters of all retail growth (74.6 percent), the greatest share of overall growth the online sector has ever had. Offline sales, which include stores, catalogs, and call centers, grew 2.1% in 2020, which was the same rate as the pandemic-free prior year.

- Meanwhile, in April 2023, the United States retail sales witnessed growth on both a month-over-month and year-over-year basis. However, clothing and clothing accessory stores continued to face challenges, with a 0.3% drop in sales compared to the previous month and a 4.1% decrease compared to the same period last year. The overall retail sales growth is majorly driven by resilient consumer spending despite the inflation fluctuation. In addition, moderate price levels, continued labor market strength, and wage gains have increased consumers’ ability to spend.

- Despite the increasing consumer spending, clothing and apparel sales have slightly declined, as consumers are becoming more aware of the quality of the products. Whereas, in 2022, according to the Specialty Food Association (SFA) study, specialty foods and beverage sales witnessed significant sales by more than 9.3%. The specialty market is composed of 63 food and beverage categories which combined account for nearly 22% of retail food and beverage sales. Thus, the growing retail sales are expected to create a huge demand for third-party logistics networks in the country.

US Retail 3PL Market Trends

Growth In E-commerce Driving the Market

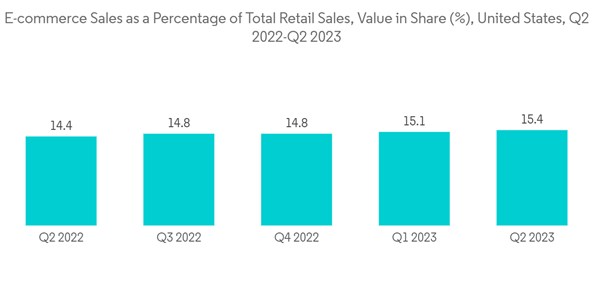

The e-commerce sales are expected to continue their surging streak into 2023, which will be driven by consumer shifts toward new and hybrid shopping patterns. In 2022, according to the U.S. Department of Commerce study, the United States e-commerce sales reached more than USD 1.03 trillion, up by 7% when compared to the previous year.Moreover, big retailers such as Amazon.com Inc. and Walmart Inc. benefitted from this consumer buying pattern. Meanwhile, e-commerce is driving rapid transformation in the retail sector. According to the United States Census Bureau of the Department of Commerce, in Q3 2022, the share of e-commerce in the total retail sales registered 14.8%, up by 3% when compared to Q2 2022. Moreover, in Q3 2022, the Census Bureau of the Department of Commerce announced retail e-commerce sales in the country. In Q3 2022, the total e-commerce sales in the country amounted to USD 265.9 billion, at a growth rate of 3% from the second quarter of 2022.

Furthermore, in Q3 2022, the fastest-growing category of e-commerce sales is Clothing and general merchandise, including clothing accessories and General merchandise. In addition, the e-commerce sales generated by Clothing and general merchandise were more than USD 42. 4 billion, up by more than 39% compared to Q3 2021. Thus, the growing e-commerce and retail sales create a huge opportunity for third-party logistics service providers in the country.

Increase In Retail Sales Driving the Market

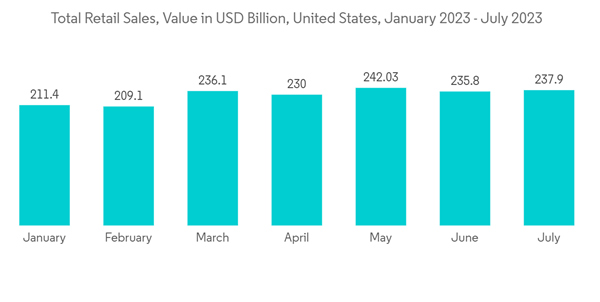

Strong retail sales as COVID-infected Americans return to stores. The lifting of Covid-19 limitations is continuing to fuel record import numbers and contribute to record volumes at America's busiest container ports. According to the National Retail Federation, sales volumes in 2022 are on course to achieve new highs. In addition, in April 2023, the United States retail sales increased, suggesting consumer spending is holding up in the face of economic headwinds including inflation and high borrowing costs.In addition, in April 2023, the value of retail purchases witnessed a growth rate of more than 0.4% after an upwardly revised 0.7% decrease in March. Meanwhile, in July 2023, retail sales surged by more than 5.4% year on year. This growth was majorly driven by Prime Day sales, which pushed several rivals to compete with Amazon’s summer sale. In addition, customers are largely prioritizing service purchases, and summer sales are also encouraging more spending online and at stores, particularly for back-to-school categories.

Moreover, the United States consumer goods imports also witnessed a growth rate of more than 0.4%, Even though the company the country can manufacture its imports, it gets much better prices when buying from other countries. Thus, the growing retail sales and imports into the country further require a huge network of third-party service providers to deliver the products without any delays.

US Retail 3PL Industry Overview

United States Retail 3PL Market is fragmented in nature with a mix of global and local players. Some of the strong players include FedEx, XPO Logistics, YRC Freight, Old Dominion Freight Line, UPS. The United States has well-established distribution channels for all types of retail companies. The retail services industry provides an openly competitive environment that fosters strong business operations and spurs innovations that increase efficiency and reliability.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.