Interest rates and loan terms in the European motorcycle loan market can vary depending on the borrower's creditworthiness, the loan amount, and the lender's policies. Borrowers must compare loan offers to find the most favorable terms for their needs. Many lenders in Europe include partnerships with motorcycle manufacturers and dealerships. These partnerships can benefit borrowers such as preferential interest rates, promotional offers, or streamlined loan application processes.

The European motorcycle loan market saw an increase in the adoption of online and digital platforms for loan applications and management. Borrowers can apply for loans online, upload required documentation, and track the status of their loan application or repayment online. Each European country includes its regulatory framework governing the motorcycle loan market. These regulations aim to protect consumers and ensure fair lending practices. Lenders must comply with these regulations, which may include requirements for transparency, consumer protection, and responsible lending.

The pandemic led to an economic downturn in many European countries, with widespread job losses, reduced income levels, and financial uncertainties. It affected consumer confidence and purchasing power, leading to a decline in motorcycle sales and a decreased demand for motorcycle loans.

Europe Motorcycle Loan Market Trends

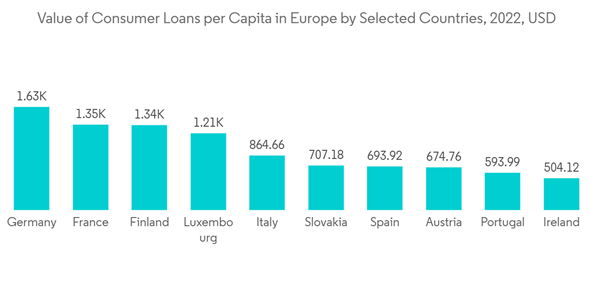

Impact of Consumer Loan Per Capita in Motorcycle Loan Market in Europe

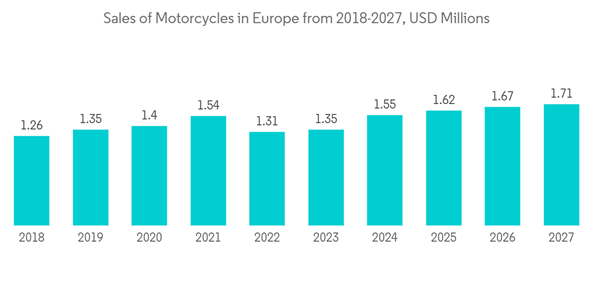

Consumer loans per capita can significantly impact the motorcycle loan market in Europe. Higher consumer loans per capita indicate a population with relatively higher purchasing power and access to credit. It can contribute to increased affordability for individuals interested in buying motorcycles. With more disposable income and available credit, consumers may be more likely to consider purchasing a motorcycle and seeking a motorcycle loan to finance their purchase. The availability of consumer loans can stimulate demand for motorcycles. When individuals access financing options, purchasing a motorcycle can be more feasible, especially for those who may contain a partial amount of cash upfront. Higher consumer loans per capita can result in a larger pool of potential motorcycle buyers, increasing demand for motorcycles and driving the motorcycle loan market. With higher consumer loans per capita, the European motorcycle loan market can become more competitive. Financial institutions, including banks, credit unions, and specialized lenders, may vie for market share by offering attractive loan terms, promotional offers, and enhanced customer service. Increased competition can benefit borrowers by giving them a wider choice of lenders and potentially more favorable loan options.Increasing Motorcycle Unit sales impact on Loan Market in Europe

The growing demand for motorcycle loans from increased motorcycle unit sales can lead to increased competition among lenders. Financial institutions may compete by offering more competitive loan terms, such as lower interest rates, longer repayment periods, or flexible payment options. This competition can benefit borrowers by providing better loan options and potentially more favorable financing terms. With a surge in motorcycle unit sales, lenders may invest in streamlining their loan application and approval processes to handle the increased volume of loan applications. It could involve leveraging digital technologies, implementing automated systems, and improving efficiency in loan processing. A smoother and more streamlined loan process can make it easier and faster for borrowers to obtain motorcycle loans, further fueling the growth of the motorcycle loan market.Increasing motorcycle unit sales can also create opportunities for specialized financing programs in collaboration with motorcycle manufacturers or dealerships. Captive financing arms of motorcycle manufacturers may introduce promotional offers, exclusive loan packages, or incentives to encourage motorcycle sales and financing. These specialized financing programs can attract buyers by providing unique benefits and tailored loan options.

Europe Motorcycle Loan Industry Overview

The competitive landscape of the motorcycle loan market in Europe comprises various financial institutions and lenders offering financing options for motorcycle purchases. The competitive landscape in the European motorcycle loan market may vary across countries and regions. Local and regional banks, credit unions, and specialized lending institutions also play significant roles in specific markets. Additionally, motorcycle manufacturers often include partnerships with financial institutions to provide financing options for their customers. Players' competitiveness in the European motorcycle loan market includes interest rates, loan terms, loan approval process efficiency, customer service, digital capabilities, and partnerships with manufacturers and dealerships. Lenders strive to differentiate themselves through competitive offerings, value-added services, and innovative loan products to attract borrowers. Following is the list of Major Companies in the Market: Santander Consumer Bank, BNP Paribas Personal Finance, Crédit Agricole Consumer Finance, Volkswagen Financial Services, and Yamaha Motor FinanceAdditional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.