Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive indicators, the market encounters significant obstacles due to high interest rates and stricter credit appraisal standards, which can suppress borrowing enthusiasm among price-sensitive groups. This financing activity is closely tied to vehicle transaction volumes in major regions. For instance, the Society of Indian Automobile Manufacturers reported that domestic two-wheeler sales reached 1.94 million units in November 2025 alone, marking a 21.2% year-over-year increase; this surge directly reinforces the addressable market base for lending institutions.

Market Drivers

The lending landscape is being fundamentally altered by the rise of electric motorcycle adoption and green financing initiatives, as financial institutions develop specialized products to reduce entry barriers for battery-operated vehicles. To mitigate the higher initial costs of electric mobility and align with global sustainability objectives, lenders are increasingly partnering with manufacturers to provide lower interest rates and subvention schemes. This trend is highlighted by fintech companies aggressively building portfolios in this sector; for example, a December 2024 report by Devdiscourse titled 'RevFin Gears Up for Massive Expansion in Electric Vehicle Financing' noted that the company has funded approximately 75,000 electric vehicles to date, with 25,000 units financed in 2024 alone, underscoring the rapid credit uptake in green mobility.Concurrently, the integration of fintech and digital lending platforms has optimized loan origination, enabling paperless approvals and alternative credit scoring to assist underserved borrowers. These digital-first strategies are essential for satisfying high-volume demand in emerging markets where smartphone usage is high despite low traditional banking penetration. This operational evolution is channeling substantial capital into two-wheeler assets. As reported by Entrackr in February 2024 within the article 'Two-wheeler EV finance platform OTO raises $10 Mn', OTO Capital stated that lending partners have committed over INR 800 crore for upcoming disbursements. Additionally, Bajaj Finserv's 'Q2 FY25 Investor Presentation' in October 2024 revealed that their two- and three-wheeler finance assets under management increased by 15% year-over-year to INR 18,960 crore, reflecting the segment's overall health.

Market Challenges

Elevated interest rates combined with stricter credit appraisal standards act as a severe bottleneck for the market by diminishing consumer purchasing power and restricting access. As borrowing costs rise, the resulting increase in monthly installments renders financing less appealing for price-sensitive and middle-income demographics, who constitute the primary customer base. Simultaneously, rigorous credit screening procedures disqualify marginal borrowers who might have secured approval under more lenient criteria, effectively shrinking the pool of eligible applicants and reducing overall lending volumes.This tightening of financial conditions directly impedes the movement of vehicle inventory from dealerships to end users, causing retail performance to trail behind wholesale distribution. Evidence of this friction is visible in recent industry data showing a slowdown in consumer purchasing. According to the Federation of Automobile Dealers Associations, two-wheeler retail sales in November 2025 fell by 3% year-on-year to roughly 2.55 million units. This contraction at the retail level emphasizes that, despite strong manufacturing output, the challenges regarding financing affordability and availability are actively limiting growth at the point of sale.

Market Trends

The emergence of specialized lending for pre-owned motorcycles is transforming the sector, as rising new vehicle costs push price-sensitive consumers toward the secondary market. Lenders are professionalizing this historically unorganized segment by partnering with re-commerce platforms to provide certified vehicles accompanied by transparent financing solutions. This structural shift resolves liquidity issues in the used vehicle market and fosters trust among lower-income borrowers who previously depended on expensive informal credit. As reported by Indian Startup Times in August 2025 in the 'Vutto Raises $7M Series A' article, the used two-wheeler marketplace Vutto secured funding to expand its integrated financing model after facilitating credit-linked sales for 1,500 vehicles in its inaugural year.Simultaneously, the growth of embedded financing at the point of sale is redefining distribution strategies, with financial institutions integrating credit systems directly into dealership networks to immediately capture demand. By establishing a physical presence within retail outlets, lenders can provide real-time approvals and seamless onboarding, which significantly boosts conversion rates compared to traditional branch-based models. This proximity to the customer is essential for maintaining volume growth in competitive environments. According to Bajaj Finance's 'Q3 FY25 Investor Presentation' in January 2025, the company added approximately 8,900 new distribution points during the quarter, contributing to a 22% year-over-year increase in new loans booked.

Key Players Profiled in the Motorcycle Loan Market

- Bank of American Corporation

- Mitsubishi HC Capital UK PLC

- GM Financial Inc.

- JPMorgan Chase & Co.

- Toyota Financial Services

- Ally Financial Inc.

- Daimler Financial Services

- Capital One Financial Corporation

- Ford Motor Credit Company

- General Motors Financial Company, Inc.

Report Scope

In this report, the Global Motorcycle Loan Market has been segmented into the following categories:Motorcycle Loan Market, by Type:

- New Motorcycle

- Used Motorcycle

Motorcycle Loan Market, by Provider:

- Banks

- NBFCs

- OEM

- Others (Fintech Companies

- etc.)

Motorcycle Loan Market, by Tenure:

- Less than 3 Years

- 3 & More than 3 Years

Motorcycle Loan Market, by Percentage of Amount Sanctioned:

- Less than 50%

- More than 50%

Motorcycle Loan Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Motorcycle Loan Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Motorcycle Loan market report include:- Bank of American Corporation

- Mitsubishi HC Capital UK PLC

- GM Financial Inc.

- JPMorgan Chase & Co.

- Toyota Financial Services

- Ally Financial Inc.

- Daimler Financial Services

- Capital One Financial Corporation

- Ford Motor Credit Company

- General Motors Financial Company, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

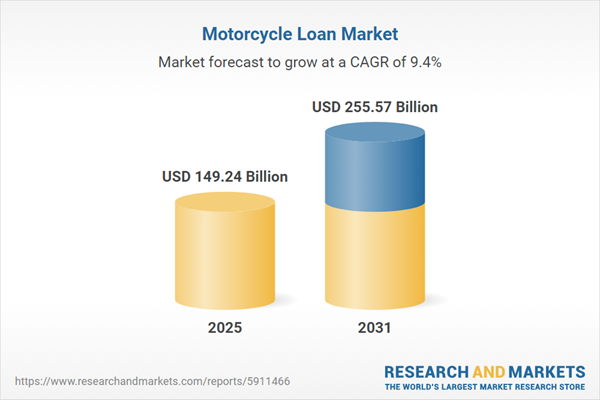

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 149.24 Billion |

| Forecasted Market Value ( USD | $ 255.57 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |