Key Highlights

- The upcoming IT load capacity of the Poland data center construction market is expected to reach 561 MW by 2029.

- The country's construction of raised floor area is expected to increase by 3.7 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 187,016 units by 2029. Warsaw is expected to house the maximum number of racks by 2029.

- There are close to 2 submarine cable systems connecting Poland. One such submarine cable was built in 1997. The cable is called Baltica, which stretches over 437 Kilometers with landing points in Mielno, Poland

Poland Data Center Construction Market Trends

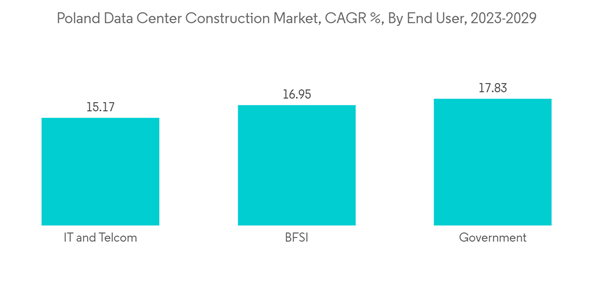

IT and Telecom to have significant market share

- Media and entertainment, manufacturing, banking, financial services, insurance (BFSI), e-commerce, and government services are expected to grow as more users opt for the services provided by them. E-government services are expected to be further improved, and therefore, demand from the government sector is projected to rise during the forecast period.

- Cloud, a major contributor to the IT and Telecom category, is expected to hold the highest market share during the forecast period, followed by telecom. The e-commerce industry will exhibit steady growth, registering a CAGR of 12%, covering a market share of 9% in 2029. As users grow more inclined to online shopping with attractive deals being offered, there will be a rise in digital payment services as well as traffic to websites.

- The value of non-cash transactions online increased from PLN 2.45 billion in 2017 to PLN 7.41 billion ( USD 653 million to USD 1.97 billion), suggesting an increase in data consumption. This increase in the consumption of data by the users and the industry for automation has led to an increase in demand for data centers in the region.

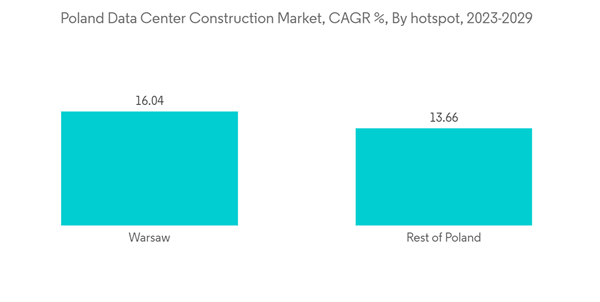

Warsaw is anticipated to witness large scale data center construction activity

- Warsaw is the most popular hotspot for the Polish data center market, and its IT load capacity is expected to increase from 142.6 MW in 2023 to 348.3 MW by 2029 while recording a CAGR of 16%. Warsaw is the economic capital of Poland, and its skilled urban population caters to the growing IT businesses in the region.

- In February 2021, the capital city announced the Digital Transformation Policy to be implemented by 2030, which outlines the concept of the capital's development in the field of new technologies and digitization. In line with the policy, the city launched a platform to gradually offer digital services, such as applications, taxes, and tickets for public transport or cultural institutions.

- The city also plans to launch an Internet of Things (IoT) platform that can process or exchange data via the internet, such as street lamps notifying people about damaged lights or free parking spaces. These factors further suggest an increase in raw data during the forecast period, which is expected tostimulate the demand for and growth of data processing and storage facilities in the country.

- However, other regions, such as Krakow and Wroclaw, are also generating demand for data center operators in Poland. The cost of commercial land in these cities is affordable, ranging from EUR 80-315/sq. m/GLA as compared to EUR 410-1170/sq. m/GLA in Warsaw. Krakow has emerged as Poland's IT hub with over 50,000 software developers and employs nearly 100,000 professionals with diverse backgrounds. These are some of the factors expected to boost the growthof the Polish data center market over the forecast period.

Poland Data Center Construction Industry Overview

The Poland Data Center Market is moderately consolidated; some of the major companies are Turner & Townsend, STULZ, AECOM, Legarnd, and Aurup.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.