Key Highlights

- In Europe, rigid bulk packaging is in high demand due to the growing demand for shipping containers, which are used for transporting raw materials and finished goods such as metal, minerals, oil & gas, chemicals, machinery, cars, aircraft components, etc. According to the Ptc. According to the PortEconomics report, Rotterdam Port handled around 14.5 million twenty-foot equivalent units (TEUs) of containers in 2022, making it the European Union's largest container port. The second-largest container port in the EU was Antwerp-Brussels, handling about 13.5 TEUs million.

- Rigid bulk packaging also provides a higher level of shipment safety compared to flexible bulk. Currently, the manufacturers are also adopting rigid bulk packaging to reduce emissions from transportation as a larger volume can be shipped at the same time, resulting in lower CO2 emissions. The European Union has set ambitious long-term environmental and climate change objectives. Thereby, the businesses are gravitating majorly towards the rigid bulk packaging in the region.

- COVID-19 had a significant impact on the European economy, according to the European Economy Report, which has been slowly recovering since 2021. Growing industries such as chemicals, construction, and the food and beverage industry are expected to recover in a V-shape from the crisis. As per the American Chemistry Council, the chemicals production growth in Europe was anticipated to drop to a negative 2.2% during 2020; however, during 2021, it recovered and witnessed a growth of 3.1% in 2021 to a stable 1.6% growth in 2022. This growth is expected in the forecast period, consequently attributing to the demand for rigid bulk drums and IBCs for chemicals.

- However, the market for rigid bulk packaging in Europe is expected to face the challenge of changing raw material prices over the next few years. The raw materials that are commonly used in rigid bulk packaging are plastic, paper board, and steel material. The raw material prices are one of the most important factors that influence the price of the final products. Therefore, raw material price fluctuations are a major issue for vendors in Europe.

- In November 2022, the European Commission incorporated a proposal for Packaging Waste Regulation (Proposal). Under the proposal, all packaging would be required to be recycled. This applies to pallets and bulk boxes, plastic crates and intermediate bulk containers (excluding cardboard trays), drums, and canisters (all sizes and materials). Therefore, in Europe, bulk packaging manufacturers are increasing the use of eco-friendly recycled material.

Europe Rigid Bulk Packaging Market Trends

Robust Demand from the Food and Beverage Segment Aids the Market Growth

- Europe's bulk rigid packaging market is one of the fastest-growing global markets, driven by the growing needs of end-use industries such as food and beverage industries. As per the EU Food and Drink Industry Report 2022, the European Union is also the world's biggest exporter of food and drink products, with exports amounting to EUR 156 billion (USD 169.71 billion).

- The COVID-19 pandemic has triggered a wave of unprecedented events that have affected every sector of the economy. However, as the food industry has been heavily burdened with the demands of the pandemic, particularly during the lockdown, the demand for packaged food has skyrocketed, and the market has responded accordingly.

- For instance, rapeseed oil dominates in markets like Europe, owing to its abundant production in the regional market and its wide application in the biodiesel, food, and animal feed industries. Germany and France are the leading consumers of rapeseed oil in the regional market. Moreover, the utilization of vegetable oil in mechanical industries for making lubricants and oleochemicals, which is a non-food applicant, has a significant share in the global market. The increasing demand for vegetable oils in Europe drives the need for safe bulk packaging mediums.

- Europe is the world's largest wine producer and exporter. The increasing production and consumption of wine in Europe will drive the growth of the European rigid bulk packaging market. The increasing wine production, consumption, and export will lead to an increase in the need for cost-efficient and secure transportation solutions.

- Wine producers in Europe use rigid bulk packaging for their wine transportation because it allows for twice the volume of shipment compared to individual unit shipments. According to UN Comtrade, in 2022, the top wine-exporting countries in Europe were France, Italy and Spain. France exported around USD 13 billion worth of wine in 2022, while Italy exported around USD 8.3 billion, and Spain exported around USD 3.2 billion worth of wine.

Germany is Anticipated to Witness a Robust Growth in the Future

- Industries are the backbone of Germany's economy. It is one of the most competitive and innovative industries in the world. Germany's manufacturing industry accounts for around 23% of Gross Value Added (GVA), a level that has remained stable over the past two decades. This is higher than the EU average of 16.2%. Even globally, Germany boasts one of the most robust industrial economies in the world. Its industry contributes more to GDP than that of France, the United Kingdom, or the United States.

- Owing to the increasing market demand, the manufacturers are innovating industrial bulk containers, drums, pails, and other products with varied technological advancements. For instance, in August 2023, a German-based industrial packaging company, Schütz GmbH & Co, announced that it would continue developing and improving its IBC and parts. The packaging specialist would present the CC/FC Breather, an innovative ventilation system specially designed for the IBC series.

- According to Germany Trade and Invest (GTAI), Germany has the largest pharmaceutical market in Europe and the fourth largest globally. One of the main reasons for the growth of the Pharmaceutical market in Germany is the high level of investment in the pharmaceutical sector. Germany has a strong and well-known pharmaceutical sector, with several leading pharmaceutical companies. IBCs and other bulk containers are used extensively in the pharmaceutical industry for storage, transportation, and as in-container blending vessels. The growth in the pharmaceutical industry would proportionately increase the demand for rigid bulk packaging in the country.

- Also, it addresses the increasing issue of plastic waste, which has been a major issue in recent years. Since January 2023, all packaging in Germany was required by law to be recyclable or reusable. The implementation of this law in Germany is taking important steps to reduce waste and safeguard the environment by requiring the use of reusable or recycled packaging. Therefore, rigid bulk packaging manufacturers across the country are considering more recyclable and reusable materials.

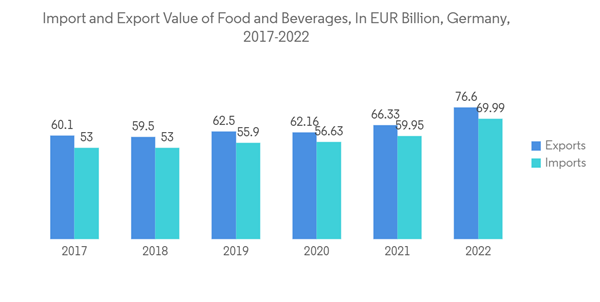

- Various initiatives in the food industry undertaken in Germany are expected to strengthen the rigid bulk packaging market growth. According to Statistisches Bundesamt, in 2022, Germany exported food and beverages worth around EUR 76.6 billion (USD 83.33 billion) compared to EUR 66.33 billion (USD 72.16 billion) last year. The country imported food and beverages worth EUR 69.66 billion (USD 75.78 billion) in 2022. Such massive exports and import value is expected to create a growth opportunity for the market studied in the region.

Europe Rigid Bulk Packaging Industry Overview

The Europe rigid bulk packaging market is moderately competitive with the presence of major players like ORBIS Corporation, Greif Inc., Schoeller Allibert Services B.V., Obal Centrum S.R.O, and more in the market. Additionally, the other major players in the market are adopting acquisition and partnership strategies to enter the market and grow their offerings.In May 2023, the world's leading reusable packaging company, Tosca, introduced a new LCA (Life Cycle Analysis) tool to assist bulk liquid transportation companies in reducing their environmental impact by choosing the most sustainable liquid intermediate bulk containers (IBC). The analysis covers Schütz containers, stainless steel containers, steel drums, and nestable plastic drums.

In December 2022, Schoeller Allibert, based out of the Netherlands, Europe, launched the Fill Level feature for intermediate bulk containers (IBCs) management. The purpose of the system is to automate fill-level monitoring. Fill-level monitoring typically requires manual inspection of each container, which is time-consuming and requires a lot of staff.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.