The Argentine seed industry offers numerous growth prospects and opportunities in terms of an increase in the demand for genetically modified seeds, higher commodity prices, and the expansion of agricultural land area. As per Ministerio de Agroindustria de la Nación, Argentina stated that the total seed production accounted for USD 1,190 million in 2021 which is higher than the previous year with a 6.2% growth rate. With the increase in seed production, seed treatment is gaining demand to protect them from pests and promote improved crop health. Also, the acceptance of biotech crops such as soybean, maize, cotton, and canola in the country is boosting the usage of seed treatment in the coming years. Argentina has the third largest area of genetically engineered (GE) crops under cultivation in the world. With more than 26 million hectares planted with genetically engineered (GE) soybean, corn, and cotton crops in the year 2021.

Increasing farm size and decreasing crop rotation, coupled with the rising awareness of Bio Agribusiness, are some of the factors contributing to the continuing strength of Brazil in the growing global grain market is the rapid adoption of high-value seeds. With the grain production narrowly focused on maize and soybeans, virtually every seed gets treated, often more than once, before it is planted in the country. At present, 35% of the certified seeds that are marketed are treated professionally (industrial seed treatment) in Argentina. In 2021, two new biotechnologies for the treatment of soybean seeds were launched in the country, namely, Rizoliq Dakar, an inoculant promoting biological fixation of nitrogen, and Rizoderma Soja, a fungal bio controller controlling the diseases present in the seed. Thus, negative affect on crop growth due to slow germination of seed, and soil fertility, the seed treatment applications will boost the growth of the market in the forecast period.

Key Market Trends

Seed Dressing Dominates the Market

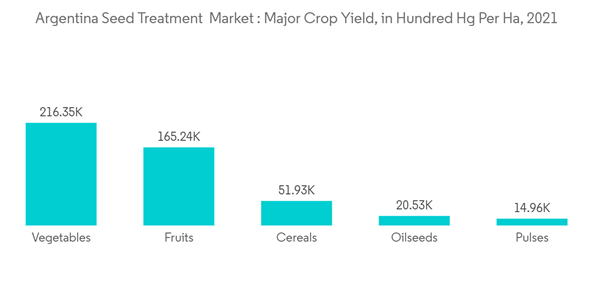

Argentina has a diverse agricultural economy, producing grains such as maize, sorghum, and wheat, and oilseeds such as soybeans and sunflowers. Most of the seeds planted in the broad list of crops receive a seed treatment package in the form of seed dressing, to address several threats to the seedlings. The Argentinean seed treatment expenditures by seed producers and channel partners are anticipated to propel the growth of the market in the study period.Seed dressing is one of the most common methods of seed treatment, where seeds are dressed with modern pesticides in which chemicals may be applied as dry powder or in the form of slurry. Moreover, fungicidal seed dressings are also sometimes applied to stored seeds to prevent disease development, which would impair the seed's ability to germinate or the seedling's ability to grow in a normal manner. Argentina is also one of the leading countries in terms of the use of Genetically Modified crops, with a total area of around 24 million hectares used for the cultivation of transgenic soybean, maize, and cotton crops, as of 2020. The presence of such an extensive area under Genetically Modified seed cultivation requires large-scale seed treatment, and hence, the demand is increasing in the country. Therefore, Genetically Modified seed cultivation requires is driving the market studied, mainly for the major crops grown in Argentina.

According to the USDA report, in 2021, Argentina imported USD 68.8 million in seeds, becoming the 27th largest importer of seeds in the world. In the same year, The seeds was the 160th most imported product in Argentina. Argentina imports seeds primarily from United States (USD 11.6 million), Australia (USD 7.44 million), the Netherlands (USD 6.23 million), France (USD 4.5 million), and Peru (USD 4.32 million). In addition, the sunflower seeds production in the country accounted for 1.3 million metric ton in 2019 and reached 4 million metric ton in 2022. Therefore, the adoption of high-value seeds with the seed dressing technique and growing awareness of agribusiness are resulting in the growth of the market during the forecast period.

Non-chemical/Biological is the Fastest-Growing Segment Drives the Market

In recent years, there has been an increase in the adoption of advanced technologies and management practices in agriculture, including biological seed treatments that significantly improve implantation and reduce costs. In this regard, in the year 2022, ADAMA expanded the wider availability of Apresa, a pre-emergent pre-mix herbicide highly effective in soybean, corn, and other crops in the South American region including Argentina to ensure the country's increased performance in soybean cultivation. Unlike chemical treatments, these biological treatments strengthen the roots and seedlings, further allowing the crop to capture more resources, later translating into higher yields. The efficiency and higher output levels of biological treatments are expected to have massive potential for these in the Argentine market in the coming years.The strict regulatory environment against chemicals provides an excellent opportunity for biological seed treatment companies to expand and grow in the region in the coming years. The information relating to pesticide registration, restrictions, commercialization, and the use of agrochemicals and biological products is issued by SENSA through the “Coordination of Agrochemical and Biological Products” department.

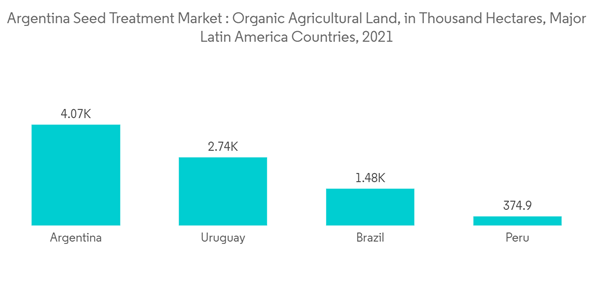

According to the FiBL report, in Latin America and the Caribbean, nearly 9.9 million hectares were managed organically in 2021. Almost 13 percent of the world’s organic farmland was in Latin America and the Caribbean. With almost 4,075 thousand hectares, Argentina had the largest farmland area under organic management, followed by Uruguay (almost 2,742 thousand hectares), Brazil (over 1,482 thousand hectares), and Peru (almost 375 thousand hectares). Almost 88 percent of Latin America and the Caribbean’s organic farmland was in these four countries. Therefore, the increasing expansion of crops under organic area drives the biological seed treatment, and also with the active participation of government initiatives, the market is anticipated to register positive growth during the forecast period.

Competitive Landscape

The market for seed treatment in Argentina is moderately consolidated, with major players holding a major share while others accounted for a minor share in 2022. Syngenta Agro SA, BASF Argentina S.A., ADAMA Agricultural Solutions Ltd, Bayer CropScience Pty Ltd, and Corteva Agriscience are some of the prominent players operating in the market. New product launches, partnerships, and acquisitions are the major strategies the leading companies adopt for greater positions in the market. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies for the vertical growth of the companies in the coming years.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.