Commercial Application is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global aircraft autopilot system market is significantly propelled by the imperative for advanced aviation safety and efficiency requirements. These demands drive the integration of sophisticated autopilot solutions that actively mitigate human error and enable optimized flight paths, directly enhancing operational safety and reducing fuel consumption. For instance, according to the International Air Transport Association's (IATA) 2023 Safety Report, published in February 2024, the all-accident rate was 0.80 per million sectors in 2023, marking the lowest rate in over a decade.Key Market Challenges

A significant challenge impeding the expansion of the Global Aircraft Autopilot System Market is the high initial investment and maintenance costs associated with implementing and certifying advanced autopilot technologies. These substantial financial outlays directly affect the rate at which operators integrate sophisticated automation into their fleets. For instance, according to the General Aviation Manufacturers Association (GAMA), the value of airplane deliveries for 2024 was $26.7 billion, an increase of 14.3% from 2023.Key Market Trends

The enhancement of cybersecurity measures in aircraft autopilot systems represents a critical trend, driven by increasingly sophisticated cyber threats targeting aviation infrastructure. Protecting these vital flight control systems from malicious intrusion is paramount for operational integrity and safety as interconnectedness grows. The Aviation ISAC’s 2024 Cyber Risk Survey identified Identity Management, Authentication, and Access Control as the most significant concern for the aviation cybersecurity community.Key Market Players Profiled:

- Honeywell

- Collins Aerospace

- Garmin

- Thales

- Safran

- Meggitt

- Moog

- BAE Systems

- UTC

- Rockwell Collins

Report Scope:

In this report, the Global Aircraft Autopilot System Market has been segmented into the following categories:By Component Type:

- Sensing Unit

- Computer,

- Servos

- Command Unit

- Feedback Unit

By Type:

- Fixed-Wing

- Rotary

- Hybrid

By Application Type:

- Commercial

- Military

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aircraft Autopilot System Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Honeywell

- Collins Aerospace

- Garmin

- Thales

- Safran

- Meggitt

- Moog

- BAE Systems

- UTC

- Rockwell Collins

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

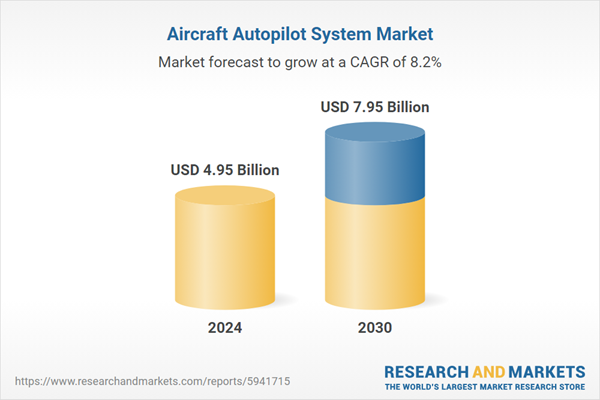

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.95 Billion |

| Forecasted Market Value ( USD | $ 7.95 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |