APGs are widely utilized in Home Care Products due to their excellent surfactant properties, biodegradability, and eco-friendly nature. In laundry detergents and fabric softeners, APGs function as effective surfactants that remove dirt, oils, and stains from fabrics while being gentle on the skin and environment. They contribute to the foaming and cleaning capabilities of dishwashing liquids, ensuring thorough grease removal without leaving residues on dishes or surfaces. Thus, the US market used 40.29 kilo tonnes of APG in home care products in 2023.

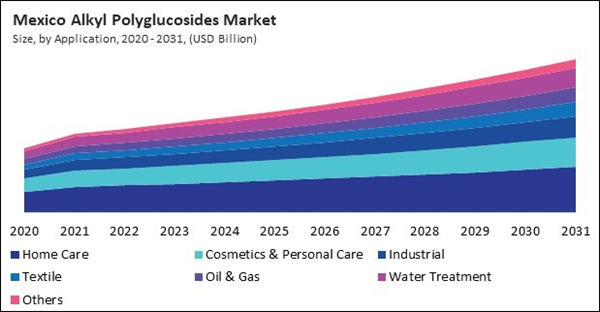

The US market dominated the North America Alkyl Polyglucosides Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $293.7 million by 2031. The Canada market is experiencing a CAGR of 8% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 7% during (2024 - 2031).

APGs have applications in many industries and product categories due to their versatile surfactant properties and compatibility with different formulation matrices. In the personal care sector, APGs are used in skincare products, hair care formulations, bath and shower products, and baby care items due to their mildness, skin-friendly nature, and ability to produce gentle cleansing and foaming effects.

Moreover, producers are adding APGs to a broad range of goods in the personal care and household cleaning industries in response to the increased demand for them. APGs can be found in various formulations, including shampoos, body washes, hand soaps, laundry detergents, dishwashing liquids, and surface cleaners. Their versatility and compatibility with other ingredients make them valuable components in formulating products that prioritize performance and environmental sustainability.

As per the data from Statistics Canada, in 2022, total revenue for the Canadian oil and gas extraction industry rose 53.6% to $269.9 billion, following an 87.5% increase in 2021. The 2022 increase was attributable to increased economic activity and demand for energy products. Hence, North America's rising oil and gas sector is expected to boost the demand in the region.

Based on Application, the market is segmented into Home Care, Cosmetics & Personal Care, Industrial, Textile, Oil & Gas, Water Treatment and Others. Based on Raw Material, the market is segmented into Fatty Alcohol, Glucose and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- BASF SE

- The Dow Chemical Company

- Croda International PLC

- LG Corporation

- Actylis (New Mountain Capital, LLC)

- Kao Corporation

- Seppic S.A. (L’Air Liquide S.A.)

- Airedale Chemical Holdings Limited

- Fenchem Biotek Ltd.

- Evonik Industries AG (RAG-Stifung)

Market Report Segmentation

By Application (Volume, Kilo Tonnes, USD Billion, 2020-31)- Home Care

- Cosmetics & Personal Care

- Industrial

- Textile

- Oil & Gas

- Water Treatment

- Others

- Fatty Alcohol

- Glucose

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- BASF SE

- The Dow Chemical Company

- Croda International PLC

- LG Corporation

- Actylis (New Mountain Capital, LLC)

- Kao Corporation

- Seppic S.A. (L’Air Liquide S.A.)

- Airedale Chemical Holdings Limited

- Fenchem Biotek Ltd.

- Evonik Industries AG (RAG-Stifung)