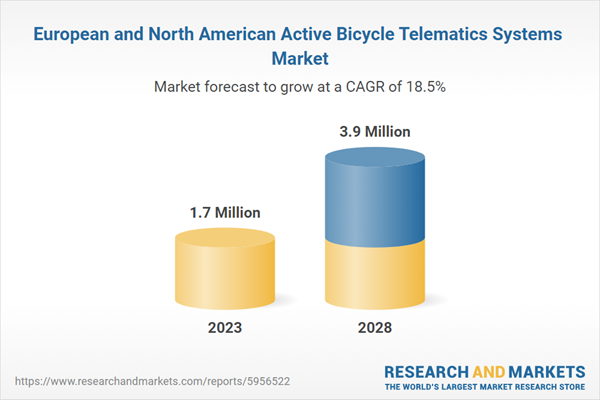

What are the latest developments on the bicycle telematics market? The report estimates that the number of active bicycle telematics systems in Europe and North America will grow at a CAGR of 18.5 percent from 1.7 million at the end of 2023 to 3.9 million by 2028. These numbers include both OEM and aftermarket solutions. Get up to date with the latest information about vendors, products and markets.

The installed base of bicycle telematics systems in Europe and North America reached 1.7 million in 2023

Telematics is a broad term that may be applied to a wide range of vehicle connectivity solutions. The report’s definition of a telematics system in this report is an automatic system designed for any bicycle that incorporates some form of cellular communications. The adoption of telematics systems in the bicycle industry has picked up speed in the past few years. There are both aftermarket and OEM telematics solutions available on the market. The main use case for bicycle telematics systems is stolen vehicle tracking and theft prevention.

Bicycle theft is a growing concern and millions of bicycles are stolen every year in Europe and North America. Bicycle OEMs also offer services such as vehicle diagnostics and maintenance services, roadside assistance services, connected navigation, crash detection services as well as over-the-air updates. In the aftermarket segment, stolen vehicle tracking services are increasingly common.

At the end of 2023, there were an estimated 1.56 million active bicycle telematics systems including both the OEM and aftermarket segments in Europe. Growing at a CAGR of 17.3 percent, the number of active bicycle telematics systems is expected to reach 3.46 million by 2028. Yearly shipments of aftermarket and OEM telematics systems are moreover expected to reach 1.17 million in Europe in 2028, up from 0.42 million in 2023.

The North American market is still far behind Europe, but is expected to grow rapidly in the coming years. The total number of active telematics systems in use including both the OEM and aftermarket segments reached 90,000 in North America by year-end 2023. Growing at a CAGR of 34.4 percent, this number is expected to reach 394,000 by 2028. Yearly shipments of aftermarket and OEM telematics systems are expected to reach 169,000 in North America in 2028, up from 45,000 in 2023.

Examples of bicycle OEMs offering telematics services include Ampler Bikes from Estonia; Canyon Bicycles, Riese & Müller and Urtopia from Germany; Cowboy and Stella from Belgium; Gaya from France; Gazelle, Urban Arrow, Van Moof and Sparta from the Netherlands; as well as QuietKat from the US. Leading telematics service providers include Comodule, Conneqtech, IoT Venture, Velco and PowUnity.

Other providers serving the market include Bosch, Haveltec, BikeFinder, Trackap, Tracefy, Boomerang Bike, Leopard Tech, ConnectLab and Boréal Bikes. Many telematics service providers offer a combination of OEM and aftermarket solutions while some focus on one of the segments. Telematics service providers moreover provide different forms of telematics services ranging from relatively simple tracking services to full telematics systems enabling a wide range of features.

Highlights from the report:

- Insights from numerous interviews with market leading companies

- Descriptions of bicycle telematics systems and associated concepts

- Case studies of 12 bicycle OEM telematics offerings

- Detailed profiles of 14 bicycle telematics service providers

- In-depth analysis of market trends and key developments

- Market forecasts by region lasting until 2028

The report answers the following questions:

- What is the current status of the bicycle OEM and aftermarket telematics industry?

- Which are the key bicycle telematics applications?

- Which are the leading bicycle telematics service providers?

- What business models are used by bicycle OEMs?

- What are the future use cases for bicycle telematics?

- How will the market evolve in Europe and North America?

- What telematics offerings are available from the leading bicycle OEMs today?

Who should read this report?

The Bicycle Telematics Market in Europe and North America is the foremost source of information about the rapid adoption of bicycle telematics solutions. Whether you are a bicycle manufacturer, telematics service provider, telecom operator, investor, consultant, or government agency, you will gain valuable insights from this in-depth research.

Table of Contents

Executive Summary

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ampler Bikes

- Canyon Bicycles

- Cowboy

- Gaya

- Gazelle

- QuietKat

- Riese & Müller

- Sparta (Accell Group)

- Stella

- Urban Arrow

- Urtopia

- Van Moof (Lavoie)

- BikeFinder

- Boomerang Bike

- Boréal Bikes

- Bosch

- Comodule

- ConnectLab

- Conneqtech

- Haveltec

- IoT Venture

- Leopard Tech

- PowUnity

- Tracefy

- Trackap

- Velco

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 45 |

| Published | April 2024 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value in 2023 | 1.7 Million |

| Forecasted Market Value by 2028 | 3.9 Million |

| Compound Annual Growth Rate | 18.5% |

| Regions Covered | Europe, North America |