Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive introduction to the scientific foundations, commercial relevance, regulatory context, and cross-sector importance of functional carbohydrates

Functional carbohydrates occupy a unique intersection of nutrition science, ingredient technology, and industrial application. These molecules, characterized by selective fermentation and physiological effects beyond basic nutrition, have attracted sustained interest from formulators, clinical researchers, and ingredient suppliers. In recent years the narrative has shifted from isolated technical curiosity toward strategic ingredient selection that supports digestive health claims, clean-label positioning, and tailored functionality in complex matrices. This evolution is grounded in a maturing evidence base, improved analytical methods, and more predictable manufacturing controls.As regulatory frameworks and consumer expectations evolve, industry participants are recalibrating priorities around product transparency, efficacy, and provenance. Ingredient developers are investing in production modalities that deliver defined functional profiles while maintaining cost-effectiveness and scalability. At the same time, downstream users in food and beverage, dietary supplements, pharmaceuticals, and animal feed are exploring new formulations that leverage these carbohydrates to differentiate products. The net effect is an expanding commercial ecosystem where scientific validation, process innovation, and supply resilience determine competitive advantage.

This introduction frames the subsequent analysis by highlighting the scientific drivers, commercial imperatives, and cross-sector relevance that make functional carbohydrates a strategic focus for R&D, sourcing, and regulatory engagement in the coming years.

Key transformative shifts driven by microbiome science, consumer clean-label demand, and advanced production methods reshaping the functional carbohydrate ecosystem

The functional carbohydrates landscape is being transformed by converging forces across science, consumer behavior, and manufacturing capability. Advances in microbiome research and mechanistic studies have clarified how specific oligosaccharides influence gut ecology, immune modulation, and nutrient absorption, shifting the discussion from generic fiber claims to targeted functional benefits that support differentiated health claims. Concurrently, consumer demand for clean-label, low-sugar, and gut-health oriented products has encouraged formulators to substitute traditional carbohydrates with functional alternatives that provide textural and sensory parity while delivering health-oriented messaging.On the production side, improvements in enzymatic synthesis, precision extraction, and fermentative technologies are enabling higher-purity ingredients with consistent performance characteristics. These process innovations reduce variability and support the development of long-chain and short-chain variants tailored for specific physiological outcomes. Regulatory scrutiny and ingredient standardization are also intensifying, prompting manufacturers to invest in traceability and quality assurance systems that demonstrate safety and reproducibility. As a result, strategic partnerships between ingredient producers, contract manufacturers, and brand owners are increasing, with collaborative models focused on co-development and risk-sharing. Together, these shifts are creating new pathways for commercial adoption while raising the bar for evidence, quality, and supply chain transparency across the sector.

Assessment of how cumulative United States tariff adjustments enacted in 2025 have altered sourcing strategies, formulation economics, and supply chain resilience for functional carbohydrate stakeholders

The cumulative impact of United States tariff adjustments implemented in 2025 has introduced tangible pressures across sourcing, formulation, and supply chain design for functional carbohydrate stakeholders. Trade measures that affect feedstocks, intermediate ingredients, and finished goods can alter procurement calculus, making previously economical imports less attractive and prompting manufacturers to re-evaluate supplier relationships. For ingredients derived from specific botanical sources or processed abroad, tariff burdens increase landed costs and can create margin compression unless offset by operational efficiencies or portfolio adjustments.In response, many organizations are intensifying efforts to secure geographically diversified raw material supplies and to validate alternative sources with comparable functional profiles. This includes closer engagement with domestic producers and investments in supply chain visibility to mitigate volatility. Manufacturers are also rethinking formulation strategies to preserve product attributes while minimizing cost impact, which may drive greater use of process optimization and waste reduction techniques. Regulatory compliance and documentation have become more prominent priorities, as tariff-related classifications and country-of-origin rules require precise recordkeeping to avoid downstream disruptions.

While tariffs are just one component of a broader geopolitical and economic environment, their cumulative effect in 2025 has accelerated strategic shifts toward resilience, supplier consolidation in some cases, and investment in domestic capabilities. Decision-makers are therefore balancing near-term cost management with longer-term investments in production and quality systems that reduce exposure to trade policy volatility.

In-depth segmentation analysis revealing how type differentiation, application requirements, source selection, form factors, and production processes intersect to shape product strategy

A granular view of market segmentation reveals the range of technical, commercial, and application-specific distinctions that shape product development and go-to-market strategies for functional carbohydrates. In terms of type, the market encompasses fructo oligosaccharides and galacto oligosaccharides alongside inulin and xylo oligosaccharides, with fructo oligosaccharides further differentiated by long chain and short chain variants and inulin distinguished between high purity and standard grades. Application segmentation spans animal feed, dietary supplements, food and beverage, and pharmaceuticals, and within food and beverage the landscape includes bakery products, beverages, confectionery, and dairy products, where beverages are further categorized into carbonated and non-carbonated formats and dairy products separate into cheese, infant formula, and yogurt applications. Source diversity is notable, with chicory root, corn, and sugarcane serving as primary feedstocks that influence cost structure, traceability, and sustainability narratives. Form factor is an important commercial variable: products are offered in liquid and powder formats, with liquid variants delivered as concentrate or syrup and powder types available as granulated powder or micro powder, each affecting handling, shelf life, and formulation compatibility. The production process dimension comprises enzymatic synthesis, extraction, and fermentation, where enzymatic synthesis is subdivided into in vitro enzymatic and microbial enzymatic approaches, extraction separates into ethanol and water-based techniques, and fermentation is executed via bacterial or yeast systems.These segmentation axes interact in practice: choice of source can constrain feasible production processes, while end-application drives requisite form factor and purity levels. For instance, infant formula and pharmaceutical applications typically favor high-purity inulin in micro powder form produced via tightly controlled extraction or enzymatic pathways, whereas animal feed and certain confectionery applications may permit broader purity tolerances and benefit from cost-efficient syrup concentrates. Manufacturers and brands must therefore align formulation decisions with supply availability, processing capabilities, and regulatory expectations to ensure functional performance and commercial viability. Strategic planning that accounts for these layered distinctions enables targeted innovation and more effective channel positioning across multiple end-use markets.

Comparative regional insights explaining how supply dynamics, regulatory environments, and consumer sophistication differ across the Americas, Europe Middle East & Africa, and Asia-Pacific markets

Regional dynamics exert a strong influence on supply chains, regulatory expectations, and market receptivity for functional carbohydrates, producing distinct strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, emphasis is often on scale, cost efficiency, and regulatory frameworks that support health claim substantiation, which encourages investment in integrated supply chains and domestic processing capacity. In Europe, Middle East & Africa, regulatory rigor and provenance concerns drive demand for traceability and ingredient standardization, while consumer sophistication around gut health and natural ingredients supports premium positioning. The Asia-Pacific region is characterized by rapid adoption, diverse consumer preferences, and variable regulatory regimes, prompting suppliers to tailor formulations and compliance strategies to local market requirements.Supply considerations also vary regionally: feedstock availability, climatic conditions, and agricultural practices influence the relative attractiveness of sources such as chicory root, corn, and sugarcane. Logistics infrastructures and tariff environments further shape distribution models, with some regions preferring concentrated liquid imports for cost reasons and others valuing micro powder forms for shelf stability and dosage control. As a result, companies pursuing global presence must adopt differentiated regional strategies that reconcile local regulatory landscapes, consumer expectations, and supply chain realities. This regional nuance informs decisions on manufacturing location, partnership selection, and the degree of product standardization versus localization necessary to succeed across markets.

Strategic company-level insights highlighting how vertical integration, process innovation, analytical rigor, and partnership models determine competitive advantage in functional carbohydrates

Competitive positioning among leading organizations in the functional carbohydrate space is increasingly determined by capabilities beyond basic production. Companies that combine secure feedstock access with advanced process technologies-whether enzymatic synthesis, precision extraction, or controlled fermentation-are better positioned to offer differentiated high-purity grades and tailored chain-length profiles. Strategic investments in analytical capability and quality assurance enable confident positioning into sensitive markets such as infant nutrition and pharmaceuticals, where specification compliance and traceability are non-negotiable.Partnership models and vertical integration are prominent strategies for managing margin pressure and ensuring supply continuity. Ingredients manufacturers that develop close ties with agricultural suppliers or acquire processing capacity reduce exposure to commodity volatility and tariff shocks. At the same time, research collaborations with academic and clinical partners bolster evidence dossiers that underpin health claims and allow brands to justify premium placements. Commercially, organizations that offer multiple form factors and flexible supply formats-liquid concentrates, syrups, granulated powders, and micro powders-create value by meeting diverse processing and packaging needs. Intellectual property in production enzymes and process control, coupled with service-oriented offerings such as regulatory support and formulation consultancy, further differentiates market leaders from commodity suppliers.

Practical, prioritized recommendations for executives and operational leaders to strengthen sourcing resilience, accelerate product innovation, and validate functional claims

Industry leaders should prioritize a set of actionable initiatives that strengthen resilience, accelerate innovation, and capture value from evolving consumer and regulatory expectations. First, diversify feedstock sourcing while establishing validated alternative suppliers and near-shore capabilities to mitigate tariff and logistics disruptions. Second, invest in production process optimization across enzymatic, extraction, and fermentation pathways to achieve consistent functional profiles and to enable premium high-purity offerings for sensitive applications. Third, deepen evidence generation by supporting mechanistic microbiome research and targeted clinical studies that substantiate functional claims and facilitate regulatory acceptance.Operationally, companies should standardize quality and traceability systems that align with region-specific compliance requirements, and adopt modular manufacturing approaches that allow rapid shifts between liquid and powder form factor production. Commercially, cultivate collaborative relationships with downstream brand partners to co-develop formulations that balance sensory expectations with functional efficacy, and offer business models that include technical support and tailored supply agreements. Finally, prioritize sustainability metrics and transparent sourcing narratives to meet consumer expectations and to preemptively address emerging regulatory scrutiny. These coordinated measures will position organizations to respond nimbly to market shifts while protecting margin and enhancing brand differentiation.

Transparent research methodology combining primary interviews, technical literature review, supply chain mapping, and expert validation to ensure rigorous and actionable findings

The research underpinning this analysis employed a multi-method approach to ensure robustness, triangulation, and practical relevance. Primary research included structured interviews with ingredient producers, R&D leaders, formulators, and regulatory specialists to capture operational realities and decision criteria across applications. Secondary analysis drew on peer-reviewed scientific literature, regulatory documents, industry conferences, and supplier technical dossiers to map production modalities and to validate mechanistic claims about physiological effects. Proprietary supply chain mapping and feedstock assessments were used to identify logistical constraints and regional sourcing patterns.Data synthesis involved cross-validation between qualitative insights and technical specifications, with sensitivity checks applied to reconcile divergent stakeholder perspectives. Quality control steps included independent review by subject matter experts and verification of process descriptions against manufacturing best practices. The combination of primary interviews, technical document analysis, and supply chain intelligence produced a comprehensive evidence base that informed the segmentation analysis, regional insights, and actionable recommendations presented in this report.

Concise conclusion synthesizing the strategic implications of scientific advances, production capabilities, regulatory shifts, and supply chain dynamics for market participants

In summary, functional carbohydrates have transitioned from niche ingredients to strategically important components across nutrition, pharmaceuticals, and industrial formulations, driven by advances in scientific understanding, production technologies, and consumer demand for health-focused, clean-label products. The interplay of type, application, source, form, and production process creates multiple pathways to differentiation, with high-purity grades and tailored chain-length profiles commanding particular strategic attention for sensitive use cases. Regional dynamics and trade policy changes have highlighted the importance of supply diversity, traceability, and production flexibility.Organizations that align investments in process capability, evidence generation, and quality systems with pragmatic supply chain strategies will be best positioned to capitalize on market opportunities while mitigating policy and logistical risks. The practical recommendations provided emphasize actions that are immediately implementable-such as supplier diversification and targeted R&D-while also encouraging longer-term commitments to analytical rigor and sustainability. Overall, a balanced approach that integrates scientific credibility with operational resilience and market-focused innovation will determine which participants capture the greatest value as the sector evolves.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Functional Carbohydrates Market

Companies Mentioned

The key companies profiled in this Functional Carbohydrates market report include:- Archer-Daniels-Midland Company

- Beneo GmbH by Südzucker AG

- Biofeed Solutions

- Cargill, Incorporated

- Evonik Industries AG

- Fraken Biochem Co. Ltd.

- Haihang Industry Co.,Ltd.

- Hayashibara Co., Ltd.

- Ingredion Incorporated

- Matsutani Chemical Industry Co. Ltd.

- Neo Cremar Co., Ltd.

- Nordzucker AG

- Roquette Frères

- Tate & Lyle PLC

- VWR International by Avantor

- Wacker Chemie AG

- Zibo Qianhui Biological Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

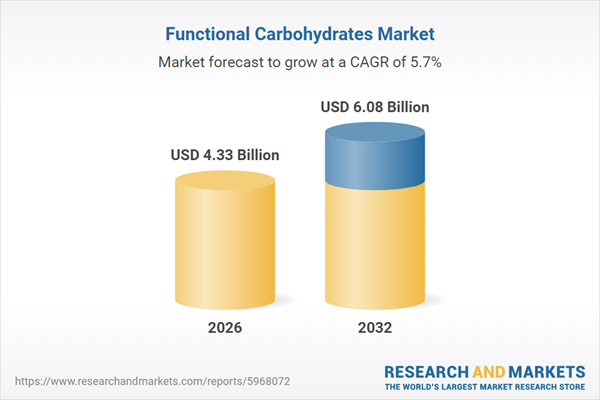

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.33 Billion |

| Forecasted Market Value ( USD | $ 6.08 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |