Speak directly to the analyst to clarify any post sales queries you may have.

Understanding the Evolution of Roller Compaction Technology in Dry Granulation for Enhanced Manufacturing Efficiency and Quality Control

Dry granulation through roller compaction has emerged as a vital processing technique for materials that are sensitive to moisture or heat, offering a high degree of control over particle size distribution and tablet strength. Originally developed to address the limitations of wet granulation, roller compaction has evolved into a versatile method adaptable to diverse industry requirements, from pharmaceutical manufacturing to specialty chemical formulations.The progression of roller compaction equipment can be traced from small-scale laboratory prototypes to fully integrated production lines. The distinctions among lab scale roller compactor, pilot scale roller compactor, and production scale roller compactor underscore the importance of scalability in process development. Meanwhile, innovations in technology such as oscillating granulator designs, advanced roller magnifications, and precision-engineered slit granulators have elevated throughput capabilities and granulate quality. Transitioning from batch processing to continuous processing models further exemplifies the drive toward efficiency and consistency.

As capacity demands shift between small scale, medium scale, and large scale operations, manufacturers are challenged to optimize throughput without sacrificing product integrity. In parallel, applications ranging from deaeration to regranulation highlight the process's adaptability, serving end users in the chemical and petrochemical sphere, the food processing sector, and pharmaceutical companies. Consequently, understanding these foundational elements is essential for stakeholders aiming to harness the full potential of roller compaction in dry granulation workflows.

A Deep Dive into the Revolutionary Shifts Shaping Roller Compaction Processes Across Pharmaceutical Chemical and Food Processing Sectors Driving Innovation

In recent years, roller compaction has undergone transformative shifts driven by the convergence of digitalization, materials science breakthroughs, and regulatory emphasis on process validation. Industry leaders are increasingly integrating smart sensors and real-time monitoring systems that enable process analytical technology, thereby reducing variability and ensuring consistent granule characteristics. Moreover, the adoption of digital twin models allows manufacturers to simulate roll force, gap settings, and downstream milling operations before committing to production runs, minimizing trial-and-error cycles.Furthermore, sustainable manufacturing initiatives have prompted the development of energy-efficient rollers and optimized material handling systems that reduce power consumption and waste generation. As a result, equipment suppliers are engineering novel roller surfaces and coatings to enhance material flow and prevent product adhesion. In addition, the rise of modular equipment architectures facilitates rapid changeovers between formulations, addressing the demand for flexible production lines capable of handling diverse batch sizes and formulations.

Consequently, these technological and operational advancements are reshaping competitive dynamics across pharmaceutical, chemical, and food processing sectors. Regulatory agencies are responding by refining guidelines on continuous manufacturing, emphasizing the importance of traceability and process control. In this context, industry stakeholders must remain vigilant to emerging best practices and leverage transformative innovations to maintain quality, reduce time to market, and support evolving end-user requirements.

Assessing the Cumulative Impact of Escalating United States Tariffs in 2025 on Global Roller Compaction Supply Chains and Pricing

The escalation of United States tariffs in 2025 has introduced new complexities for global roller compaction supply chains, prompting stakeholders to reassess sourcing strategies and cost structures. Raw material components such as specialty excipients and precision-engineered steel rollers have seen increased import duties, translating into higher procurement expenses for original equipment manufacturers and end-user processors alike.As a result, companies are pursuing alternative sourcing arrangements, including local fabrication of roller shells and domestic production of critical spare parts, to mitigate reliance on tariff-impacted imports. Strategic partnerships with regional suppliers in Asia-Pacific and Europe have emerged as viable routes to circumvent elevated costs, while nearshoring initiatives within the Americas are gaining traction to preserve lead times and logistical reliability.

In addition, the tariffs have accelerated collaborative efforts between equipment vendors and end users to explore design-for-manufacture approaches that reduce component complexity and material usage. Consequently, this realignment of supply chain priorities underscores the importance of agility and resilience in procurement practices. Stakeholders must therefore evaluate the cumulative impact of trade policy changes on their capital expenditure plans and operational budgets, ensuring that roller compaction investments continue to deliver value under evolving tariff regimes.

Unlocking Critical Segmentation Insights to Navigate Diverse Product Types Technologies Processes Applications and End-User Demands in Roller Compaction Markets

Analyzing product type distinctions reveals that laboratory-scale compacters are primarily employed for formulation development and feasibility assessments, offering rapid feedback on roll compaction parameters. As processes advance into pilot-scale compacters, developers gain access to equipment capable of replicating production dynamics while maintaining process control. Ultimately, production-scale compacters serve as the cornerstone of high-volume manufacturing, integrating advanced features such as automated feeder systems and closed-loop control to deliver consistent granulate quality.Technology type considerations further differentiate process capabilities. Oscillating granulator configurations provide enhanced granule uniformity through adjustable oscillation rates, whereas roller magnification systems focus on precise gap calibration to optimize ribbon density. Slit granulator mechanisms, by contrast, enable rapid disintegration of compacts into predefined particle sizes, expediting downstream milling and blending operations.

Process type segmentation underscores the evolving preference for continuous compaction lines that minimize batch-to-batch variability and reduce downtime between runs. Capacity requirements, whether large scale in high-demand environments or small scale for niche applications, drive equipment customization and accessories selection. Finally, application use cases span from simple deaeration to sophisticated regranulation workflows, serving end-user industries including chemical and petrochemical processing, food ingredient production, and pharmaceutical manufacturing. By synthesizing these segmentation insights, industry players can refine their equipment selection, streamline process design, and align procurement strategies with specific operational objectives.

Examining Strategic Regional Dynamics across Americas Europe Middle East and Africa and Asia-Pacific to Drive Roller Compaction Deployment Strategies

The Americas region stands out for its extensive pharmaceutical and specialty chemical manufacturing infrastructure, with a growing emphasis on adoption of continuous roller compaction lines to support just-in-time production. With established logistics networks and favorable regulatory frameworks, processors in North America and Latin America are well positioned to integrate advanced compaction equipment that reduces reliance on moisture-based granulation methods.In Europe, the Middle East and Africa, stringent quality regulations and sustainability mandates have driven investments in energy-efficient compaction systems and digital process controls. Industry stakeholders are collaborating with research institutes to validate new compaction methodologies under Good Manufacturing Practices, while regional OEMs are expanding service networks to support maintenance, retrofits, and aftermarket upgrades.

Asia-Pacific continues to exhibit robust demand fueled by rapid pharmaceutical and food ingredient manufacturing growth. Emerging markets in Southeast Asia and South Asia are prioritizing capacity expansions with modular roller compaction platforms that enable flexible production runs. Moreover, technology transfers and joint ventures between local processors and international equipment suppliers are accelerating the adoption of state-of-the-art granulation techniques across the region.

Revealing Pioneering Strategies and Innovations from Leading Roller Compactor Manufacturers Shaping Industry Competition and Trends

Leading equipment manufacturers have been at the forefront of integrating digital monitoring and automation into roller compaction lines, leveraging predictive maintenance algorithms to minimize unplanned downtime. These pioneering companies have also established global service networks that offer rapid spare part provisioning and specialized field support, reinforcing customer confidence in operational uptime.Meanwhile, emerging innovators are focusing on modular compaction architectures that support plug-and-play scalability, enabling end users to incrementally upgrade compaction capacity without significant capital outlays. Collaborative agreements between equipment suppliers and material science firms are facilitating the development of novel roller coatings and die materials that extend maintenance intervals and improve ribbon quality.

Furthermore, partnerships between machinery manufacturers and software developers are yielding advanced process analytics suites capable of real-time performance benchmarking. Such tools enable stakeholders to compare compaction efficiency across multiple sites, fostering continuous improvement cultures. By monitoring equipment utilization and granulation metrics, leading firms are capturing valuable insights that inform future design iterations and enable benchmarking against industry best practices.

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Roller Compaction Advancements and Future-Proof Operational Excellence

Industry leaders should prioritize integration of digital process controls and real-time sensor feedback to achieve robust process consistency and facilitate faster troubleshooting. Investing in advanced analytics platforms that leverage machine learning can reveal hidden correlations between roll pressure, granule density, and downstream performance, enabling predictive adjustments before quality deviations occur.In addition, organizations must diversify supply chain partnerships to mitigate tariff and logistics risks. Establishing regional manufacturing or assembly hubs in key geographies can reduce dependency on import-based components and shorten lead times. Collaborative ventures with material suppliers can unlock co-development opportunities for next-generation excipients designed specifically for roller compaction applications.

Moreover, embracing modular equipment designs will allow processors to scale capacity in alignment with evolving demand profiles, enhancing operational flexibility. Cross-functional teams should also engage with regulatory authorities early in the process development cycle to align on continuous manufacturing validation approaches, ensuring smoother product approvals. By enacting these recommendations, industry leaders can strengthen their competitive position, optimize resource allocation, and future-proof their roller compaction strategies.

Detailed Overview of Rigorous Research Methodologies Ensuring Credibility Validity and Depth in Roller Compaction Market Analysis

The research methodology underpinning this analysis combined extensive primary interviews with subject matter experts in equipment design, process engineering, and regulatory compliance, alongside a thorough review of proprietary technical literature and white papers. Across multiple validation rounds, data points were cross-checked with industry journals and patent filings to ensure accuracy and relevance.Secondary research encompassed examination of regional trade reports, regulatory guidance documents, and technology roadmaps issued by leading trade associations. To further validate findings, the analysis incorporated insights from multi-location site visits and process audits conducted at both pilot and full-scale roller compaction facilities. This triangulation approach bolstered the credibility of performance benchmarks and operational metrics.

Quality control measures included expert peer reviews and statistical consistency checks on process parameter ranges, while scenario planning exercises were used to assess the potential impact of trade policy changes and technology adoption rates. By employing a rigorous, multi-layered research framework, the report delivers a comprehensive and trustworthy foundation for strategic decision-making in roller compaction applications.

Concluding Insights Highlighting the Strategic Imperatives and Key Takeaways Driving the Future of Dry Granulation Roller Compaction Technologies

In summary, the roller compaction landscape is being reshaped by advances in digital monitoring, continuous processing paradigms, and sustainable manufacturing imperatives. Equipment differentiation across lab scale, pilot scale, and production scale compacters underscores the importance of aligning process selection with application needs, while emerging technologies such as oscillating granulators and roller magnification systems are redefining granule quality standards.Trade policy developments, particularly the 2025 escalation of United States tariffs, have prompted a reconfiguration of global supply chains and accelerated efforts toward regional sourcing and design optimization. Key segmentation insights reveal that capacity scaling, process type selection, and end-user industry requirements must be carefully balanced to achieve operational and regulatory compliance goals.

Collectively, these findings highlight strategic imperatives for equipment customization, supply chain resilience, and collaborative innovation. As the sector continues to evolve, stakeholders who adopt data-driven methodologies and flexible production architectures will be best positioned to drive efficiency gains, maintain product quality, and respond agilely to shifting market demands.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Lab Scale Roller Compactor

- Pilot Scale Roller Compactor

- Production Scale Roller Compactor

- Technology Type

- Oscillating Granulator

- Roller Magnifications

- Slit Granulator

- Process Type

- Batch Processing

- Continuous Processing

- Capacity

- Large Scale

- Medium Scale

- Small Scale

- Application

- Deaeration

- Dry Granulation

- Regranulation

- End-User Industry

- Chemical And Petrochemical

- Food Processing Industry

- Pharmaceutical Companies

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Adare Pharma Solutions

- Alexanderwerk AG

- Beijing Longlitech Co., Ltd.

- Bepex International LLC

- Cadmach Machinery Co. Pvt. Ltd.

- Chamunda Pharma Machinery Pvt. Ltd.

- faytec ag

- Freund-Vector Corporation

- Gerteis Maschinen + Processengineering AG

- Hosokawa Micron Corporation

- IDEX MPT, Inc.

- Jiangyin Junzhuo Machinery Manufacturing Co., Ltd.

- Kevin Process Technologies Pvt. Ltd.

- L.B. Bohle Maschinen und Verfahren GmbH

- Natoli Engineering Company, Inc.

- Nicomac Srl

- Prism Pharma Machinery

- Yenchen Machinery Co., Ltd.

- Yichun Wonsen Intelligent Equipment Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Roller Compactor for Dry Granulation market report include:- Adare Pharma Solutions

- Alexanderwerk AG

- Beijing Longlitech Co., Ltd.

- Bepex International LLC

- Cadmach Machinery Co. Pvt. Ltd.

- Chamunda Pharma Machinery Pvt. Ltd.

- faytec ag

- Freund-Vector Corporation

- Gerteis Maschinen + Processengineering AG

- Hosokawa Micron Corporation

- IDEX MPT, Inc.

- Jiangyin Junzhuo Machinery Manufacturing Co., Ltd.

- Kevin Process Technologies Pvt. Ltd.

- L.B. Bohle Maschinen und Verfahren GmbH

- Natoli Engineering Company, Inc.

- Nicomac Srl

- Prism Pharma Machinery

- Yenchen Machinery Co., Ltd.

- Yichun Wonsen Intelligent Equipment Co., Ltd.

Table Information

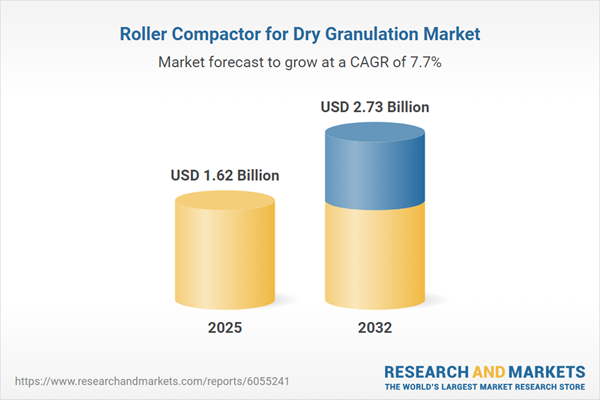

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.62 Billion |

| Forecasted Market Value ( USD | $ 2.73 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |