Speak directly to the analyst to clarify any post sales queries you may have.

The lipid nanoparticle raw material market is rapidly evolving, presenting strategic opportunities and operational challenges for organizations seeking to lead in advanced therapeutic and cosmetic applications. As innovation drives sector expansion and supply chain complexities intensify, informed decision-making is essential for sustained growth.

Market Snapshot: Lipid Nanoparticle Raw Material Market Overview

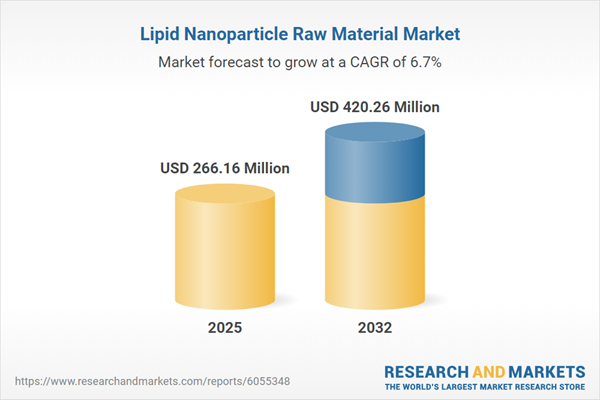

The lipid nanoparticle raw material market expanded from USD 250.25 million in 2024 to USD 266.16 million in 2025 and is set to grow at a CAGR of 6.69%, reaching USD 420.26 million by 2032. This robust trajectory reflects increased demand for high-performance lipid components supporting modern therapeutics, gene therapies, vaccines, and next-generation cosmetic products at a global scale.

Lipid Nanoparticle Raw Material Market Scope & Segmentation

This report offers in-depth analysis and forecasts across core dimensions shaping the lipid nanoparticle sector. Detailed segmentation includes:

- Product Types: Ionizable lipids; kits and reagents; neutral phospholipids; PEGylated lipids; sterol lipids

- Applications: Cosmetics (haircare and skincare); drug delivery; gene therapy; vaccine development

- Distribution Channels: Offline and online procurement platforms

- End-users: Cosmetic brands, pharmaceutical and biotech companies, research institutions

- Regions: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru); Europe, Middle East & Africa (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya); Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Companies: Alnylam Pharmaceuticals, AstraZeneca, Avanti Polar Lipids, BASF, Biopharma PEG Scientific, CordenPharma International, Creative Biolabs, Danaher, Echelon Biosciences, Evonik Industries, Fujifilm Diosynth Biotechnologies, Lipoid, Lonza Group, Merck KGaA, Nanosoft Polymers, NOF AMERICA CORPORATION, Pfizer, Polysciences, Saudi Basic Industries, Tebubio, Wacker Chemie, WuXi AppTec

- Technological Trends: AI-enabled lipid design, green chemistry synthesis, digital supply chain integration, end-to-end traceability tools

Key Takeaways for Senior Decision-Makers

- The shift to engineered lipid nanoparticles is accelerating advanced drug delivery and cosmetic product efficacy, reshaping R&D and commercial priorities.

- Innovations such as AI-driven molecular modeling and sustainable synthesis routes are redefining how manufacturers develop and scale novel lipid compounds for diverse applications.

- Regulatory complexity, especially across North America, Europe, the Middle East, Africa, and Asia-Pacific, requires agile compliance strategies—particularly as end-user needs become more differentiated.

- Strategic partnerships between industry and academia are expediting technology transfer, formulation optimization, and the creation of high-purity, application-specific materials.

- The advancement of digital platforms for lot tracking and quality verification is becoming essential for transparency and customer trust in supply chains.

- End-users in pharmaceuticals, cosmetics, and research institutions now demand bespoke lipid blends and analytical support, influencing supplier selection and partnership models.

Tariff Impact: Navigating Changes in US Import Policy

Introduction of United States tariffs in 2025 has generated marked supply chain shifts and cost adjustments for lipid nanoparticle raw materials. As market participants respond, strategies now emphasize the development of domestic production, review of supplier diversification, and proactive collaboration with regulatory agencies to secure exemptions or optimize tariff classifications—a critical factor for sustaining operational efficiency and pricing.

Methodology & Data Sources

This report employs a mixed-method approach, including primary interviews with industry executives and supply chain leaders, alongside secondary analysis of peer-reviewed sources, patents, regulatory documents, and trade data. Cross-validation of findings delivers robust, actionable insights derived from both qualitative and quantitative evidence.

Why This Report Matters

- Gain clear visibility into the transformative shifts and emerging risks influencing the global lipid nanoparticle market.

- Identify growth opportunities, supplier dynamics, and technology trends supporting resilience, compliance, and product innovation.

- Access analytical frameworks for customizing supply chain and regional strategies in response to regulatory, tariff, and end-user changes.

Conclusion

Staying ahead in the lipid nanoparticle raw material market requires evolving with technology, regulatory policies, and customer expectations. This report equips leaders with critical insights to navigate challenges and capitalize on the sector's ongoing transformation.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Lipid Nanoparticle Raw Material market report include:- Alnylam Pharmaceuticals, Inc.

- AstraZeneca PLC

- Avanti Polar Lipids, LLC

- BASF SE

- Biopharma PEG Scientific Inc.

- CordenPharma International

- Creative Biolabs

- Danaher Corporation

- Echelon Biosciences

- Evonik Industries AG

- Fujifilm Diosynth Biotechnologies

- Lipoid GmbH

- Lonza Group AG

- Merck KGaA

- Nanosoft Polymers, Inc.

- NOF AMERICA CORPORATION

- Pfizer Inc.

- Polysciences, Inc.

- Saudi Basic Industries Corporation

- Tebubio

- Wacker Chemie AG

- WuXi AppTec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 266.16 Million |

| Forecasted Market Value ( USD | $ 420.26 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |