Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Transformative Potential of Gene Expression Analysis in Agricultural Biotechnology to Drive Sustainable Crop Innovations

Gene expression analysis has become a cornerstone in advancing agricultural biotechnology, enabling researchers and industry leaders to decode the molecular underpinnings of crop performance and resilience. By examining transcriptional profiles across diverse plant species, scientists can identify key regulatory genes associated with stress tolerance, nutrient efficiency, and enhanced yield. This depth of understanding accelerates the breeding of superior crop varieties and fosters innovative approaches to address global food security challenges. Moreover, the integration of high-throughput techniques has democratized access to large-scale genomic data, catalyzing a shift toward precision agriculture.Transitioning from traditional phenotypic selection to molecular-driven strategies, the agricultural sector is witnessing an unprecedented convergence of biology and data science. From the deployment of rapid PCR assays in field diagnostics to the utilization of next-generation sequencing platforms in trait discovery, the breadth of tools available empowers stakeholders to make informed, evidence-based decisions. As demand for sustainable and climate-resilient crops intensifies, gene expression analysis emerges not only as a research imperative but also as a commercial differentiator for organizations striving to lead in an increasingly competitive landscape.

Key Transformational Trends Reshaping Gene Expression Analysis Applications and Investment Priorities in Modern Agricultural Research and Crop Development

Emerging technological breakthroughs are redefining how gene expression data informs agricultural solutions, ushering in an era of unprecedented precision and scalability. Advances in sample preparation and multiplexed assays have reduced turnaround times for transcriptomic profiling, enabling real-time monitoring of plant responses to environmental stressors. At the same time, cloud-based infrastructure and artificial intelligence algorithms are democratizing access to complex data analytics, facilitating predictive modeling of gene networks that underpin critical agronomic traits.Concurrently, the integration of genome editing tools such as CRISPR with high-resolution expression mapping has catalyzed a paradigm shift from observation to targeted intervention. This fusion of capabilities empowers crop developers to validate gene function rapidly and engineer novel traits with a degree of accuracy previously unattainable. As interdisciplinary collaborations deepen across molecular biology, computational science, and agronomy, the collective momentum is driving a transformative landscape where data-driven breeding cycles compress development timelines and amplify the impact of next-generation crops.

Assessing the Comprehensive Effects of United States Tariff Policies Implemented in 2025 on Gene Expression Analysis Supply Chains and Cost Structures

The introduction of new tariff measures by the United States in 2025 has reverberated across the supply chains that support gene expression analysis in agriculture. In particular, increased duties on specialized reagents and imported sequencing components have elevated input costs, prompting laboratories to reassess procurement strategies. Reaction kits that were once sourced exclusively from international suppliers are now being evaluated against emerging domestic alternatives, as organizations seek to mitigate price volatility and shipping delays.Beyond cost pressures, the tariff landscape has accelerated strategic collaborations between instrument manufacturers and local distributors to ensure uninterrupted access to critical equipment. Companies supplying high-throughput sequencers and data analysis platforms are exploring joint ventures to establish regional assembly or calibration hubs, thereby reducing lead times and operational risk. Through these adaptive measures, stakeholders are forging more resilient networks capable of withstanding regulatory fluctuations while maintaining the pace of discovery and innovation.

In-Depth Segmentation Perspectives Illuminating Product, Technology, Crop Type, Application and End-User Dynamics in Agricultural Gene Expression Analysis

A granular look at market segmentation reveals distinct trajectories across product categories, analytical technologies, crop varieties, application areas, and end-user groups. Within consumables and reagents, the demand for streamlined kits has intensified alongside core reagent volumes, reflecting a preference for turnkey solutions that accelerate assay deployment. Instrument adoption patterns diverge between polymerase chain reaction platforms used for targeted gene quantification and high-throughput sequencers optimized for transcriptome-wide surveys. At the same time, software solutions encompassing data analysis suites and laboratory information management systems are evolving to support increasingly complex workflows.Technology-driven preferences further differentiate the market, with microarray analysis retaining relevance for comparative gene profiling even as next-generation sequencing garners majority attention for its depth and scalability. Conventional PCR continues to hold a niche in routine diagnostics and validation assays. Crop-specific dynamics underscore the centrality of cereals and grains in driving foundational research, while fruits, vegetables, oilseeds, and pulses each present tailored breeding challenges that influence analytical method selection.

Applications focused on enhancing disease resistance, whether against fungal or viral threats, are commanding significant resources, paralleled by expanding initiatives in trait development aimed at bolstering drought tolerance and pest resilience. Yield improvement and GMO detection maintain steady demand for robust expression assays. Across this diverse ecosystem, academic and research institutions pioneer foundational studies, biotechnology companies channel commercial R&D, contract research organizations deliver outsourced testing, and government agencies guide regulatory frameworks and public-private collaborations.

Critical Regional Variations Shaping Gene Expression Analysis Adoption and Innovation across Americas, EMEA, and Asia-Pacific Agricultural Markets

Regional dynamics play a pivotal role in shaping the adoption and innovation trajectories of gene expression analysis within agricultural biotechnology. In the Americas, advanced research hubs and established biotechnology clusters have accelerated the integration of high-throughput sequencing and AI-enabled analytics into commercial breeding programs. The presence of robust regulatory frameworks and significant public-private funding has fostered collaboration between leading institutions and emerging startups, driving both methodological refinement and market expansion.Within Europe, the Middle East, and Africa, a mosaic of research capacity and regulatory environments dictates adoption curves. Western European nations benefit from consolidated research infrastructure and stringent quality standards, while emerging markets across the region prioritize cost-effective solutions and capacity building. At the same time, public-private initiatives are strengthening genomics research in parts of the Middle East and Africa, creating new opportunities to address localized crop threats.

In Asia-Pacific, a rapidly growing agricultural sector is catalyzing demand for scalable gene expression platforms that support high-value crop development. Investment in both instruments and data analysis capabilities has soared in response to national initiatives targeting food security and export competitiveness. Collaboration between multinational technology providers and regional research centers is fostering localized innovations, ensuring that tools and methodologies adapt to the unique agronomic challenges of diverse climates and cropping systems.

Strategic Profiles and Competitive Fortunes of Leading Companies Advancing Gene Expression Technologies in Agricultural Biotechnology

Leading industry participants are expanding their footprints through strategic R&D investments, partnerships, and portfolio diversification. Several established life science firms have intensified efforts to develop integrated solutions that span from sample preparation to advanced data interpretation. By enhancing reagent stability and throughput of PCR instruments, these companies strive to address both routine assays and large-scale transcriptomic studies concurrently.Meanwhile, pure-play sequencing providers are refining platform scalability and cost efficiency, positioning themselves as essential collaborators for large breeding programs and multi-site research initiatives. Complementing these efforts, software-focused enterprises are innovating modular analysis pipelines and enhanced laboratory information management systems to streamline data workflows and ensure compliance with evolving data governance standards.

Emerging biotech startups are disrupting traditional business models by offering subscription-based access to cloud-native analytics and end-to-end service packages, targeting resource-limited research settings. Through selective partnerships and co-development agreements with academic institutions and contract research organizations, these agile players are accelerating the translation of novel discoveries into practical applications for disease resistance, trait improvement, and yield optimization.

Tactical Strategic Directions and Practical Steps for Industry Leaders to Optimize Gene Expression Analysis Operations and Bolster Crop Development Outcomes

To capitalize on the evolving gene expression landscape, industry leaders should prioritize the localization of critical reagent and instrument supply chains, thereby reducing exposure to cross-border tariff fluctuations. Cultivating partnerships with regional distributors and establishing in-country calibration centers will ensure consistent access to high-performance platforms while minimizing logistical hurdles. Concurrently, investing in hybrid training initiatives that combine virtual modules with hands-on workshops can elevate operational proficiency across geographically dispersed research teams.Organizations are also encouraged to integrate machine learning capabilities into their data analysis pipelines, enabling predictive modeling of genetic networks that underlie complex traits. By leveraging cloud-native infrastructures, companies can democratize access to sophisticated analytics and reduce reliance on in-house computational resources. Furthermore, fostering multi-stakeholder consortia that unite academic researchers, government bodies, and private enterprises will accelerate the validation and deployment of next-generation assays, driving a more cohesive innovation ecosystem.

Finally, maintaining active engagement with regulatory authorities and standards organizations will streamline approval pathways and enhance methodological transparency. Anticipating regulatory shifts around genetically modified organisms and molecular diagnostic standards will position industry leaders to navigate compliance requirements proactively and safeguard their competitive edge.

Robust Research Frameworks and Methodological Approaches Underpinning the Credible Generation of Insights in Agricultural Gene Expression Analysis Studies

This research draws upon a comprehensive mixed-methods approach, integrating qualitative interviews with leading molecular biologists, agronomists, and data scientists alongside a systematic review of peer-reviewed journals, white papers, and thought leadership publications. Primary insights were validated through structured dialogues with stakeholders spanning academic laboratories, biotechnology firms, contract research organizations, and regulatory agencies to capture nuanced perspectives on adoption drivers and operational challenges.Complementing these engagements, secondary research leveraged institutional databases, patent filings, and technology adoption reports to map historical trends and identify emerging application areas. Data triangulation was employed to reconcile divergent viewpoints and ensure methodological rigor. Analytical frameworks incorporating scenario analysis and sensitivity testing supported the interpretation of tariff impacts and regional adoption curves, while expert validation sessions refined key thematic narratives and recommendation sets.

This robust methodology guarantees that the insights presented are grounded in empirical evidence and reflect the dynamic interplay of technological innovation, policy shifts, and market forces. Stakeholders can confidently leverage these findings to inform strategic planning, product development roadmaps, and collaborative ventures.

Synthesis of Critical Findings and Forward-Looking Perspectives on Gene Expression Analysis Empowering Agricultural Biotechnology Progress

The convergence of advanced analytical tools, shifting regulatory landscapes, and evolving industry partnerships underscores a pivotal moment for gene expression analysis in agriculture. As high-throughput technologies become more accessible and data ecosystems mature, research teams are equipped to tackle complex trait discovery with unprecedented speed and precision. The ripple effects of these developments extend from laboratory workflows to field implementation, catalyzing next-generation crop varieties tailored for sustainability, resilience, and yield enhancement.Looking ahead, the most successful organizations will be those that adeptly navigate external pressures-such as tariff adjustments and regional regulatory nuances-while harnessing integrative platforms that streamline end-to-end workflows. Collaborative consortia and cross-sector alliances will play an indispensable role in translating molecular insights into scalable agricultural solutions. By remains agile in methodology, strategic in partnerships, and visionary in application, stakeholders can unlock the full transformative potential of gene expression analysis to address the pressing demands of global food security.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Consumables & Reagents

- Kits

- Reagents

- Instruments

- PCR Machines

- Sequencers

- Software

- Data Analysis Software

- LIMS

- Consumables & Reagents

- Technology

- Microarray Analysis

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Application

- Disease Resistance

- Fungal Resistance

- Viral Resistance

- GMO Detection

- Trait Development

- Drought Tolerance

- Pest Resistance

- Yield Improvement

- Disease Resistance

- End-User

- Academic & Research Institutions

- Biotechnology Companies

- Contract Research Organizations

- Government Agencies

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Illumina, Inc.

- Agilent Technologies, Inc.

- Azenta Life Sciences

- Bio-Rad Laboratories, Inc.

- CD Genomics

- Cibus Inc.

- Eurofins Scientific

- Genedata AG

- IGA Technology Services srl

- Intertek Group plc

- LGC Limited

- NanoString Technologies, Inc.

- Nath Bio-Genes (I) Ltd.

- Oxford Nanopore Technologies plc.

- Pacific Biosciences of California, Inc.

- PerkinElmer Inc.

- seqWell

- Thermo Fisher Scientific Inc.

- Trace Genomics.

- QIAGEN GmbH

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Gene Expression Analysis in Agricultural Biotechnology Market report include:- Illumina, Inc.

- Agilent Technologies, Inc.

- Azenta Life Sciences

- Bio-Rad Laboratories, Inc.

- CD Genomics

- Cibus Inc.

- Eurofins Scientific

- Genedata AG

- IGA Technology Services srl

- Intertek Group plc

- LGC Limited

- NanoString Technologies, Inc.

- Nath Bio-Genes (I) Ltd.

- Oxford Nanopore Technologies plc.

- Pacific Biosciences of California, Inc.

- PerkinElmer Inc.

- seqWell

- Thermo Fisher Scientific Inc.

- Trace Genomics.

- QIAGEN GmbH

Table Information

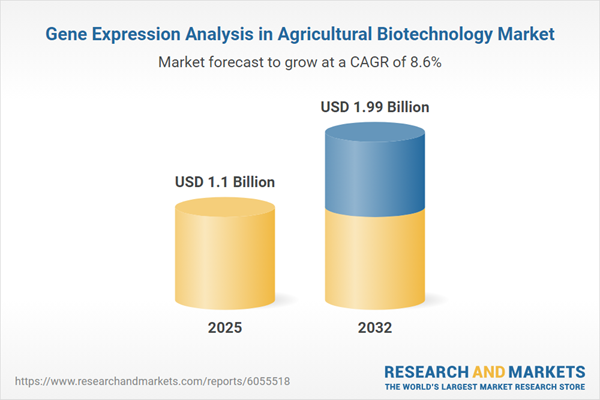

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.99 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |