Speak directly to the analyst to clarify any post sales queries you may have.

Amid urgent sustainability priorities and tightening decarbonization targets, the power-to-liquid market is becoming central to energy transition strategies for organizations seeking innovative, secure, and adaptable fuel solutions. Senior decision-makers are positioning power-to-liquid as a lever in addressing sector-specific decarbonization and enabling resilient growth across evolving regulatory landscapes.

Market Snapshot: Power-to-Liquid Market Growth and Trends

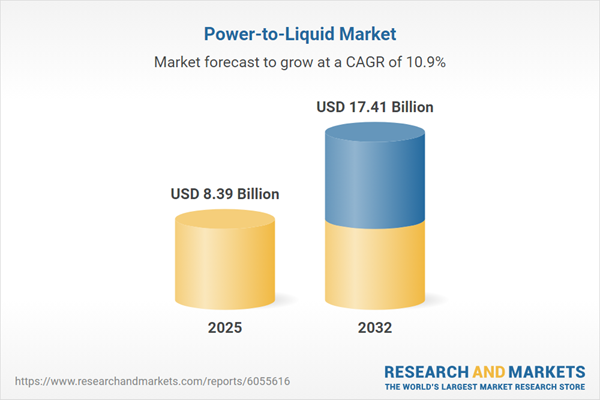

The global power-to-liquid market is on an upward path, valued at USD 7.60 billion in 2024 with expectations to increase to USD 8.39 billion in 2025 and continue to USD 17.41 billion by 2032, supported by a compound annual growth rate (CAGR) of 10.90%. This advance is primarily driven by robust investments in sustainable fuels within the industrial, transport, and energy sectors. Policy incentives and private adoption are fuelling innovations in technology integration, while strategic partnerships across value chains enhance competitiveness. Cross-sector demand for synthetic fuels underpins market expansion as organizations seek to future-proof energy supply, reduce carbon intensity, and comply with evolving policy.

Scope & Segmentation

This report delivers a detailed framework for industry leaders to evaluate risk, opportunity, and technological direction across the power-to-liquid market. Assessment spans every major segment relevant to market evolution:

- Technology Types: Biological Conversion, Electrolysis-Based Power-To-Liquid, Fischer-Tropsch Synthesis, Methanol Conversion. Each alternative aligns with emission reduction targets and the technical needs of energy-intensive sectors.

- Fuel Types: Hydrogen, Methanol, Synthetic Hydrocarbons. The choice is influenced by infrastructure readiness, legislative trends, and requirements across transportation, chemicals, and power generation.

- Applications: Chemical Feedstocks, Energy Storage & Grid Services, Specialty Product Manufacturing, Synthetic Fuels Production. Each supports critical goals, including decarbonization, security of supply, and the diversification of raw materials.

- End Users: Energy & Utility Providers, Industrial Sector, Public & Government Entities, Transportation Sector. Pioneers in these sectors are prioritizing solutions that align with decarbonization strategies and evolving regulation, especially in hard-to-abate industries.

- Regions & Countries: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan). Distinct regulatory climates and market priorities characterize each region, shaping adoption and project development.

- Key Companies: Audi AG by Volkswagen, Avantium N.V, BP p.l.c., Climeworks AG, Enerkem Inc., Eni S.p.A., Exxon Mobil Corporation, Fraunhofer UMSICHT, Haldor Topsoe Holding A/S, INERATEC GmbH, LanzaTech Global, Inc., Ludwig-Bölkow-Systemtechnik GmbH, Neste Corporation, Sasol Limited, Shell plc., Siemens AG, Sunfire Technologies Private Limited, Thyssenkrupp AG, Velocys PLC., Ørsted A/S. Global participation ranges from pioneers in synthetic fuel scaling to technology developers advancing system efficiencies.

Key Takeaways

- Power-to-liquid solutions are well-suited for creating carbon-neutral, transportable fuels, meeting decarbonization mandates in sectors less amenable to direct electrification.

- Growth in renewable energy capacity and improvement in carbon capture technologies are making both pilot and commercial projects increasingly feasible in developed and emerging economies.

- Collaboration across public and private actors accelerates market deployment, with risk-sharing and early knowledge transfer addressing scale-up bottlenecks and fostering project viability.

- Industrial and transport segments are adopting solutions compatible with legacy infrastructure, while public and regulatory agencies focus on stringent emissions targets and dependable energy sourcing.

- Regional differences in resource access and policy frameworks drive distinctive strategies, with Europe, the Middle East, and Asia-Pacific advancing technology development, and the Americas leveraging feedstock and policy strengths.

- Strategic investments and alliances underscore the increasing importance of building capacity and maintaining a competitive edge as the commercial landscape continues to mature.

Tariff Impact: Responding to Policy Evolution in the Power-to-Liquid Sector

Recent tariff updates in the United States, targeting electrolyzer modules and chemical feedstocks, are reshaping operational strategies for both local and international market participants. These changes are designed to drive domestic manufacturing and safeguard supply chain reliability, prompting companies to optimize procurement, pivot toward local collaborations, and monitor evolving policy closely. In the short term, these measures present challenges that require proactive risk management, though long-term incentives may support market expansion and resilience.

Methodology & Data Sources

This power-to-liquid market report integrates comprehensive secondary research from academic, regulatory, and industrial publications, augmented by over forty qualitative interviews with leaders. Scenario analysis and sensitivity models ensure the reliability and strategic relevance of findings for executive decision-making.

Why This Report Matters

- Delivers benchmarks for senior executives to evaluate technology progress and identify where value emerges across the power-to-liquid value chain.

- Equips organizations to navigate policy volatility, such as tariff adjustments, by highlighting new sourcing strategies and supply chain adaptations.

- Offers actionable perspective on regional variations, technology trends, and application opportunities to inform long-term market positioning and resilience.

Conclusion

The power-to-liquid market is rapidly advancing from demonstration to full-scale commercial activity, shaped by ongoing technology innovation and regulatory adaptability. Informed strategic action is essential for navigating this dynamic sector and securing competitive, sustainable value.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Power-to-Liquid market report include:- Audi AG. by Volkswagen

- Avantium N.V

- BP p.l.c.

- Climeworks AG

- Enerkem Inc.

- Eni S.p.A.

- Exxon Mobil Corporation

- Fraunhofer UMSICHT

- Haldor Topsoe Holding A/S

- INERATEC GmbH

- LanzaTech Global, Inc.

- Ludwig-Bölkow-Systemtechnik GmbH

- Neste Corporation

- Sasol Limited

- Shell plc.

- Siemens AG

- Sunfire Technologies Private Limited

- Thyssenkrupp AG

- Velocys PLC.

- Ørsted A/S

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 8.39 Billion |

| Forecasted Market Value ( USD | $ 17.41 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |