Global 3D Secure Payment Authentication Market - Key Trends & Drivers Summarized

How Is the Rise in Online Transactions Fueling the Demand for 3D Secure Authentication?

The rapid surge in digital transactions, driven by the proliferation of e-commerce platforms, has significantly increased the demand for robust payment security solutions, propelling the growth of the 3D Secure payment authentication market. As cyber threats and fraudulent activities escalate globally, businesses and financial institutions are turning to advanced authentication protocols to ensure secure payment processing. The increasing consumer preference for cashless transactions, fueled by convenience and accessibility, has made secure payment systems a top priority for merchants and service providers alike. Governments and regulatory bodies across regions have introduced stringent compliance standards, such as the Payment Services Directive 2 (PSD2) in Europe, mandating strong customer authentication (SCA), further driving adoption. Additionally, the shift towards mobile-first payment solutions and the expansion of cross-border e-commerce transactions have created a pressing need for multi-layered authentication mechanisms, solidifying the role of 3D Secure technology as a crucial element in securing digital payments.What Are the Technological Innovations Transforming the 3D Secure Landscape?

Technological advancements in artificial intelligence, machine learning, and behavioral biometrics are revolutionizing the 3D Secure authentication framework, enhancing both security and user experience. The introduction of 3D Secure 2.0 (3DS2) has addressed many limitations of its predecessor by providing frictionless authentication, reducing cart abandonment rates, and enhancing approval rates for legitimate transactions.How Are Regulatory Compliance and Industry Standards Influencing Market Expansion?

Regulatory frameworks and industry mandates are playing a pivotal role in shaping the growth trajectory of the 3D Secure payment authentication market. Compliance with evolving security standards, including PCI-DSS, GDPR, and regional financial regulations, is compelling businesses to invest in secure payment authentication solutions to safeguard consumer data and financial assets. The enforcement of PSD2 in the European Union has set a global benchmark for secure payment practices, pushing merchants worldwide to implement 3D Secure technology to avoid penalties and ensure compliance. In parallel, the rise of open banking initiatives and the increasing adoption of API-driven payment ecosystems are facilitating seamless interoperability between merchants, banks, and payment gateways. As financial institutions seek to maintain regulatory compliance while delivering a seamless checkout experience, the demand for adaptive and intelligent authentication solutions is expected to soar. Additionally, partnerships between payment networks, including Visa, Mastercard, and American Express, are driving the adoption of standardized 3D Secure solutions across diverse markets, fostering global consistency in secure online transactions.What Are the Key Drivers Propelling Growth in the 3D Secure Payment Authentication Market?

The growth in the 3D Secure Payment Authentication market is driven by several factors, including the rapid digitalization of retail and financial services, the increasing frequency of cyber threats targeting payment transactions, and the widespread adoption of contactless and mobile payment solutions. The expansion of cross-border e-commerce and the growing penetration of digital wallets have fueled the demand for enhanced security protocols that offer seamless yet secure authentication. Additionally, consumer expectations for faster and frictionless online payment experiences have pushed businesses to adopt adaptive authentication methods that balance security with convenience. The shift towards real-time payments and the rise of buy now, pay later (BNPL) services have also increased the need for robust fraud prevention mechanisms powered by 3D Secure technology. Furthermore, the growing emphasis on customer trust and brand reputation is encouraging merchants to invest in cutting-edge authentication solutions that enhance security while reducing false declines and friction during the checkout process. As financial institutions and merchants continue to navigate the evolving digital landscape, the adoption of 3D Secure payment authentication is expected to witness sustained growth, driven by regulatory mandates and technological advancements.Report Scope

The report analyzes the 3D Secure Payment Authentication market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component Type (Merchant Plug-in, Access Control Server, Other Component Types); Application (Banks Application, Merchants and Payment Gateway Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Merchant Plug-inComponent segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 14.1%. The Access Control Server Component segment is also set to grow at 11.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $373.9 Million in 2024, and China, forecasted to grow at an impressive 17.3% CAGR to reach $599.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global 3D Secure Payment Authentication Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global 3D Secure Payment Authentication Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global 3D Secure Payment Authentication Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this 3D Secure Payment Authentication market report include:

- Adyen

- Broadcom Inc.

- Cybersource

- EMVCo, LLC

- Entersekt Proprietary Limited

- Evervault Ltd,

- GPayments Pty Ltd.

- Lyra SAS

- Marqeta, Inc.

- N26 AG

- Nuvei Technologies

- Verifi, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adyen

- Broadcom Inc.

- Cybersource

- EMVCo, LLC

- Entersekt Proprietary Limited

- Evervault Ltd,

- GPayments Pty Ltd.

- Lyra SAS

- Marqeta, Inc.

- N26 AG

- Nuvei Technologies

- Verifi, Inc.

Table Information

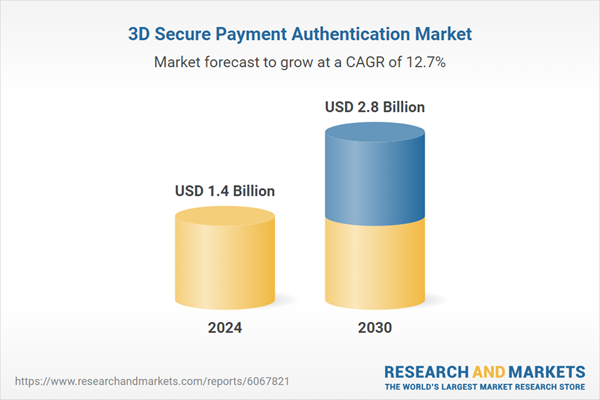

| Report Attribute | Details |

|---|---|

| No. of Pages | 268 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |