Global Mineral Supplements Market - Key Trends & Drivers Summarized

What Are Mineral Supplements and Why Are They Essential for Health?

Mineral supplements are dietary products that provide essential micronutrients such as calcium, magnesium, iron, zinc, selenium, potassium, and iodine to support overall health, metabolism, immune function, bone strength, and cognitive performance. These supplements are available in various forms, including tablets, capsules, powders, liquid solutions, and gummies, catering to diverse consumer preferences.The growing demand for mineral supplements is driven by lifestyle-related deficiencies, poor dietary habits, aging populations, and increased awareness of preventive healthcare. Many individuals fail to meet their daily mineral requirements due to unbalanced diets, processed food consumption, and soil depletion reducing the natural mineral content in crops. Consequently, mineral supplementation is becoming a key strategy to combat nutrient deficiencies and associated health risks such as osteoporosis (calcium deficiency), anemia (iron deficiency), and immune dysfunction (zinc deficiency).

Additionally, the rising popularity of functional foods, sports nutrition, and personalized health solutions has expanded the market for customized mineral supplements tailored for specific needs, such as prenatal health, elderly nutrition, athletic performance, and immune support. As consumers become more health-conscious, mineral supplements are being positioned as an essential part of daily wellness routines.

How Are Technological Advancements Transforming Mineral Supplements?

The mineral supplements industry is undergoing a transformation due to advancements in formulation, bioavailability, delivery mechanisms, and ingredient sourcing.One of the most significant innovations is the development of chelated minerals, where essential minerals like magnesium, zinc, and iron are bonded to amino acids or organic compounds to enhance absorption and bioavailability. Chelated minerals improve nutrient uptake, reduce gastrointestinal discomfort, and provide higher efficacy compared to traditional mineral salts.

Liposomal and nanoencapsulation technologies are also gaining traction in supplement formulations. Liposomal minerals, where nutrients are encapsulated in lipid layers, ensure better absorption, increased stability, and extended release in the digestive system. Nanoencapsulation improves the solubility of minerals, particularly for fat-soluble elements like selenium and magnesium, making them more bioavailable and effective in smaller doses.

The rise of personalized nutrition and AI-driven health analysis is also influencing the mineral supplement market. Companies are leveraging genetic testing, microbiome analysis, and AI-powered wellness platforms to recommend customized mineral formulations based on an individual's diet, lifestyle, and specific health needs. This shift toward precision nutrition is expected to drive future innovations in supplement manufacturing.

Another notable trend is the development of plant-based and marine-derived mineral supplements. As consumers seek vegan, organic, and natural options, manufacturers are turning to seaweed-derived iodine, red algae calcium, and plant-based magnesium to cater to clean-label and eco-conscious consumers. These sources offer higher bioavailability and sustainability compared to traditional mineral sources derived from rocks or animal-based products.

What Are the Key Challenges Facing the Mineral Supplements Market?

Despite its rapid growth, the mineral supplements market faces several challenges, including regulatory compliance, product formulation difficulties, consumer skepticism, and price fluctuations in raw materials.One of the primary concerns is inconsistent regulatory frameworks across different regions. While the U.S. FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and WHO (World Health Organization) set safety and labeling standards, regulations on mineral dosages, health claims, and ingredient sources vary between countries. This lack of standardization creates market entry barriers and compliance complexities for supplement manufacturers.

Another major challenge is mineral bioavailability and absorption. Not all mineral forms are easily absorbed by the body, leading to low efficacy and wastage in certain formulations. For example, iron supplements often cause gastrointestinal side effects such as constipation or nausea, while calcium supplements may lead to poor absorption if not combined with vitamin D or other cofactors. Manufacturers must continuously optimize formulations to enhance nutrient uptake and reduce side effects.

Consumer skepticism and misinformation about supplements also pose hurdles for market growth. Some consumers are wary of synthetic additives, fillers, and heavy metal contamination in mineral supplements. Concerns over overdosing and potential toxicity, especially with fat-soluble minerals like selenium, zinc, and iron, highlight the need for scientific research, transparent labeling, and education on safe supplementation.

Price volatility in raw material sourcing is another challenge, particularly for marine-derived minerals, organic plant-based sources, and specialty chelated minerals. Factors such as supply chain disruptions, geopolitical trade restrictions, and environmental sustainability concerns can impact the availability and pricing of premium mineral ingredients, affecting product affordability and profit margins.

What Are the Key Growth Drivers for the Mineral Supplements Market?

The growth in the mineral supplements market is driven by rising health consciousness, government-backed nutrition programs, aging demographics, and expanding functional food applications.One of the most significant growth drivers is the increasing prevalence of mineral deficiencies and lifestyle-related health disorders. According to the WHO, billions of people worldwide suffer from micronutrient deficiencies, particularly iron, iodine, and calcium deficiencies. Governments and health organizations are actively promoting food fortification programs and supplement interventions to address these public health challenges.

The aging population is another key factor fueling demand for mineral supplements. Older adults require higher levels of calcium, magnesium, and vitamin D to maintain bone density, joint health, and cognitive function. The rise of healthy aging and longevity trends is leading to increased consumption of bone health, cardiovascular support, and cognitive enhancement supplements enriched with essential minerals.

The expanding sports nutrition and active lifestyle movement is also driving growth in the mineral supplement sector. Athletes and fitness enthusiasts require electrolyte minerals like potassium, sodium, and magnesium to support hydration, muscle recovery, and endurance performance. Magnesium and zinc supplements, in particular, are widely used for energy metabolism, muscle repair, and stress reduction in fitness-oriented consumers.

The integration of mineral supplements into functional foods and beverages is another key market driver. Instead of standalone supplement pills, consumers are increasingly turning to fortified dairy products, mineral-enriched plant-based milks, functional teas, and sports drinks as convenient ways to meet their daily nutritional needs. The development of effervescent tablets, chewable gummies, and liquid mineral formulations has further expanded accessibility for consumers who prefer alternative supplement delivery formats.

Additionally, the rise of e-commerce and direct-to-consumer (DTC) supplement brands has transformed market accessibility. Online retailers, subscription-based supplement services, and personalized nutrition platforms are making mineral supplements more widely available and customizable, fueling global market expansion.

Report Scope

The report analyzes the Mineral Supplements market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Calcium Supplements, Magnesium Supplements, Iron Supplements, Potassium Supplements, Zinc Supplements, Other Product Types); Formulation Type (Tablet Formulation, Capsule Formulation, Powder Formulation, Liquid / Gel Formulation, Other Formulation Types); Sales Channel (Pharmacies & Drug Stores Sales Channel, Supermarkets / Hypermarkets Sales Channel, Online Sales Channel); Application (General Health Application, Bone & Joint health Application, Gastrointestinal Health Application, Immunity Application, Other Applications); End-Use (Adults End-Use, Geriatric End-Use, Pregnant Women End-Use, Children End-Use, Infants End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Calcium Supplements segment, which is expected to reach US$5.6 Billion by 2030 with a CAGR of a 3.5%. The Magnesium Supplements segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.5 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Mineral Supplements Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Mineral Supplements Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Mineral Supplements Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADM WILD Europe GmbH & Co.KG, Barry Callebaut, Blommer Chocolate Company, Bühler AG, Cargill, Incorporated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Mineral Supplements market report include:

- BASF

- Danone

- FullWell

- Garden of Life

- Herbalife

- HUM Nutrition

- Jarrow Formulas

- Klean Athlete

- Life Extension

- Nature Made

- Nature's Way

- Nestlé

- Nordic Naturals

- NOW Foods

- Perrigo Company

- Pure Encapsulations

- Ritual

- Thorne

- Thorne HealthTech

- USANA Health Sciences

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF

- Danone

- FullWell

- Garden of Life

- Herbalife

- HUM Nutrition

- Jarrow Formulas

- Klean Athlete

- Life Extension

- Nature Made

- Nature's Way

- Nestlé

- Nordic Naturals

- NOW Foods

- Perrigo Company

- Pure Encapsulations

- Ritual

- Thorne

- Thorne HealthTech

- USANA Health Sciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 584 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

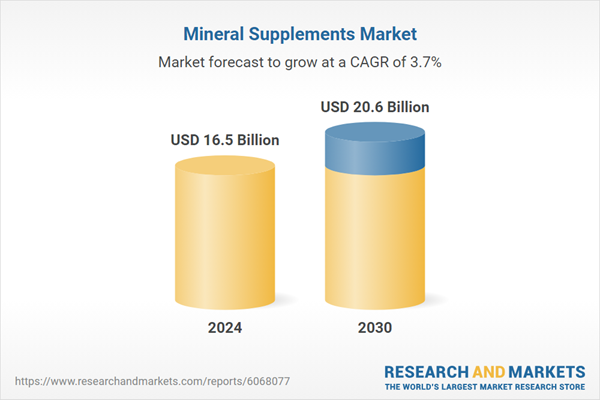

| Estimated Market Value ( USD | $ 16.5 Billion |

| Forecasted Market Value ( USD | $ 20.6 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |