Global Industrial Distribution Substation Market - Key Trends & Drivers Summarized

Industrial Distribution Substation: Strengthening Power Networks for Industrial Operations

The industrial distribution substation market is witnessing significant growth as industries seek efficient, reliable, and high-capacity power distribution systems. Industrial distribution substations serve as critical infrastructure for stepping down high-voltage electricity from transmission lines to lower voltages suitable for industrial use. These substations ensure stable voltage regulation, minimize power losses, and protect industrial electrical systems from faults and fluctuations. Industries such as manufacturing, mining, oil & gas, data centers, and transportation rely heavily on distribution substations to maintain uninterrupted operations.A major trend driving the market is grid modernization and smart substation development. With the increasing demand for electricity, aging power infrastructure is being replaced with intelligent and automated substations featuring IoT-based monitoring, digital control systems, and AI-driven fault detection. These technologies enhance grid reliability, optimize power distribution efficiency, and minimize downtime. Additionally, the integration of renewable energy sources such as solar and wind power into industrial grids is accelerating the need for adaptive and flexible distribution substations capable of managing fluctuating power inputs.

Why Are Industrial Distribution Substations Critical for Power Management?

Industrial facilities depend on stable and efficient power distribution to sustain operations, prevent equipment failures, and avoid costly production downtime. Fluctuations in voltage or unexpected outages can damage sensitive machinery, disrupt automation systems, and lead to financial losses. Distribution substations ensure that industries receive the right amount of power at the correct voltage level, supporting heavy-duty equipment, automated manufacturing processes, and high-energy industrial applications.In addition to voltage transformation, industrial distribution substations are crucial for power quality management. They help eliminate harmonic distortions, correct power factor issues, and mitigate voltage sags and swells, which are common in industrial environments with high power demands. Furthermore, mobile and modular substations are gaining traction for remote industrial operations such as mining, oil & gas exploration, and large-scale construction projects, where rapid deployment and adaptability to harsh conditions are essential.

How Is Technology Transforming Industrial Distribution Substations?

Technological advancements are making industrial distribution substations smarter, more resilient, and energy-efficient. One of the most transformative innovations is digital substations, which replace traditional copper wiring with fiber-optic communication systems. This enhances data transmission speed, reduces maintenance costs, and improves system accuracy. Additionally, cloud-based SCADA (Supervisory Control and Data Acquisition) systems are enabling real-time remote monitoring and control of industrial substations, allowing for predictive maintenance and automated fault detection.The integration of AI and machine learning algorithms is also revolutionizing power management in industrial substations. These technologies analyze historical data, predict equipment failures, and recommend energy optimization strategies, reducing operational risks and improving efficiency. Additionally, the development of advanced switchgear with SF6-free insulation technology is enhancing environmental sustainability by reducing greenhouse gas emissions. The rise of self-healing grids, which can automatically isolate faulty sections and reroute power, is further improving grid resilience and minimizing industrial downtime.

What’ s Driving the Growth of the Industrial Distribution Substation Market?

The growth in the industrial distribution substation market is driven by several key factors, including rising industrialization, increasing demand for energy-efficient power systems, and the modernization of aging electrical grids. With industries expanding operations and adopting automation, the need for high-capacity, reliable, and intelligent power distribution is greater than ever.Additionally, the push toward renewable energy integration is accelerating demand for substations that can manage distributed energy resources (DERs), microgrids, and hybrid power systems. Government incentives and regulatory mandates for energy efficiency and grid reliability are also encouraging industries to upgrade to smart substations with digital controls and AI-driven energy management solutions. As industries continue their transition to sustainable, smart, and resilient power systems, the demand for advanced industrial distribution substations will continue to rise.

Report Scope

The report analyzes the Industrial Distribution Substation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Conventional Technology, Digital Technology); Component (Substation Automation System Component, Communication Network Component, Electrical System Component, Monitoring & Control System Component, Other Components); Category (New Category, Refurbished Category): Voltage Level (Low Voltage Level, Medium Voltage Level, High Voltage Level).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventional Technology segment, which is expected to reach US$10.2 Billion by 2030 with a CAGR of a 4.6%. The Digital Technology segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $3.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Distribution Substation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Distribution Substation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Distribution Substation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Applied Engineering, Inc., Belden Inc., Cypress Industries, E+I Engineering Corp, USA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Industrial Distribution Substation market report include:

- ABB Ltd

- Applied Industrial Technologies, Inc.

- CG Power and Industrial Solutions Limited

- China XD Group

- Eaton Corporation plc

- General Electric Company

- Hitachi Energy Ltd

- KEC International Limited

- Larsen & Toubro Limited

- Michels Corporation

- MRC Global Inc.

- MYR Group Inc.

- Quanta Services, Inc.

- Schneider Electric SE

- Siemens AG

- Sunten Electric Equipment Co., Ltd.

- Vallen Distribution, Inc.

- Vertiv Holdings Co

- WESCO International, Inc.

- Würth Industry North America (WINA)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- Applied Industrial Technologies, Inc.

- CG Power and Industrial Solutions Limited

- China XD Group

- Eaton Corporation plc

- General Electric Company

- Hitachi Energy Ltd

- KEC International Limited

- Larsen & Toubro Limited

- Michels Corporation

- MRC Global Inc.

- MYR Group Inc.

- Quanta Services, Inc.

- Schneider Electric SE

- Siemens AG

- Sunten Electric Equipment Co., Ltd.

- Vallen Distribution, Inc.

- Vertiv Holdings Co

- WESCO International, Inc.

- Würth Industry North America (WINA)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

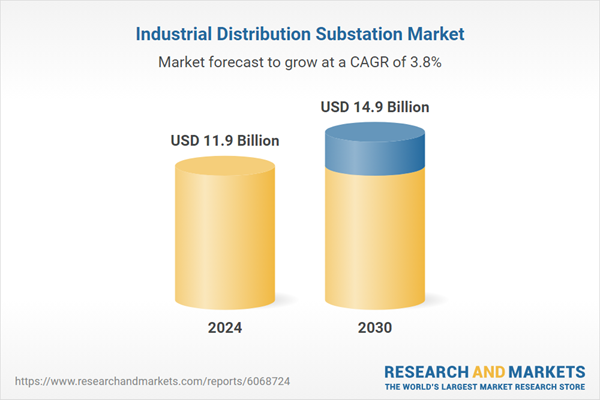

| Estimated Market Value ( USD | $ 11.9 Billion |

| Forecasted Market Value ( USD | $ 14.9 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |