Global Electric Construction Dump Trucks Market - Key Trends & Drivers Summarized

Why Are Electric Construction Dump Trucks Emerging as Game-Changers on Job Sites?

Electric construction dump trucks are fast becoming a pivotal innovation in the heavy equipment landscape, representing a strategic convergence of sustainability, performance, and cost-efficiency in the construction sector. Traditionally powered by diesel engines, dump trucks have been a significant source of carbon emissions and noise pollution at construction and mining sites. The electric variant offers a powerful alternative by operating emission-free, significantly reducing the environmental footprint of heavy-duty operations. These vehicles are engineered to deliver high torque at low speeds, making them especially suited for rugged terrain, hauling heavy loads, and stop-and-go operations common in construction environments. Leading manufacturers are designing purpose-built electric dump trucks that incorporate battery-electric drivetrains, regenerative braking systems, and integrated energy management technologies to maximize efficiency and uptime. With no tailpipe emissions, these vehicles help construction firms comply with increasingly strict environmental regulations and green building certifications. Their quieter operation also allows for extended work hours in urban environments where noise restrictions are in place. Electric dump trucks reduce maintenance demands due to fewer moving parts and no engine oil changes, which is an added advantage for fleet operators. Their integration with telematics and smart diagnostics allows real-time performance monitoring, route optimization, and preventive maintenance alerts, enhancing productivity on the ground. As infrastructure projects grow in complexity and scale, especially in urban developments and sustainable construction projects, the demand for electric heavy equipment like dump trucks is climbing rapidly. The ongoing transition to electric machinery is redefining what efficiency and environmental responsibility look like on the job site.How Are Global Infrastructure Trends and Regulations Steering Market Adoption?

The rapid adoption of electric construction dump trucks is closely linked to global infrastructure investment trends and evolving regulatory landscapes that prioritize environmental sustainability. In Europe, where the construction industry is facing intense scrutiny over emissions, several countries have introduced mandates requiring the use of zero-emission machinery in public infrastructure projects. Scandinavian nations such as Norway and Sweden are pioneering this transition by incentivizing the adoption of electric construction equipment through subsidies and preferential contracts. Germany, the Netherlands, and the UK are also encouraging green construction fleets by offering grants and tax relief for electric vehicle acquisitions. In North America, large-scale infrastructure bills in the United States and Canada are embedding sustainability targets within federally funded construction projects, prompting contractors to adopt electric dump trucks to stay eligible for bids. Additionally, local and state-level environmental regulations - particularly in regions like California - are phasing out diesel engines in off-road equipment, accelerating the move to electric alternatives. In the Asia-Pacific region, China is driving adoption through strict emissions controls in urban construction zones and heavy investments in electric industrial machinery manufacturing. Meanwhile, Japan and South Korea are integrating electric construction vehicles into their broader smart city initiatives, creating fertile ground for market growth. In emerging economies such as India and parts of Southeast Asia, electric dump trucks are beginning to see interest as part of international climate finance projects and government-driven electrification schemes. Across all regions, the rising cost of diesel fuel, coupled with public pressure for cleaner construction practices, is acting as a powerful catalyst for change. Contractors are increasingly factoring in emissions compliance, operational noise, and fuel cost savings when making procurement decisions - trends that directly benefit the electric dump truck market.Is Technological Innovation Driving Performance and Reliability of Electric Dump Trucks?

Electric construction dump trucks are benefiting from a wave of technological innovation that is transforming their design, efficiency, and on-site performance. Battery technology is at the forefront, with improvements in lithium-ion and solid-state batteries enabling longer run times, faster charging, and better durability under demanding load conditions. Manufacturers are integrating high-capacity battery packs with advanced thermal management systems to maintain performance in extreme temperatures - critical for outdoor construction environments. These electric trucks are being engineered with modular drivetrains that allow torque vectoring, improving traction on uneven terrain and enhancing load-handling capability. Regenerative braking systems are also becoming standard, enabling the trucks to recover energy during downhill movement and braking phases, which is particularly useful on construction sites with varying elevations.What’ s Fueling the Fast-Paced Growth of the Global Electric Construction Dump Trucks Market?

The growth in the global electric construction dump trucks market is driven by several factors tied directly to technology evolution, end-use requirements, and shifting contractor and fleet management strategies. A major growth driver is the increasing need for sustainable construction practices, particularly in large-scale urban and infrastructure projects that must meet green certification standards and emission reduction targets. Construction companies are being incentivized - both financially and contractually - to adopt electric machinery, including dump trucks, to secure government and private sector contracts that prioritize eco-conscious operations. The rising cost of diesel fuel and the volatility of fossil fuel markets are pushing fleet operators toward electric alternatives that promise long-term cost stability and lower total cost of ownership. Another significant factor is the growing complexity of urban job sites, where emission-free, low-noise equipment is not just preferred but often mandated by local ordinances. End-use diversification is also driving demand, with electric dump trucks being adopted not just in traditional construction but also in mining, tunneling, landscaping, and industrial waste management. Technological improvements - such as faster charging, increased battery lifespan, and advanced diagnostics - are making these vehicles more reliable and easier to integrate into existing fleets. The rise of turnkey electrification solutions, which bundle vehicles, charging stations, and fleet management software, is reducing adoption barriers for construction firms. Additionally, OEMs and start-ups alike are investing in dedicated electric heavy equipment platforms, allowing for custom-built dump trucks tailored to specific load capacities and operational needs. Public funding, emissions-based taxation, and green procurement policies are further propelling demand. Collectively, these factors - rooted in regulatory compliance, operational efficiency, and sustainability alignment - are propelling the global electric construction dump trucks market into a new era of innovation, adoption, and growth.Report Scope

The report analyzes the Electric Construction Dump Trucks market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Autonomy Level (Manual Operation, Semi-Autonomous, Fully Autonomous); Battery Type (Lithium-Ion Battery, Sodium-Ion Battery, Solid-State Battery); Capacity (Upto 50 Tons, 50 - 100 Tons).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Manual Operation Dump Trucks segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of a 12.2%. The Semi-Autonomous Dump Trucks segment is also set to grow at 8.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $598.6 Million in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $644.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Construction Dump Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Construction Dump Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Construction Dump Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Volvo (Volvo Trucks), Bollinger Motors, Freightliner Custom Chassis, Harbinger Motors Inc., Hubei Qixing Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Electric Construction Dump Trucks market report include:

- AB Volvo (Volvo Trucks)

- Hitachi Construction Machinery (China) Co., Ltd.

- Hydrema Group

- KNOW-HOW Group

- Komatsu Ltd.

- Larsen & Toubro Ltd.

- Propel Industries Pvt. Ltd.

- Sany Group Co., Ltd.

- Scania AB

- Xuzhou Construction Machinery Group Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Volvo (Volvo Trucks)

- Hitachi Construction Machinery (China) Co., Ltd.

- Hydrema Group

- KNOW-HOW Group

- Komatsu Ltd.

- Larsen & Toubro Ltd.

- Propel Industries Pvt. Ltd.

- Sany Group Co., Ltd.

- Scania AB

- Xuzhou Construction Machinery Group Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.3 Billion |

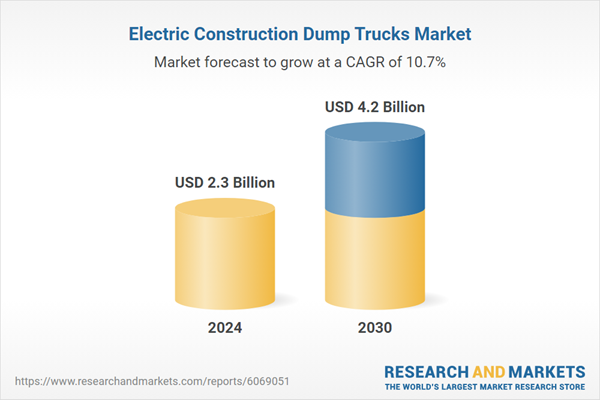

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |