Global Electric Dump Truck Market - Key Trends & Drivers Summarized

Why Are Electric Dump Trucks Gaining Momentum in Heavy-Duty Transportation?

Electric dump trucks are rapidly gaining traction as a transformative force in heavy-duty transport, particularly in construction, mining, and infrastructure development sectors where emissions, operational costs, and efficiency are under increasing scrutiny. These trucks, powered by large-capacity battery systems or hybrid-electric drivetrains, offer a compelling alternative to traditional diesel-fueled models. As industries strive to meet stricter emissions regulations and climate commitments, electric dump trucks are emerging as a practical and future-ready solution for decarbonizing bulk material transport. Their advantages extend beyond zero tailpipe emissions - electric models are quieter, generate less vibration, and require significantly less maintenance due to the reduced number of mechanical components. This makes them not only environmentally beneficial but also operationally efficient. In mining operations, where air quality and worker health are major concerns, electric dump trucks reduce on-site diesel exposure and ventilation requirements, particularly in underground environments. On construction sites, these trucks support 24/7 operation in urban areas with noise restrictions and emission controls. The development of high-torque electric motors enables these vehicles to handle steep gradients and heavy payloads without performance compromise. Additionally, regenerative braking systems convert kinetic energy back into battery power, enhancing overall energy efficiency. With fuel prices fluctuating globally, electric dump trucks provide long-term cost predictability and stability. As electric powertrains become more affordable and battery technology continues to improve, electric dump trucks are positioning themselves as a core element of the next generation of clean, heavy-duty vehicle fleets.How Are Policies and Industry Demands Accelerating Market Adoption Globally?

Government regulations, industry sustainability goals, and evolving procurement criteria are significantly shaping the global adoption of electric dump trucks. Across key markets, regulatory bodies are pushing for stricter emissions standards and encouraging the electrification of heavy-duty vehicles through subsidies, tax credits, and public procurement mandates. In Europe, the Green Deal and country-specific initiatives are pressuring manufacturers and fleet operators to transition to electric power, particularly in construction and waste sectors. In Germany, the use of electric trucks is actively promoted in public infrastructure projects, with low-emission zones in urban areas further accelerating demand. In the U.S., policies at both federal and state levels - such as California’ s Advanced Clean Trucks rule and various clean fleet programs - are driving incentives for electric truck deployment, including dump trucks used in public works and municipal services. Meanwhile, Canada’ s Clean Fuel Standard is influencing fleet electrification across provinces. In Asia-Pacific, China leads the way in electric heavy-duty vehicle production and deployment, supported by subsidies, local mandates, and a strong domestic supply chain for batteries and components. Countries like Japan and South Korea are integrating electric dump trucks into their low-carbon construction and smart city initiatives. Emerging economies, including India and Brazil, are exploring pilot programs and international funding avenues to electrify municipal and industrial fleets. The private sector is also driving momentum, as companies commit to science-based targets and seek cleaner logistics solutions. Contractors bidding for large-scale infrastructure projects are increasingly expected to demonstrate environmental compliance, making electric dump trucks a strategic investment. Globally, the combination of regulatory support and market demand is creating favorable conditions for the accelerated adoption of electric dump trucks.Are Advancements in Powertrain and Battery Tech Elevating Truck Performance?

Breakthroughs in electric powertrain and battery technologies are playing a vital role in elevating the performance and appeal of electric dump trucks. High-energy-density lithium-ion and lithium-iron-phosphate (LFP) batteries are enabling trucks to achieve longer ranges and higher payload capacities without compromising performance. These batteries are often integrated into modular platforms that allow customization based on terrain, usage intensity, and operational schedules. Fast-charging capabilities are also evolving, with some electric dump trucks now able to reach significant charge levels in under an hour, reducing downtime and increasing productivity. Electric motors deliver instant torque, which is particularly advantageous in steep or rugged conditions common on construction and mining sites. Regenerative braking systems further extend range by recovering energy during downhill hauls and deceleration. Integrated thermal management systems keep battery temperatures optimal, enhancing safety and extending service life. Advanced drivetrain architectures, including dual-motor and all-wheel drive configurations, offer improved traction, maneuverability, and load distribution. Many trucks also feature smart energy management systems that optimize power usage across driving modes, route conditions, and payload levels. Telematics integration provides real-time diagnostics, predictive maintenance alerts, and performance analytics, enabling fleet managers to monitor and fine-tune operations remotely. Safety features such as adaptive cruise control, collision detection, and automated emergency braking are increasingly being incorporated into electric models, making them safer and more compliant with modern regulatory standards. These technological enhancements are narrowing the gap between electric and diesel dump trucks in terms of range and uptime, while significantly surpassing them in areas such as efficiency, maintenance, and environmental impact.What’ s Driving the Surge in Global Demand for Electric Dump Trucks?

The growth in the global electric dump truck market is driven by several factors tied directly to energy transition imperatives, sector-specific demands, and technological readiness. One of the primary growth drivers is the construction and mining industry’ s urgent need to decarbonize heavy machinery fleets to meet both regulatory mandates and investor expectations for ESG compliance. Electric dump trucks are becoming a focal point in green procurement strategies for public infrastructure projects, especially in cities enforcing zero-emission construction sites. The rise in urban development and smart city initiatives is also increasing demand for low-noise, clean-operating vehicles that can work in environmentally and socially sensitive zones. Another significant driver is the cost advantage over time - while initial capital expenditure remains high, lower fuel costs, fewer maintenance requirements, and the elimination of idling inefficiencies contribute to a much lower total cost of ownership. From an end-use perspective, the use of electric dump trucks is diversifying beyond traditional construction sites to include applications in mining, quarrying, port logistics, and even agricultural sectors where emissions compliance and sustainability are gaining attention. Government-backed incentives, financing programs, and public-private partnerships are reducing adoption barriers, particularly in developing regions. Advances in charging infrastructure, including mobile and on-site charging solutions, are also alleviating logistical concerns related to electric fleet operation. OEMs and equipment rental companies are expanding their offerings to include electric models, enabling access to cleaner equipment without the need for full ownership. All these factors - grounded in evolving infrastructure needs, regulatory pressure, and advances in electric mobility - are converging to fuel the rapid growth of the electric dump truck market on a global scale.Report Scope

The report analyzes the Electric Dump Truck market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Articulated Type, Rigid Type); Propulsion Systems (Battery Electric Propulsion Systems, Fuel Cell Electric Propulsion Systems, Hybrid Electric Propulsion Systems); Application (Mining Application, Construction Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Articulated Dump Truck segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of a 4.1%. The Rigid Dump Truck segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $763.6 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $740.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Dump Truck Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Dump Truck Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Dump Truck Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Consolidated Edison, Inc., Duke Energy Corporation, E.ON SE, Enel SpA, ENGIE SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Electric Dump Truck market report include:

- AB Volvo (Volvo Trucks)

- Caterpillar, Inc.

- Hitachi Construction Machinery (China) Co., Ltd.

- Hydrema Group

- Komatsu Europe International NV

- Larsen & Toubro Ltd.

- Liebherr-International AG

- Mack Trucks, Inc.

- Nikola Corporation

- Propel Industries Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Volvo (Volvo Trucks)

- Caterpillar, Inc.

- Hitachi Construction Machinery (China) Co., Ltd.

- Hydrema Group

- Komatsu Europe International NV

- Larsen & Toubro Ltd.

- Liebherr-International AG

- Mack Trucks, Inc.

- Nikola Corporation

- Propel Industries Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 368 |

| Published | February 2026 |

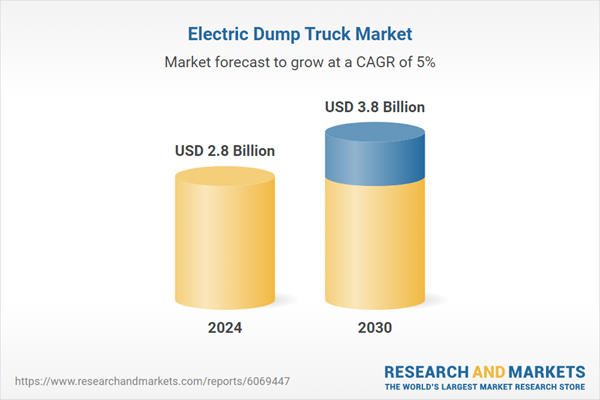

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |