Global On-Demand Trucking Market - Key Trends & Drivers Summarized

Why Is On-Demand Trucking Disrupting Traditional Freight and Logistics Models?

On-demand trucking is rapidly transforming the freight and logistics industry by replacing rigid, pre-booked transport schedules with real-time, flexible cargo-matching solutions. This tech-enabled model connects shippers directly with available truckers or fleets via digital platforms, significantly improving freight visibility, reducing idle capacity, and enhancing delivery speed. Traditionally dominated by brokers, paperwork-heavy processes, and fragmented communication, the trucking sector is now seeing a wave of digitalization driven by mobile apps, cloud platforms, and automated dispatch tools. Shippers benefit from instant pricing, tracking, and booking capabilities, while carriers enjoy greater route optimization, fewer empty miles, and faster payment cycles. On-demand trucking meets the increasing need for just-in-time and same-day deliveries, especially in e-commerce, retail, manufacturing, and agricultural supply chains. Its ability to provide dynamic, scalable freight solutions is particularly useful during seasonal peaks or last-minute shipments. The model also supports smaller fleet owners and independent truckers, helping them access high-value loads and maintain better asset utilization. As global trade networks and logistics expectations evolve, on-demand trucking is positioning itself as the agile, efficient, and tech-forward alternative to traditional freight transportation methods.How Are Digital Platforms and Automation Technologies Driving Efficiency Gains?

The backbone of the on-demand trucking market is its digital infrastructure - platforms powered by AI, IoT, machine learning, and real-time analytics. These technologies enable predictive freight matching by analyzing location data, load specifications, vehicle capacity, traffic, and fuel costs to suggest optimal truck-load pairings. App-based systems allow drivers to accept jobs, update delivery status, and navigate using integrated GPS and route optimization tools, while shippers can track cargo in real time, communicate with drivers, and receive instant digital documentation. Automation reduces human error and accelerates operations - from smart contract generation to e-POD (proof of delivery) and auto-billing. Fleet management features, including telematics and predictive maintenance alerts, help carriers maintain vehicle uptime and reduce operating costs. In larger fleets, AI-driven demand forecasting tools and dynamic pricing engines further enhance profitability. Additionally, API integration with TMS (Transport Management Systems), ERPs, and warehouse platforms ensures seamless end-to-end supply chain visibility.Is Shifting Consumer and Supply Chain Behavior Fueling Market Momentum?

Changing consumer expectations and evolving supply chain dynamics are among the most significant drivers of the on-demand trucking market. The explosion of e-commerce and direct-to-consumer delivery models has shortened delivery windows and increased the frequency of small-batch shipments, making flexibility and speed critical to fulfillment operations. Retailers, manufacturers, and 3PLs are demanding logistics partners who can provide fast, trackable, and cost-effective solutions without long-term commitments. This need aligns perfectly with the on-demand model, which offers scalable freight capacity on a per-shipment basis.What’ s Driving the Growth of the On-Demand Trucking Market Across Global Regions?

The growth in the on-demand trucking market is driven by several factors rooted in logistics innovation, digital transformation, evolving trade dynamics, and shifting business models. The increasing complexity of urban and regional freight needs, especially driven by e-commerce and same-day delivery trends, is pushing businesses to adopt more flexible transport solutions. Startups and tech-based logistics companies are launching digital freight matching platforms tailored to small and mid-sized shippers, unlocking new capacity in previously fragmented markets. In developed regions such as North America and Europe, widespread smartphone adoption, telematics infrastructure, and regulatory openness to digital freight brokerage are enabling rapid scalability of on-demand platforms. In emerging markets across Asia-Pacific, Latin America, and Africa, the rise of digital ecosystems and underutilized trucking capacity are providing fertile ground for market penetration. Fleet owners in these regions benefit from on-demand models that offer consistent loads and access to broader freight networks without reliance on traditional intermediaries. The convergence of freight digitalization, urbanization, and supply chain diversification is also encouraging investment from venture capitalists, logistics incumbents, and tech conglomerates, further propelling global growth. Lastly, policy trends supporting data transparency, smart logistics, and digital infrastructure development are reinforcing adoption. Together, these dynamics are driving the accelerated global expansion of the on-demand trucking market, reshaping how goods are moved in a hyper-connected world.Report Scope

The report analyzes the On-demand Trucking market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Service (One-Time Services, Contractual Services); Delivery (First Mile & Last Mile Delivery, Same-Day Delivery); Freight (Full Truck Load, Less Than Truck Load, Intermodal Truck Load); Vehicle (Medium-Duty Trucks, Light-Duty Trucks, Heavy-Duty Trucks); Vertical (Manufacturing Vertical, Retail & E-commerce Vertical, Healthcare Vertical, Food & Beverage Vertical, Automotive Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the One-Time Services segment, which is expected to reach US$485.4 Billion by 2030 with a CAGR of a 21.2%. The Contractual Services segment is also set to grow at 15.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $62.0 Billion in 2024, and China, forecasted to grow at an impressive 25.9% CAGR to reach $152.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global On-demand Trucking Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global On-demand Trucking Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global On-demand Trucking Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akulaku, Bestow Inc., Clearcover Inc., Cover Genius, Cuvva Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this On-demand Trucking market report include:

- BlackBuck

- Cargomatic

- Convoy

- Deliveree

- DHL Supply Chain

- Einride

- FreightBro

- GoShare

- J.B. Hunt Transport

- Kargo Technologies

- Lalamove

- Loadsmart

- NEXT Trucking

- Relay On Demand

- Rivigo

- Transfix

- TruKKer

- Uber Freight

- uShip

- XPO Logistics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BlackBuck

- Cargomatic

- Convoy

- Deliveree

- DHL Supply Chain

- Einride

- FreightBro

- GoShare

- J.B. Hunt Transport

- Kargo Technologies

- Lalamove

- Loadsmart

- NEXT Trucking

- Relay On Demand

- Rivigo

- Transfix

- TruKKer

- Uber Freight

- uShip

- XPO Logistics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 560 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

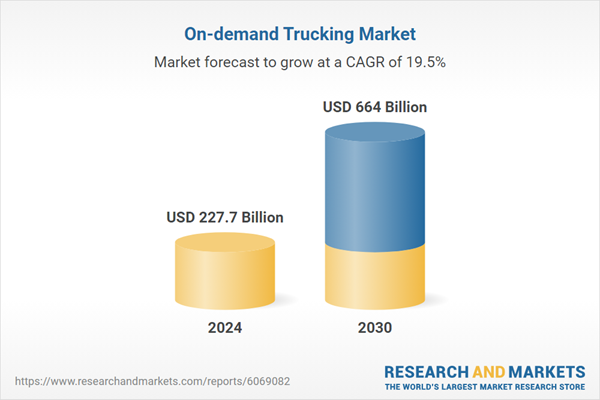

| Estimated Market Value ( USD | $ 227.7 Billion |

| Forecasted Market Value ( USD | $ 664 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |