Global LNG Truck Market - Key Trends & Drivers Summarized

Why Are LNG Trucks Gaining Popularity in the Transportation Industry?

The global push toward reducing carbon emissions and dependence on diesel-powered vehicles has led to increased adoption of liquefied natural gas (LNG) trucks. Compared to traditional diesel trucks, LNG-powered trucks offer lower greenhouse gas emissions, reduced operating costs, and compliance with stringent environmental regulations. Fleet operators and logistics companies are turning to LNG as an alternative fuel due to its ability to provide long-range capabilities while cutting fuel costs. Additionally, government incentives promoting LNG-powered commercial vehicles have further fueled market growth, particularly in regions where natural gas infrastructure is expanding. The logistics and freight transport sectors have emerged as primary adopters of LNG trucks, leveraging the fuel’ s cost-effectiveness and sustainability benefits to transition toward cleaner transportation solutions.How Are Advancements in LNG Truck Technology Enhancing Performance?

Technological advancements in LNG truck manufacturing have significantly improved vehicle efficiency, safety, and reliability. Modern LNG trucks are equipped with high-performance cryogenic fuel storage systems that maintain liquefied natural gas at extremely low temperatures, ensuring efficient combustion and extended driving ranges. Enhanced engine designs, including high-pressure direct injection (HPDI) technology, have optimized fuel efficiency while maintaining power output comparable to diesel engines. Additionally, onboard telemetry and fleet management software are enabling logistics operators to monitor fuel consumption, optimize routes, and enhance vehicle performance in real time. The introduction of dual-fuel engines, which allow trucks to switch between LNG and diesel based on fuel availability, has further increased the versatility of LNG-powered vehicles. These technological innovations are making LNG trucks more competitive with diesel alternatives, accelerating their adoption across the transportation industry.What Are the Challenges Facing the LNG Truck Market?

Despite its benefits, the widespread adoption of LNG trucks faces challenges related to infrastructure availability, high initial costs, and fuel supply logistics. The lack of an extensive LNG refueling network in many regions limits the feasibility of long-haul operations, requiring significant investments in fueling infrastructure. The higher upfront costs of LNG trucks compared to diesel alternatives also pose a barrier to adoption, particularly for small and mid-sized logistics companies. Additionally, concerns over methane leakage during LNG handling and storage have raised environmental considerations that manufacturers and regulators are working to address. To overcome these challenges, governments and energy companies are investing in expanding LNG refueling stations, providing subsidies for fleet conversions, and developing stricter emission control measures for LNG-powered vehicles.What Factors Are Driving Growth in the LNG Truck Market?

The growth in the LNG truck market is driven by several factors, including government regulations on emissions, advancements in natural gas engine technology, and the expansion of LNG refueling infrastructure. Stringent carbon emission reduction targets are pushing logistics companies to transition from diesel to cleaner fuel alternatives, making LNG a preferred choice for commercial fleets. The increasing availability of high-efficiency LNG engines with lower operating costs and reduced emissions is attracting fleet operators seeking long-term cost savings. Investments in LNG fueling infrastructure, particularly in Europe, China, and North America, are making LNG trucks more viable for long-haul transportation. Additionally, the rise of green logistics initiatives and corporate sustainability commitments are driving demand for alternative fuel vehicles, positioning LNG trucks as a critical solution for achieving low-emission freight transport. As technological advancements continue to improve vehicle efficiency and infrastructure expands, the LNG truck market is expected to witness sustained growth, reinforcing its role in the global transition toward cleaner transportation.Report Scope

The report analyzes the LNG Trucks market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Class (Class 7, Class 8); Cab (Day cab, Sleeper cab); Ownership (Fleet operator, Independent operator); Application (Freight delivery, Utility services, Construction & mining, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Class 7 Trucks segment, which is expected to reach US$25.3 Billion by 2030 with a CAGR of a 8.6%. The Class 8 Trucks segment is also set to grow at 8.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.9 Billion in 2024, and China, forecasted to grow at an impressive 13.3% CAGR to reach $8.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LNG Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LNG Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LNG Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4-Star Trailers, Apex Trailers, Delta Manufacturing, EBY (M.H. EBY, Inc.), Eagle X Trailers and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 35 companies featured in this LNG Trucks market report include:

- ADB Global Sales

- Blue Energy Motors

- China FAW Group Corporation

- China National Heavy Duty Truck Group Co., Ltd. (Sinotruk)

- Daimler Truck AG

- Dongfeng Motor Corporation

- FAW Group Corporation

- Fiat Industrial (now CNH Industrial)

- GreenLine Mobility Solutions

- Hegelmann Group

- Hyundai Motor Company

- IVECO

- Isuzu Motors Ltd.

- Kenworth (PACCAR Inc.)

- MAN Truck & Bus

- Navistar International Corporation

- Nikola Corporation

- PACCAR Inc.

- Peterbilt Motors (PACCAR Inc.)

- Scania AB

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADB Global Sales

- Blue Energy Motors

- China FAW Group Corporation

- China National Heavy Duty Truck Group Co., Ltd. (Sinotruk)

- Daimler Truck AG

- Dongfeng Motor Corporation

- FAW Group Corporation

- Fiat Industrial (now CNH Industrial)

- GreenLine Mobility Solutions

- Hegelmann Group

- Hyundai Motor Company

- IVECO

- Isuzu Motors Ltd.

- Kenworth (PACCAR Inc.)

- MAN Truck & Bus

- Navistar International Corporation

- Nikola Corporation

- PACCAR Inc.

- Peterbilt Motors (PACCAR Inc.)

- Scania AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 458 |

| Published | February 2026 |

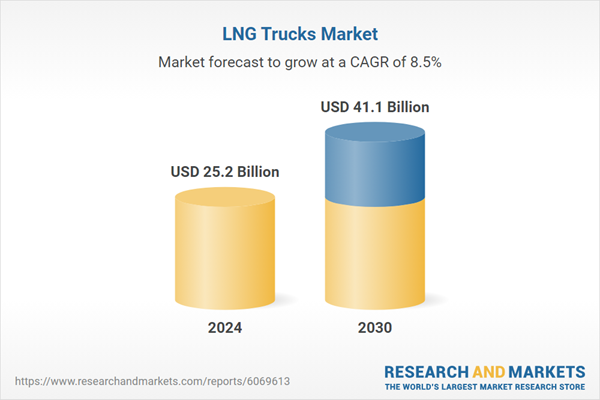

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.2 Billion |

| Forecasted Market Value ( USD | $ 41.1 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |