Global Fire Resistant Lubricants Market - Key Trends & Drivers Summarized

Why Are Fire Resistant Lubricants Becoming Mission-Critical in Industrial Operations?

In industries where high-temperature operations and fire hazards are routine, fire resistant lubricants have become essential for safe and reliable performance. These specialized fluids are formulated to resist ignition and suppress flame propagation under extreme conditions, significantly reducing the risk of catastrophic equipment failure or workplace fires. Their adoption is particularly prevalent in sectors such as steel, mining, aviation, marine, power generation, and military, where hydraulic systems, gearboxes, and turbines operate under high pressure and in proximity to heat sources. Unlike conventional mineral oils, fire resistant lubricants - categorized into types such as water-containing (HFA, HFB), water-free (HFC, HFD), and synthetic esters - offer a much higher flash point and reduced flammability. The growing use of automated machinery and robotics in hazardous industrial environments has further emphasized the need for lubricants that can function reliably under thermal stress without compromising fire safety. With workplace safety regulations becoming increasingly stringent across the globe, the demand for fire resistant alternatives is rising as companies look to mitigate risks and ensure operational continuity. As asset protection becomes a strategic priority, fire resistant lubricants are no longer optional - they are a vital investment in industrial safety and risk management.How Are Technological Innovations Transforming Lubricant Formulations and Applications?

Recent advances in additive chemistry and synthetic base oils are playing a pivotal role in the evolution of fire resistant lubricants. New-generation formulations now combine fire resistance with superior lubrication properties, thermal stability, and oxidation resistance, addressing earlier trade-offs in performance. High-performance synthetic esters and phosphate esters are leading the way, offering low toxicity, biodegradability, and compatibility with a wide range of seals and system materials. These developments have enabled the use of fire resistant lubricants in applications that were previously dominated by traditional oils, such as high-load gear systems and critical hydraulic circuits. The integration of nanotechnology and advanced anti-wear additives is also improving load-carrying capacity and extending lubricant life, thereby reducing maintenance frequency and downtime. In high-temperature environments like steel mills and aluminum smelters, where fluid leakage poses both a fire and environmental hazard, these cutting-edge formulations provide a dual advantage. Additionally, manufacturers are investing in digital monitoring systems that track lubricant condition in real-time, ensuring predictive maintenance and reducing the likelihood of system failure. As technology continues to enhance performance parameters, fire resistant lubricants are becoming indispensable in sectors where safety, durability, and efficiency intersect.What Role Do Regulations and Industry Standards Play in Influencing Adoption?

The adoption of fire resistant lubricants is being strongly influenced by a tightening global regulatory environment, which increasingly prioritizes safety, sustainability, and environmental stewardship. Occupational safety guidelines established by bodies such as OSHA (Occupational Safety and Health Administration), MSHA (Mine Safety and Health Administration), and EU-OSHA emphasize the use of non-flammable or fire-suppressing fluids in critical machinery, especially in confined or high-risk operational zones. Industry-specific standards such as ISO 12922 and FM Global certifications further define performance benchmarks that lubricants must meet to qualify for use in safety-sensitive environments. Compliance with these standards is now a core requirement in industrial procurement processes, especially for multinational corporations operating across regulated markets. Moreover, growing environmental awareness is pushing end-users to opt for fire resistant lubricants that are biodegradable and low in volatile organic compounds (VOCs). Insurance providers are also playing a role, offering premium discounts or coverage advantages for facilities using certified fire resistant fluids. These regulatory and institutional pressures are not only expanding the use of fire resistant lubricants in traditional industries but also opening up new opportunities in renewable energy, electric vehicles, and clean manufacturing ecosystems where safety and sustainability are co-prioritized.What’ s Fueling Market Expansion Across End-Use Segments and Global Regions?

The growth in the fire resistant lubricants market is driven by several factors related to evolving industrial demands, technological progress, regulatory frameworks, and regional development trends. The increasing automation of manufacturing processes across industries such as steel, mining, and heavy machinery has intensified the need for high-performance, fire-safe fluids in hydraulic and lubrication systems. In the power generation sector, particularly in gas turbines and nuclear facilities, fire resistant lubricants are gaining traction due to their ability to operate under extreme temperatures while meeting strict safety codes. The aviation and marine industries are also seeing expanded usage, as they require lubricants that can perform in confined, high-risk environments without igniting under pressure. Rapid industrialization in emerging economies - especially in Asia-Pacific, Latin America, and the Middle East - is creating a significant demand surge, driven by new infrastructure projects and the modernization of industrial safety standards. Additionally, the increasing focus on worker safety and environmental compliance among global manufacturers is fostering greater adoption of fire resistant lubricants as part of comprehensive risk management strategies. The availability of customized, application-specific lubricant solutions and the rise of service-based maintenance contracts are further accelerating market growth. Together, these drivers are shaping a robust global demand outlook for fire resistant lubricants across a diverse range of applications and geographies.Report Scope

The report analyzes the Fire Resistant Lubricants market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (HFA, HFB, HFC, HFDU, HFDR); End-Use (Metal Processing End-Use, Mining End-Use, Power Generation End-Use, Aerospace End-Use, Marine End-Use, Construction End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the HFA segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 1.2%. The HFB segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $876.1 Million in 2024, and China, forecasted to grow at an impressive 3.7% CAGR to reach $672.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fire Resistant Lubricants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fire Resistant Lubricants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fire Resistant Lubricants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Fire Resistant Lubricants market report include:

- BP plc

- Castrol Limited

- Chevron Corporation

- CONDAT Corporation

- Eastman Chemical Company

- Eni S.p.A.

- ExxonMobil Corporation

- FUCHS Petrolub SE

- Idemitsu Kosan Co., Ltd.

- LUKOIL Lubricants Company

- Petro-Canada Lubricants Inc.

- PETROFER Chemie H.R. Fischer GmbH

- Petronas Lubricants International

- Phillips 66 Company

- Quaker Houghton

- Shell Global

- Sinopec Limited

- TotalEnergies Lubrifiants

- TotalEnergies SE

- Valvoline Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BP plc

- Castrol Limited

- Chevron Corporation

- CONDAT Corporation

- Eastman Chemical Company

- Eni S.p.A.

- ExxonMobil Corporation

- FUCHS Petrolub SE

- Idemitsu Kosan Co., Ltd.

- LUKOIL Lubricants Company

- Petro-Canada Lubricants Inc.

- PETROFER Chemie H.R. Fischer GmbH

- Petronas Lubricants International

- Phillips 66 Company

- Quaker Houghton

- Shell Global

- Sinopec Limited

- TotalEnergies Lubrifiants

- TotalEnergies SE

- Valvoline Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 296 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

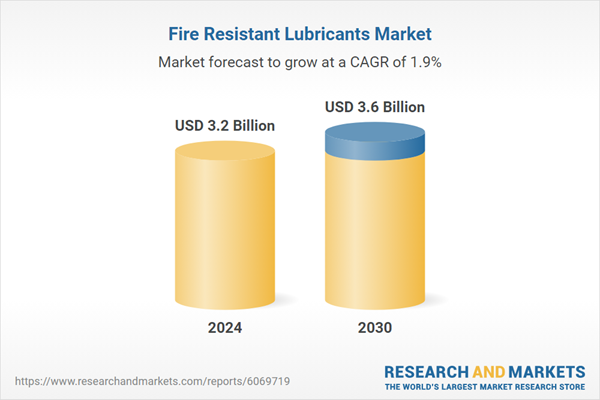

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |