Global Plant-Based Yogurt Market - Key Trends & Drivers Summarized

The plant-based yogurt market is witnessing exponential growth, fueled by rising consumer demand for dairy-free alternatives, advancements in food technology, and the increasing adoption of plant-based diets. As consumers become more aware of lactose intolerance, digestive health, and ethical food choices, plant-based yogurt has emerged as a mainstream dairy alternative, offering a rich source of probiotics, protein, and essential nutrients. This category is no longer limited to niche vegan markets but is expanding into mainstream retail, foodservice, and functional food segments, with innovations in taste, texture, and nutritional fortification driving consumer interest.One of the most prominent trends in the plant-based yogurt industry is the diversification of ingredient bases. While soy and almond-based yogurts dominated the early market, the industry has evolved with the introduction of oat, coconut, cashew, macadamia, pea protein, and hemp-based formulations. Each plant source offers distinct texture, flavor, and nutritional benefits, catering to different consumer preferences. Oat-based yogurt, in particular, has gained massive popularity due to its creamy texture, gut-friendly beta-glucans, and neutral flavor, making it a preferred choice in smoothie bowls, breakfast alternatives, and snacking options.

Another key trend shaping the market is the rise of protein-enriched and fortified plant-based yogurts. As dairy yogurt traditionally serves as a protein-rich breakfast or snack, plant-based brands are leveraging pea protein, soy protein isolates, and nut-based proteins to improve amino acid profiles and satiety levels. Additionally, fortification with probiotics, omega-3 fatty acids, fiber, and vitamins (such as B12 and D3) is making plant-based yogurt a functional and nutrient-dense alternative. The shift toward high-protein, clean-label, and gut-health-supporting products is expanding the market beyond vegans, attracting health-conscious and fitness-focused consumers.

How Are Technological Innovations Transforming Plant-Based Yogurt?

Advancements in food science, fermentation techniques, and ingredient processing are playing a crucial role in improving the taste, texture, and nutritional profile of plant-based yogurts. The biggest challenge for manufacturers has been replicating the creamy, thick consistency and probiotic-rich profile of dairy yogurt, and recent innovations are addressing these concerns through novel fermentation methods and stabilizing agents.One of the most transformative innovations in the industry is precision fermentation and microbial fermentation. Companies are using non-dairy probiotics and fermentation-enhancing bacteria strains to improve texture, tanginess, and gut-health benefits in plant-based yogurts. The development of customized vegan lactic acid bacteria strains has allowed brands to achieve better flavor complexity and probiotic stability, making these yogurts more comparable to traditional dairy versions.

Another key breakthrough is the enhancement of texture using natural thickeners and emulsifiers. While traditional dairy yogurt relies on casein proteins for structure, plant-based alternatives require plant-derived hydrocolloids and stabilizers such as agar-agar, tapioca starch, guar gum, pectin, and chicory root fiber to achieve a smooth, creamy mouthfeel. Additionally, enzyme-based processing techniques are being utilized to reduce grittiness and sedimentation, particularly in nut- and oat-based formulations.

The introduction of AI-driven ingredient optimization and 3D food printing is further revolutionizing the plant-based yogurt sector. AI is being used to analyze consumer preferences, optimize plant-based protein blends, and predict ideal flavor pairings, allowing brands to develop tailored yogurt textures and flavors. Meanwhile, 3D printing of plant-based dairy alternatives is being explored to enhance precision in ingredient layering and textural complexity, particularly in premium, artisanal yogurt brands.

Additionally, packaging innovations are playing a critical role in market expansion. With the rise in sustainability-conscious consumers, brands are moving toward biodegradable, compostable, and plastic-free packaging solutions. The use of plant-derived bioplastics, recyclable paper cartons, and edible yogurt containers is aligning with eco-friendly initiatives, appealing to consumers who prioritize both health and environmental impact.

How Are Retail and Foodservice Trends Shaping the Demand for Plant-Based Yogurt?

The retail and foodservice sectors are significantly influencing the growth and accessibility of plant-based yogurt. Supermarkets, health food stores, and online retailers are expanding their plant-based dairy sections, offering a wider selection of flavored, unsweetened, and high-protein yogurt variants to cater to diverse consumer needs.One of the fastest-growing segments in the market is single-serve and grab-and-go plant-based yogurt cups, which align with the on-the-go lifestyle of modern consumers. Convenience-driven product innovations, such as drinkable plant-based yogurts, probiotic shots, and layered parfait-style offerings, are gaining popularity in urban markets, workplace snack aisles, and fitness centers. Additionally, the inclusion of prebiotics, adaptogens, and functional herbs in plant-based yogurt formulations is attracting the wellness-conscious demographic, driving demand for holistic health-oriented dairy alternatives.

The foodservice sector is also experiencing a surge in plant-based yogurt adoption, with major coffee chains, restaurants, and quick-service restaurants (QSRs) incorporating dairy-free yogurt options into their menus. Coffee shops are using plant-based yogurt for smoothie bowls, parfaits, and vegan-friendly breakfast options, while fast-casual dining establishments are integrating it into sauces, dips, and dessert recipes. Brands like Starbucks, Jamba Juice, and Panera Bread have expanded their plant-based offerings, leading to greater mainstream exposure and acceptance of plant-based yogurt as a versatile and functional food ingredient.

The rise of direct-to-consumer (DTC) brands and subscription-based yogurt delivery services is another factor shaping the retail landscape. Online platforms allow consumers to customize their plant-based yogurt purchases, explore seasonal flavors and limited-edition releases, and receive fresh probiotic-rich alternatives delivered to their doorstep. This model is especially popular among health-conscious millennials and Gen Z consumers, who prioritize convenience, personalization, and premium-quality plant-based dairy alternatives.

What Factors Are Driving the Growth of the Plant-Based Yogurt Market?

The growth in the plant-based yogurt market is driven by several factors, including advancements in fermentation technology, increasing demand for protein-rich dairy alternatives, the rise of functional food trends, and the expansion of sustainable food packaging solutions. The continuous improvement in texture, probiotic content, and nutritional fortification is making plant-based yogurt a viable competitor to traditional dairy yogurt, attracting both vegan and flexitarian consumers.One of the major factors accelerating market expansion is the increasing investment in plant-based food innovation. Large food corporations and startups alike are investing in biotechnology-driven dairy alternatives, novel protein blends, and sustainable fermentation techniques to create next-generation plant-based yogurts. Strategic partnerships between food tech firms and retail chains are ensuring wider product availability and enhanced consumer awareness, strengthening the overall market.

The shift toward functional foods and gut-health-enhancing products is also playing a crucial role in driving demand. With consumers prioritizing digestive wellness, immune support, and holistic nutrition, brands are incorporating science-backed probiotics, prebiotic fiber, and anti-inflammatory ingredients into their yogurt formulations. The convergence of plant-based nutrition and gut-friendly benefits is positioning plant-based yogurt as a staple in functional food categories, appealing to health-focused consumers globally.

Additionally, government policies and regulatory approvals supporting plant-based dairy alternatives and clean-label products are further fueling market growth. Regulatory agencies are standardizing labeling, ensuring transparency in ingredient sourcing, and promoting sustainable agriculture, leading to a more structured and legally compliant plant-based yogurt industry.

As sustainability, clean-label innovation, and personalized nutrition continue to gain momentum, the plant-based yogurt market is expected to see sustained growth and diversification. Companies that invest in advanced food technology, ingredient optimization, and sustainable production will lead the next phase of dairy-free innovation, shaping the future of plant-based functional foods worldwide.

Report Scope

The report analyzes the Plant-based Yogurts market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Source (Almond, Oat, Soy, Coconut, Others); Flavor (Flavored Yogurt, Non-Flavored Yogurt); Distribution Channel (B2B, B2C).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Almond Source segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 13.1%. The Oat Source segment is also set to grow at 10.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $927.2 Million in 2024, and China, forecasted to grow at an impressive 17% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plant-based Yogurts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plant-based Yogurts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plant-based Yogurts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpro (Danone), Anita's Yogurt, Califia Farms, Cocojune, Culina Yogurt and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Plant-based Yogurts market report include:

- Alpro (Danone)

- Anita's Yogurt

- Califia Farms

- Cocojune

- Culina Yogurt

- Daiya Foods Inc.

- Danone S.A.

- Forager Project

- Harmless Harvest

- Kite Hill

- Lavva

- Maison Riviera

- Nancy's Probiotic Foods

- Oatly AB

- Ripple Foods

- Siggi's Dairy

- The Coconut Collaborative

- Trader Joe's

- Yoconut Dairy Free

- Yoplait (General Mills)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpro (Danone)

- Anita's Yogurt

- Califia Farms

- Cocojune

- Culina Yogurt

- Daiya Foods Inc.

- Danone S.A.

- Forager Project

- Harmless Harvest

- Kite Hill

- Lavva

- Maison Riviera

- Nancy's Probiotic Foods

- Oatly AB

- Ripple Foods

- Siggi's Dairy

- The Coconut Collaborative

- Trader Joe's

- Yoconut Dairy Free

- Yoplait (General Mills)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

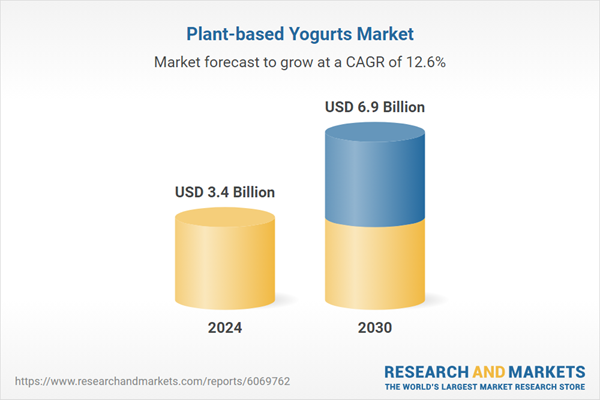

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 6.9 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |