Global Millet Market - Key Trends & Drivers Summarized

What Is Millet and Why Is It Gaining Popularity?

Millet is a group of small-seeded cereal grains that belong to the Poaceae family and have been cultivated for thousands of years. Known for their high nutritional value, drought resistance, and ability to thrive in harsh climatic conditions, millets are an important food staple in regions such as Africa, India, and parts of Asia. The most commonly grown varieties include pearl millet, finger millet, foxtail millet, proso millet, and barnyard millet, each offering unique health benefits and agricultural advantages.The growing popularity of millet is primarily due to its high protein, fiber, and essential mineral content, making it a nutritious alternative to wheat and rice. With increasing awareness about gluten-free and whole grain diets, millet has become a preferred choice for consumers seeking healthier dietary options. It is also a rich source of antioxidants, iron, magnesium, and B vitamins, promoting better digestion, heart health, and blood sugar regulation.

Millet is also attracting attention for its role in climate-smart agriculture. Unlike other staple grains, millet is highly resistant to drought, requires minimal water, and can grow in poor soil conditions. This makes it an ideal crop for regions facing water scarcity and soil degradation. As climate change threatens global food security, millet is being promoted as a sustainable crop that can support resilient food systems while reducing dependence on resource-intensive grains like rice and wheat.

How Are Technological Innovations Transforming Millet Cultivation and Processing?

The millet market is undergoing a transformation due to technological advancements in farming, processing, and value-added product development. One of the most significant innovations is the adoption of precision agriculture techniques, which use drones, satellite imaging, and AI-driven data analytics to optimize soil health, irrigation, and pest control in millet farming. These technologies are helping farmers improve crop yields, reduce input costs, and minimize environmental impact.The development of improved millet varieties through biotechnology and selective breeding is another major breakthrough. Research institutes and agricultural organizations are working on hybrid and genetically improved millet strains that offer higher yields, improved pest resistance, and enhanced nutritional content. These advancements are helping boost production efficiency and make millet a more competitive alternative to conventional grains.

Post-harvest processing and value-added product innovations

are also driving market expansion. Traditionally, millet has been consumed in whole grain form or as flour, but modern food technology is enabling the production of ready-to-eat millet products, breakfast cereals, snacks, pasta, and gluten-free baked goods. Companies are investing in milling, extrusion, and fortification techniques to improve the texture, shelf life, and nutritional profile of millet-based foods. These innovations are making millet more appealing to urban consumers and international markets.Additionally, smart packaging and blockchain-based supply chain management are improving millet traceability, quality assurance, and market transparency. Blockchain technology allows consumers to track the origin of their millet products, ensuring organic, non-GMO, and fair-trade compliance, which is increasingly valued in global food markets.

What Are the Key Challenges Facing the Millet Industry?

Despite the growing demand for millet, the industry faces several challenges related to low productivity, limited awareness, processing difficulties, and market access constraints. One of the primary issues is the low yield potential of traditional millet varieties compared to wheat, rice, and maize. While millet is drought-resistant and hardy, it often produces lower grain output per hectare, making it less economically attractive for large-scale farmers. Investment in agronomic research, hybrid seed development, and improved farming techniques is crucial to addressing this challenge.Another major hurdle is processing and storage limitations. Millet grains have a hard outer husk, which makes dehulling, milling, and refining more complex and costly compared to other cereals. The lack of efficient processing infrastructure in many millet-producing regions restricts market expansion and discourages farmers from growing the crop. Additionally, the short shelf life of processed millet flour poses challenges for distribution and export markets. Innovations in milling technology, grain preservation, and packaging solutions are needed to enhance supply chain efficiency.

Limited consumer awareness and market demand in some regions

also hinder millet growth. While millet is widely consumed in Africa and South Asia, it remains underutilized in Western markets, where wheat, rice, and quinoa dominate the grain industry. Despite its health benefits, millet has yet to achieve widespread mainstream appeal due to lack of familiarity, cooking difficulties, and perception as a “ poor man’ s grain” in some cultures. Education campaigns, celebrity endorsements, and strategic branding efforts are necessary to increase millet’ s market visibility and consumer acceptance.Furthermore, government policies and trade barriers impact the millet industry’ s growth potential. Unlike wheat and rice, which receive heavy subsidies in many countries, millet farmers often lack financial support, insurance coverage, and access to credit. Policies that promote millet as a climate-resilient crop, provide incentives for farmers, and support research and development could significantly boost production and global adoption.

What Are the Key Growth Drivers for the Millet Market?

The growth in the millet market is driven by rising health consciousness, growing demand for sustainable crops, expanding gluten-free food markets, and government initiatives promoting millet cultivation.One of the primary growth drivers is the global shift toward healthier eating habits. Consumers are actively seeking whole grains, plant-based proteins, and functional foods, making millet an attractive choice due to its high fiber content, low glycemic index, and rich nutrient profile. As awareness of diabetes management, heart health, and gut-friendly foods increases, millet is gaining recognition as a superfood in global markets.

The rise of the gluten-free and plant-based food industries is another major factor fueling millet demand. With more people adopting gluten-free, vegan, and flexitarian diets, millet is being positioned as a natural, nutritious, and versatile ingredient. Food manufacturers are developing millet-based pasta, cereals, energy bars, and plant-based dairy alternatives, expanding its appeal among health-conscious consumers.

Governments and international organizations are also playing a crucial role in promoting millet cultivation. The United Nations declared 2023 as the International Year of Millets, highlighting its potential to improve global food security, support smallholder farmers, and combat climate change. Countries like India have launched initiatives to boost millet production, increase farmer incentives, and integrate millet into public food programs such as school meals and government ration supplies. These efforts are expected to drive both domestic consumption and export opportunities for millet-producing countries.

The expansion of export markets and international trade agreements is further boosting the millet industry. Demand for organic, non-GMO, and fair-trade grains is rising in regions like North America, Europe, and the Middle East, where consumers prioritize sustainability and ethical sourcing. Strengthening global supply chains, improving trade policies, and ensuring compliance with international food safety standards will be key to unlocking new market opportunities.

Additionally, the integration of millet into animal feed and biofuel production is opening up new revenue streams. With rising feed costs and sustainability concerns in livestock farming, millet is being explored as a cost-effective and nutrient-rich alternative to traditional grains in poultry, cattle, and aquaculture feed. Research is also underway to utilize millet biomass for renewable energy applications, further diversifying its market potential.

Conclusion

The millet market is witnessing strong growth due to increasing health awareness, sustainability concerns, and government support for climate-resilient agriculture. While challenges such as low yields, processing difficulties, and limited market awareness persist, ongoing investments in agricultural research, food technology, and consumer education are driving market expansion. As global food trends continue to shift toward healthier, gluten-free, and environmentally sustainable options, millet is well-positioned to become a staple grain for the future, offering both economic opportunities for farmers and nutritional benefits for consumers worldwide.Report Scope

The report analyzes the Millet market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Other Types); End-Use (B2B End-Use, B2C End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pearl Millet segment, which is expected to reach US$18.5 Billion by 2030 with a CAGR of a 3.2%. The Finger Millet segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.4 Billion in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $9.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Millet Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Millet Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Millet Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alltech, Alsons Aquaculture, Archer Daniels Midland Co., Avanti Feeds Ltd., Cargill and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Millet market report include:

- Archer Daniels Midland Company

- Ardent Mills

- Arrow Seed Company

- Bay State Milling Company

- Bayer Crop Science AG

- Cargill

- Earthon Products Pvt Ltd

- Grain Millers Inc.

- Great Basin Seed

- Janadhanya Farmers Producer Company Ltd

- Just Organik

- KWS SAAT SE & Co. KGaA

- Manitoba Harvest Hemp Foods

- Nature’s Path Foods

- Nestlé S.A.

- NH Foods Ltd.

- Panhandle Milling

- Pristine Organics Pvt Ltd

- Sahaja Samrudha Organic Producer Company Ltd

- Seitenbacher Natural Foods

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company

- Ardent Mills

- Arrow Seed Company

- Bay State Milling Company

- Bayer Crop Science AG

- Cargill

- Earthon Products Pvt Ltd

- Grain Millers Inc.

- Great Basin Seed

- Janadhanya Farmers Producer Company Ltd

- Just Organik

- KWS SAAT SE & Co. KGaA

- Manitoba Harvest Hemp Foods

- Nature’s Path Foods

- Nestlé S.A.

- NH Foods Ltd.

- Panhandle Milling

- Pristine Organics Pvt Ltd

- Sahaja Samrudha Organic Producer Company Ltd

- Seitenbacher Natural Foods

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

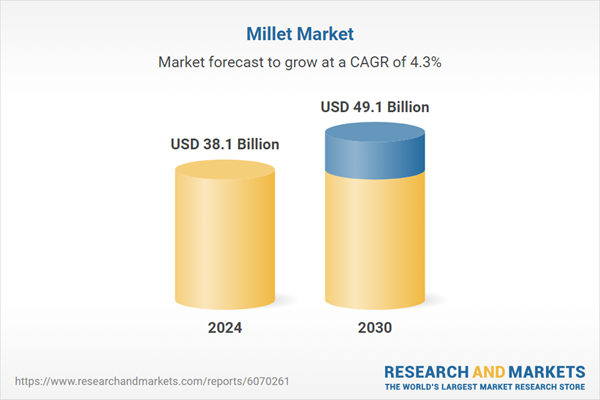

| Estimated Market Value ( USD | $ 38.1 Billion |

| Forecasted Market Value ( USD | $ 49.1 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |