Global Meat Stabilizers Blends Market - Key Trends & Drivers Summarized

What's Behind the Surge in Demand for Meat Stabilizers Blends?

The global market for meat stabilizers blends is witnessing notable growth, fueled by a rising demand for processed and convenience meat products. As lifestyles become increasingly fast-paced, particularly in urban regions, the preference for ready-to-eat, shelf-stable, and frozen meat goods has skyrocketed. These stabilizer blends - which typically include a combination of hydrocolloids, emulsifiers, phosphates, and other functional ingredients - play a vital role in enhancing the texture, appearance, and shelf life of meat products. Their use is particularly critical in formulations of sausages, deli meats, meat analogues, and restructured meat products. Major meat processing companies are leveraging these blends not only for product consistency but also for aligning with clean label and low-sodium product demands.Are Regional Preferences and Cultural Cuisines Influencing the Market?

Regional differences in meat consumption patterns significantly shape the dynamics of the meat stabilizers blends market. In North America and Europe, where processed meat consumption is deeply entrenched, stabilizers are used extensively to maintain sensory and safety standards across diverse product lines. Meanwhile, in Asia-Pacific and Latin America, rapid urbanization, increasing meat intake per capita, and the rise of Western dietary habits are accelerating demand. The growing popularity of ethnic and fusion cuisines, which often rely on processed or preserved meat components, has expanded the application scope for stabilizer blends. Moreover, manufacturers are tailoring formulations to match regional tastes, regulatory frameworks, and processing technologies, enhancing the market's complexity and competitiveness.How Is Innovation Reshaping Product Development and Application?

Innovation is a defining feature of the current meat stabilizers blends market, with a strong focus on product reformulation and technological advancements. Driven by consumer demand for healthier, natural, and allergen-free meat products, producers are developing stabilizer blends that incorporate natural alternatives to synthetic additives. This includes plant-based hydrocolloids, enzymatic systems, and fiber-based ingredients that ensure water retention, protein binding, and emulsification without compromising on quality. Additionally, the rise of meat analogues and hybrid meat products has opened new frontiers for stabilizer blend applications. These innovations require specialized blends to mimic the mouthfeel, juiciness, and structure of conventional meat, thereby widening the role of stabilizers beyond traditional meat processing.What's Fueling the Upward Trajectory of the Global Meat Stabilizers Blends Market?

The growth in the meat stabilizers blends market is driven by several factors linked to technological developments, evolving end-use segments, and shifting consumer behaviors. Advances in food processing equipment and formulation science have enabled the development of multifunctional stabilizer systems tailored for specific meat types and processing techniques. The booming demand for clean label and reduced-sodium meat products has prompted manufacturers to redesign their stabilizer blends to accommodate these preferences without sacrificing functionality. Additionally, the expansion of cold chain logistics and retail infrastructure in emerging economies has amplified the market for processed meats, thus increasing the demand for stabilizers. Changing consumer eating habits, including a growing preference for protein-rich snacks and convenience foods, have further escalated the usage of these blends across new product formats. Finally, the diversification of meat products in both traditional and plant-based categories has broadened the scope of stabilizer applications, cementing their essential role in contemporary meat product development.Report Scope

The report analyzes the Meat Stabilizers Blends market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Source (Plant, Seaweed, Animal, Microbial, Synthetic); Application (Meat Processing, HoReCa, Pet Food).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plant Source segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of a 4.8%. The Seaweed Source segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Meat Stabilizers Blends Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Meat Stabilizers Blends Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Meat Stabilizers Blends Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company (ADM), Ashland Global Holdings Inc., BASF SE, Caragum International, Cargill, Incorporated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Meat Stabilizers Blends market report include:

- Archer Daniels Midland Company (ADM)

- Ashland Global Holdings Inc.

- BASF SE

- Caragum International

- Cargill, Incorporated

- CP Kelco

- FPS Food Process Solutions

- GC Ingredients

- Gino

- Hydrosol GmbH & Co. KG

- Ingredion Incorporated

- International Food Products Corporation

- Kerry Group plc

- Meat Cracks Technologie GmbH

- Meat Cracks Technologie GmbH

- Nexira

- Pacific Blends

- Palsgaard A/S

- Tate & Lyle PLC

- Van Hees

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company (ADM)

- Ashland Global Holdings Inc.

- BASF SE

- Caragum International

- Cargill, Incorporated

- CP Kelco

- FPS Food Process Solutions

- GC Ingredients

- Gino

- Hydrosol GmbH & Co. KG

- Ingredion Incorporated

- International Food Products Corporation

- Kerry Group plc

- Meat Cracks Technologie GmbH

- Meat Cracks Technologie GmbH

- Nexira

- Pacific Blends

- Palsgaard A/S

- Tate & Lyle PLC

- Van Hees

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | January 2026 |

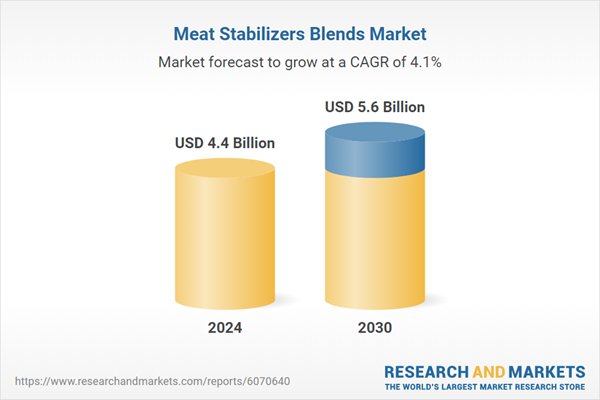

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 5.6 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |