Global Aluminium Wires Market - Key Trends & Drivers Summarized

Why Is the Demand for Aluminium Wires Increasing Across Industries?

Aluminium wires have become a critical component in electrical transmission, automotive applications, construction, and industrial manufacturing due to their lightweight nature, excellent conductivity, and corrosion resistance. As industries increasingly focus on cost-effective and energy-efficient solutions, aluminium wires have gained preference over copper wires, which are heavier and more expensive. The global shift toward electrification, renewable energy expansion, and infrastructure development is further driving the demand for aluminium wiring solutions.One of the major factors boosting the aluminium wire market is the rising adoption of aluminium conductors in electrical grids and power transmission networks. With rapid urbanization, smart city projects, and upgrades to aging electrical infrastructure, many countries are replacing copper-based power lines with aluminium alternatives. Aluminium wires, particularly aluminium conductor steel-reinforced (ACSR) cables, are extensively used in overhead power transmission and distribution networks, helping to reduce energy loss and lower operational costs.

The automotive and transportation industry is another key driver of aluminium wire demand, especially with the transition to electric vehicles (EVs). Automakers are increasingly using aluminium wiring harnesses to reduce vehicle weight, improve fuel efficiency, and enhance battery performance. With governments promoting EV adoption through subsidies and emission regulations, aluminium wiring solutions are expected to play a major role in the next generation of lightweight automotive design.

What Are the Key Trends Shaping the Aluminium Wires Market?

The aluminium wire industry is experiencing rapid growth due to technological advancements, material innovations, and evolving application areas. One of the most significant trends is the increasing use of aluminium-clad and alloyed aluminium wires. These variants offer improved conductivity, enhanced mechanical strength, and higher resistance to oxidation, making them ideal for high-performance electrical applications in both industrial and residential sectors.Another emerging trend is the replacement of copper wiring with aluminium alternatives in residential and commercial buildings. As copper prices continue to rise, construction companies and real estate developers are turning to aluminium electrical wiring for cost-effective and efficient installations. Modern aluminium alloys have overcome traditional challenges like oxidation and thermal expansion, making them a safe and durable alternative for wiring in homes, offices, and industrial facilities.

The growth of renewable energy infrastructure, particularly solar and wind power projects, is also fueling the demand for aluminium wires. Aluminium is widely used in solar panel connections, wind turbine wiring, and high-voltage transmission lines, where its lightweight properties and corrosion resistance ensure long-term performance. As global investments in green energy transition continue to rise, aluminium wiring will play a crucial role in supporting high-efficiency power distribution systems.

The advancement of aluminium wire recycling technologies is another key trend shaping the market. The recyclability of aluminium makes it a highly sustainable material, aligning with circular economy initiatives and environmental regulations. Aluminium wire manufacturers are investing in closed-loop recycling systems, allowing industries to reuse aluminium materials with minimal energy consumption, further strengthening its position as a sustainable alternative to copper.

Which Industries Are Driving the Demand for Aluminium Wires?

The power transmission and distribution industry is the largest consumer of aluminium wires, utilizing them for high-voltage overhead transmission lines, substations, and rural electrification projects. Governments and utilities are investing in grid modernization, smart grid technologies, and renewable energy integration, all of which require high-performance aluminium conductors to ensure efficient and cost-effective power distribution.The automotive and transportation sector is another major driver, particularly in the electric vehicle (EV) and lightweight vehicle segment. Automakers are shifting toward aluminium wiring harnesses in EVs and hybrid vehicles to reduce weight, improve energy efficiency, and extend battery range. With increasing production of electric cars, buses, and rail systems, the demand for automotive-grade aluminium wires is expected to surge in the coming years.

The construction industry is also a key consumer of aluminium wiring, particularly in residential, commercial, and industrial electrical installations. The use of aluminium building wire (Type AA-8000 series) is growing due to its cost-effectiveness, improved safety standards, and compliance with modern electrical codes. Many countries are mandating aluminium wiring in new construction projects to reduce overall costs and enhance fire safety standards.

The aerospace and defense industry is also expanding its use of aluminium wiring, particularly in lightweight aircraft components, unmanned aerial vehicles (UAVs), and military-grade electrical systems. Aluminium’ s high strength-to-weight ratio and corrosion resistance make it a preferred material for aircraft wiring, avionics, and satellite systems, further driving market demand.

What Is Driving the Growth of the Global Aluminium Wires Market?

The growth of the global aluminium wires market is driven by several factors, including cost advantages, electrification trends, and increasing demand for lightweight materials in transportation and energy sectors. One of the biggest growth drivers is the cost-effectiveness of aluminium compared to copper. With copper prices fluctuating due to supply chain constraints and geopolitical issues, industries are shifting toward aluminium wire solutions to reduce overall material costs without compromising performance.The rapid expansion of renewable energy projects is another major factor boosting the aluminium wire market. With governments worldwide investing in solar farms, wind power plants, and grid-scale energy storage systems, the demand for high-capacity transmission cables made of aluminium is increasing. Aluminium’ s ability to conduct electricity efficiently over long distances makes it a preferred material for high-voltage direct current (HVDC) transmission lines, particularly in remote and offshore renewable energy installations.

Technological advancements in aluminium wire alloys and coating technologies have also contributed to market growth. The development of corrosion-resistant aluminium-clad wires, nanostructured aluminium conductors, and improved insulation materials has enhanced the reliability and longevity of aluminium wiring solutions. These innovations are making aluminium-based electrical infrastructure more durable and efficient, expanding its application scope in critical industries such as aerospace, healthcare, and industrial automation.

The increasing focus on sustainability and recyclability is another key driver for aluminium wire adoption. With industries aiming to reduce their carbon footprint and meet sustainability goals, the recyclability of aluminium provides a major advantage over other wiring materials. Governments and regulatory bodies are encouraging the use of environmentally friendly materials, further strengthening the case for aluminium-based electrical solutions.

Additionally, the growing demand for smart homes, IoT-connected devices, and industrial automation is driving the need for high-performance electrical wiring solutions. Aluminium wires are playing a key role in powering smart grids, home automation systems, and industrial IoT infrastructure, ensuring efficient energy management and seamless connectivity.

With continuous advancements in aluminium wire technology, increasing applications across multiple industries, and the ongoing push for sustainable materials, the global aluminium wires market is set for strong growth in the coming years. As demand for lightweight, cost-effective, and high-conductivity electrical solutions continues to rise, aluminium wires will remain a cornerstone of modern electrical and industrial infrastructure.

Report Scope

The report analyzes the Aluminum Wires market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Enameled Round and Rectangular Wire, Paper Insulated Round and Rectangular Wire, Fiber Glass Insulated Round and Rectangular Wire, Nomex Insulated Round and Rectangular Wire, Mica Insulated Round and Rectangular Wire, Cotton Insulated Round and Rectangular Wire); End-Use (Transformers End-Use, Automotive End-Use, Circuit Breakers, Switches and Meters End-Use, Home Electrical Appliances End-Use, Motors, Rotating Machines End-Use, Shipping End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Enameled Round & Rectangular Wire segment, which is expected to reach US$31.8 Billion by 2030 with a CAGR of a 2.8%. The Paper Insulated Round & Rectangular Wire segment is also set to grow at 2.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17.3 Billion in 2024, and China, forecasted to grow at an impressive 4.7% CAGR to reach $14.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aluminum Wires Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aluminum Wires Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aluminum Wires Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avant, LLC, Fleximize Limited, Funding Circle Ltd., GoFundMe Group, Inc., LendingClub Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Aluminum Wires market report include:

- Cerro Wire LLC

- Dubai Cable Company (Ducab)

- Henan Chalco Aluminium Co., Ltd.

- Kaiser Aluminum Corporation

- Kobelco Aluminum Wire Co., Ltd.

- Nexans SA

- Norsk Hydro ASA

- Prysmian S.p.A

- Southern Cable Group Berhad

- Southwire Company, LLC

- Sumitomo Electric Industries Ltd.

- Totoku, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cerro Wire LLC

- Dubai Cable Company (Ducab)

- Henan Chalco Aluminium Co., Ltd.

- Kaiser Aluminum Corporation

- Kobelco Aluminum Wire Co., Ltd.

- Nexans SA

- Norsk Hydro ASA

- Prysmian S.p.A

- Southern Cable Group Berhad

- Southwire Company, LLC

- Sumitomo Electric Industries Ltd.

- Totoku, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 305 |

| Published | February 2026 |

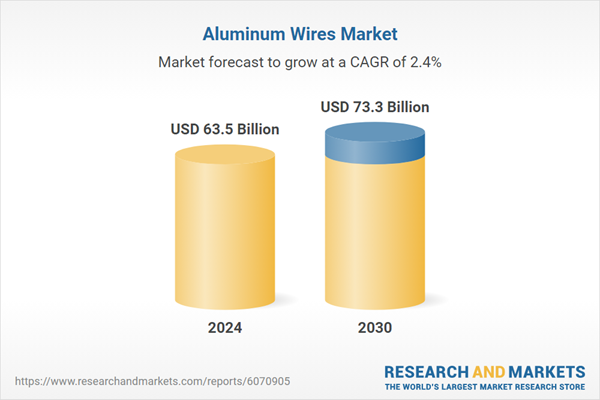

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 63.5 Billion |

| Forecasted Market Value ( USD | $ 73.3 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |