Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market encompasses a diverse array of applications, with the electrical sector accounting for a significant share, as aluminum wire rods are extensively used in the manufacturing of overhead power transmission lines, underground cables, and electrical wiring due to their high conductivity, lightweight nature, and corrosion resistance. In the automotive industry, increasing emphasis on lightweighting for fuel efficiency and electric vehicle development has led to growing adoption of aluminum-based components, further driving demand for aluminum wire rods. The construction industry also relies on aluminum wire rods for structural reinforcements, earthing wires, and conduit applications.

The market includes both primary aluminum producers who manufacture wire rods directly from smelted aluminum and secondary producers who recycle scrap aluminum to meet sustainability goals. Key market dynamics are influenced by raw material availability, fluctuations in aluminum prices, regulatory standards regarding emissions and energy consumption, and advancements in processing technologies aimed at enhancing product quality, performance, and environmental compliance. With the ongoing global transition toward renewable energy infrastructure, smart grids, and electrification, demand for efficient and reliable conductors has significantly increased, positioning aluminum wire rods as a vital component in modern infrastructure development.

Key Market Drivers

Rising Demand for Lightweight Conductive Materials in the Automotive and Aerospace Industries

The growing emphasis on lightweight and high-efficiency materials in the automotive and aerospace sectors is a significant driver fueling the expansion of the aluminum wire rod market. As both industries aggressively pursue weight reduction strategies to enhance fuel efficiency, reduce carbon emissions, and comply with evolving regulatory frameworks, aluminum wire rods are increasingly being adopted as a favorable alternative to traditional copper wiring. Aluminum offers substantial weight advantages over copper while maintaining sufficient electrical conductivity and cost-effectiveness. In the automotive industry, particularly in electric vehicles (EVs) and hybrid electric vehicles (HEVs), manufacturers are replacing conventional copper wire harnesses with aluminum wire rods to optimize vehicle range and reduce battery load.This shift is supported by ongoing innovations in material processing and joining technologies that mitigate aluminum's limitations, such as its relatively higher resistance and lower ductility. In aerospace applications, aluminum’s superior strength-to-weight ratio is proving valuable in reducing the overall mass of aircraft electrical systems, contributing to improved fuel economy and payload capacity. The proliferation of high-performance aircraft and next-generation vehicles, along with increased investments in urban air mobility and autonomous transport systems, has further accelerated the demand for specialized wiring solutions that meet stringent safety and durability requirements. Aluminum wire rods are being tailored to meet these advanced specifications through enhanced alloying techniques and precise extrusion processes, increasing their appeal across engineering platforms.

Moreover, the continued rise in consumer demand for energy-efficient and technologically advanced vehicles reinforces the need for materials that strike a balance between performance, reliability, and sustainability. As a result, global automakers and aerospace suppliers are strengthening supply chain partnerships and investing in aluminum processing facilities to secure a consistent supply of high-quality wire rods.

These dynamics are creating a robust growth environment for the aluminum wire rod market, as manufacturers ramp up capacity and product innovations to align with evolving industry demands. The market is also witnessing increasing integration of aluminum conductors in battery cables, harness assemblies, and electronic control units, thereby expanding its footprint beyond traditional applications. This multifaceted demand from key end-use industries underscores aluminum wire rods’ strategic importance as a future-ready material and reinforces their position as a critical component in next-generation mobility solutions.

Global demand for lightweight materials in automotive manufacturing is projected to surpass 90 million metric tons annually by 2030, driven by fuel efficiency goals. Use of conductive polymers and composites in aerospace is expected to grow at a CAGR of over 8% globally over the next five years. Lightweight conductive materials can reduce vehicle weight by up to 30%, leading to energy savings of 6-8% per 10% weight reduction. The global electric vehicle (EV) market is set to reach over 100 million units cumulatively by 2035, increasing demand for conductive lightweight materials in battery and motor components. Aerospace manufacturers aim to cut aircraft weight by 15-20% through advanced materials, boosting performance and reducing emissions.

Key Market Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

The Aluminum Wire Rod Market is significantly challenged by the volatility in raw material prices, particularly the fluctuating costs of primary aluminum and associated alloying elements. Since aluminum wire rod production is highly dependent on bauxite mining, alumina refining, and primary aluminum smelting, any instability in these upstream processes can ripple through the supply chain, affecting production costs and profit margins. Unpredictable shifts in global commodity markets, geopolitical tensions, mining restrictions, and energy price fluctuations all contribute to pricing uncertainty, making it difficult for manufacturers to forecast budgets or maintain stable pricing strategies for long-term contracts.In addition to pricing volatility, logistical bottlenecks in transporting raw materials, particularly in the context of global port congestion, transportation labor shortages, and disruptions from extreme weather events or political unrest, have also emerged as critical challenges. These disruptions extend lead times, delay order fulfillment, and elevate inventory costs. Many aluminum wire rod producers, particularly those in developing regions, lack vertical integration and are vulnerable to the upstream supply-side challenges imposed by large-scale aluminum producers or mining conglomerates. Moreover, trade policies such as export tariffs, import duties, and anti-dumping regulations in major economies can significantly impact the cross-border movement of raw materials and finished goods, creating regulatory complexities and increasing operational risk.

For instance, producers who rely on imported aluminum are often subject to unpredictable costs stemming from tariff hikes or shifting bilateral trade agreements, which directly affect their competitiveness. On the demand side, uncertainty in raw material prices often discourages bulk purchases by end-users in industries like construction, power, and transportation, thereby impacting revenue flow. As companies aim to diversify their supplier base to reduce risk, it often leads to increased administrative burden, quality control challenges, and added logistics expenses.

Key Market Trends

Rising Demand for Lightweight Conductors in Automotive and Transportation Sector

The aluminum wire rod market is experiencing a significant trend driven by the increasing demand for lightweight conductors in the automotive and transportation sector. As the global automotive industry transitions toward electric mobility and more fuel-efficient vehicles, the need for materials that offer high conductivity without the weight burden of traditional metals has intensified. Aluminum wire rods, known for their lightweight properties and corrosion resistance, have emerged as a preferred alternative to copper in many vehicle wiring applications. The push for lightweighting has become a critical design priority, as manufacturers seek to reduce vehicle weight to improve energy efficiency and extend the range of electric vehicles.With EV production accelerating and governments worldwide incentivizing low-emission transport, automakers are investing in aluminum-based components, including wiring systems made from aluminum rods. Additionally, aluminum wire rods are being increasingly used in railway electrification systems, high-speed trains, and electric buses, where lightweight and high-strength materials are essential to performance and reliability. This trend is further reinforced by the global shift toward sustainable and eco-friendly mobility solutions, which positions aluminum wire rods as a cost-effective and recyclable alternative. The ability of aluminum to reduce both raw material costs and vehicle weight without compromising electrical performance provides manufacturers a strategic advantage.

Moreover, aluminum rods offer ease of forming, extrusion, and alloying with other metals, making them suitable for diverse end-use designs in both passenger and commercial vehicles. The integration of electronics and data systems in modern vehicles also drives the demand for durable and high-performing electrical systems, which aluminum wire rods help enable. This increasing adoption across transportation platforms - ranging from hybrid cars to long-haul freight locomotives - underscores the vital role aluminum wire rods play in addressing industry-wide shifts toward electrification, weight optimization, and material efficiency. As this trend gains momentum, the market for aluminum wire rods is expected to expand significantly in alignment with the global evolution of transportation infrastructure and vehicle design priorities.

Key Market Players

- Norsk Hydro ASA

- Vedanta Limited

- Bahrain Aluminium (Alba)

- Kaiser Aluminum Corporation

- Southwire Company, LLC

- Intral S.A.

- Prysmian Group

- Baotou Aluminum Co., Ltd.

Report Scope:

In this report, the Global Aluminum Wire Rod Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Aluminum Wire Rod Market, By Application:

- Electrical Conductors

- Automotive

- Construction

- Electronics

- Packaging

Aluminum Wire Rod Market, By End-User Industry:

- Aerospace

- Automotive

- Power Generation

- Consumer Goods

- Construction

Aluminum Wire Rod Market, By Product Type:

- Bare Wire Rod

- Coated Wire Rod

- Alloyed Wire Rod

Aluminum Wire Rod Market, By Form:

- Round

- Square

- Flat

Aluminum Wire Rod Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aluminum Wire Rod Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Norsk Hydro ASA

- Vedanta Limited

- Bahrain Aluminium (Alba)

- Kaiser Aluminum Corporation

- Southwire Company, LLC

- Intral S.A.

- Prysmian Group

- Baotou Aluminum Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

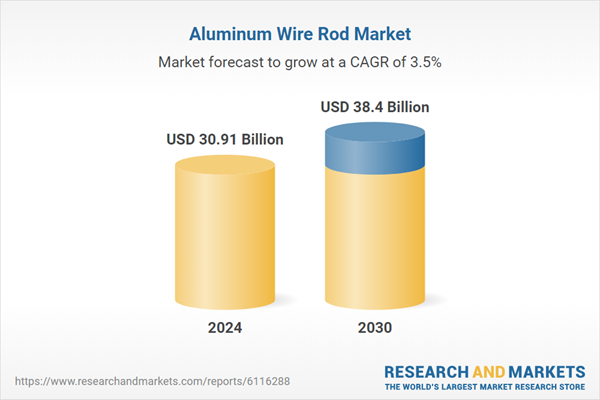

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 30.91 Billion |

| Forecasted Market Value ( USD | $ 38.4 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |