Global First Mile Delivery Market - Key Trends & Drivers Summarized

Why Is First Mile Delivery Evolving Into a Strategic Pillar of Supply Chain Efficiency?

In today’ s rapidly shifting global commerce landscape, first mile delivery - the process of moving goods from the point of origin, such as a manufacturing facility or supplier warehouse, to a central distribution center or fulfillment hub - has emerged as a vital link in the end-to-end logistics chain. Traditionally overlooked in favor of last mile logistics, the first mile is now garnering strategic focus due to its influence on delivery timelines, cost efficiency, and inventory accuracy. As retailers transition to omnichannel fulfillment models and consumers demand faster, traceable delivery, pressure is mounting on upstream logistics to perform flawlessly. In sectors such as e-commerce, food and beverage, fast fashion, and pharmaceuticals, the speed and accuracy of first mile operations are critical in determining whether stock arrives on time, intact, and ready for downstream processing. Delays, damage, or disorganization at this stage can cause ripple effects across the supply chain, leading to missed delivery windows and dissatisfied customers.How Are Digital Technologies and Automation Transforming First Mile Logistics?

Technological disruption is reshaping the traditional structure of first mile logistics, bringing automation, intelligence, and real-time control into what was once a largely manual and opaque process. The implementation of IoT sensors, RFID tags, and GPS tracking is enabling precise, real-time monitoring of goods as they leave the production site, enhancing traceability and accountability throughout the journey to the warehouse or distribution center. Warehouse management systems (WMS), transportation management systems (TMS), and API-integrated freight platforms are being deployed to automate route planning, vehicle allocation, and load optimization, which significantly reduces delivery delays and cost inefficiencies. Robotics and automated conveyor systems are also gaining ground within the warehouse and during loading operations, minimizing human error and improving throughput. Artificial intelligence and machine learning algorithms are being applied to forecast first mile demand, anticipate supply chain bottlenecks, and optimize vehicle dispatching based on historical data and predictive modeling. Additionally, cloud-based platforms are facilitating seamless communication between suppliers, carriers, and logistics managers, promoting agile decision-making. These innovations are transforming first mile delivery into a highly responsive, intelligent operation that supports the increasingly complex and customer-driven nature of global supply chains.What Role Do Regulation and Sustainability Play in Shaping First Mile Strategy?

The evolution of first mile delivery is being strongly influenced by a growing matrix of regulatory mandates, environmental goals, and evolving expectations around ethical supply chain practices. As governments tighten regulations on emissions, labor conditions, and transportation safety, companies must ensure that their first mile operations are fully compliant across geographies. Emissions standards, such as Euro 6 and Clean Truck Programs, are driving the adoption of electric and low-emission vehicles for short-haul transportation from manufacturing units to regional hubs. In addition, the pressure to reduce carbon footprints and achieve sustainability targets is pushing companies to implement more fuel-efficient routing, consolidate shipments, and utilize eco-friendly packaging from the point of origin. Regulations around data privacy and trade compliance are also reshaping how first mile data is captured, stored, and shared - especially in cross-border logistics. Moreover, consumer and investor interest in transparent, responsible sourcing has led to the demand for first mile visibility tools that can verify product origins, working conditions, and environmental impact. This intersection of compliance and conscience is not only reshaping first mile logistics infrastructure but also reinforcing its importance as a foundation of ethical, sustainable, and future-proof supply chain operations.What’ s Driving Market Growth and Innovation in First Mile Delivery Worldwide?

The growth in the first mile delivery market is driven by several factors related to e-commerce expansion, evolving fulfillment models, regional logistics investments, and the increasing importance of speed and reliability in global supply chains. The surge in online retail - particularly from small businesses and third-party sellers - has drastically increased the number of shipments originating from decentralized locations, thereby amplifying the need for efficient first mile pickup and transfer systems. The rise of dark stores, urban fulfillment centers, and distributed warehousing is prompting companies to reconfigure their first mile networks for speed, proximity, and cost control. In emerging markets, infrastructure development, digitization of logistics, and increased penetration of online commerce are creating new demand for localized, scalable first mile solutions. At the same time, the growing adoption of direct-to-consumer (D2C) models by manufacturers and brands is compressing traditional supply chains and increasing the reliance on agile first mile logistics. The proliferation of cross-border e-commerce is also driving the need for integrated first mile strategies that align with international shipping and customs protocols. In parallel, the demand for full-chain visibility, faster inventory turnover, and enhanced service levels is pushing logistics providers to innovate continuously in first mile execution. As businesses aim to create frictionless, responsive, and resilient supply chains, the first mile is becoming a core battleground for operational excellence and customer satisfaction.Report Scope

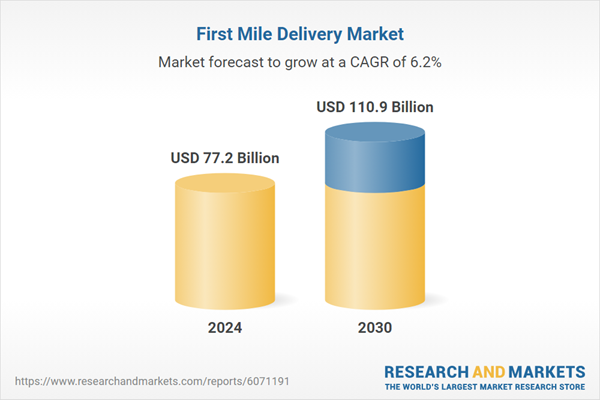

The report analyzes the First Mile Delivery market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Delivery Mode (Truck, Ship, Plane, Rail); Goods (Perishables Goods, Non-Perishables Goods, Hazardous Material Goods); Sourcing (Inhouse Sourcing, Outsource); Application (Manufacturing Application, Agriculture Application, Retail Application, Pharmaceutical Application, Automotive Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Truck Delivery segment, which is expected to reach US$48.0 Billion by 2030 with a CAGR of a 4.7%. The Ship Delivery segment is also set to grow at 8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $21.0 Billion in 2024, and China, forecasted to grow at an impressive 9.5% CAGR to reach $22.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global First Mile Delivery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global First Mile Delivery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global First Mile Delivery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company (ADM), Borregaard ASA, Bunge Limited, Cargill, Incorporated, Chevron Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this First Mile Delivery market report include:

- Cargo Carriers Limited

- DHL International GmbH

- Dronamics

- Dynamon

- FedEx Corporation

- FirstMile

- Interlogix Pty. Ltd.

- Intramotev, Inc.

- J.B. Hunt Transport Services, Inc.

- May Mobility

- Metrobi

- ORTEC

- PNPLINE Inc.

- ScrapBees

- Shadowfax Technologies Pvt Ltd

- Shield AI

- Swift Transport

- Transtech Logistics

- United Parcel Service (UPS)

- UniUni

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargo Carriers Limited

- DHL International GmbH

- Dronamics

- Dynamon

- FedEx Corporation

- FirstMile

- Interlogix Pty. Ltd.

- Intramotev, Inc.

- J.B. Hunt Transport Services, Inc.

- May Mobility

- Metrobi

- ORTEC

- PNPLINE Inc.

- ScrapBees

- Shadowfax Technologies Pvt Ltd

- Shield AI

- Swift Transport

- Transtech Logistics

- United Parcel Service (UPS)

- UniUni

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 480 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 77.2 Billion |

| Forecasted Market Value ( USD | $ 110.9 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |