Global Veterinary Microchips Market - Key Trends & Drivers Summarized

Why Is the Demand for Veterinary Microchips Increasing?

The demand for veterinary microchips has been steadily rising due to increasing pet ownership, concerns about pet safety, and advancements in animal identification technology. Microchipping has become a widely adopted method for permanent pet identification, offering a reliable way to reunite lost animals with their owners. With the increasing number of stray and missing pets, governments and animal welfare organizations are advocating for mandatory microchipping to enhance pet tracking and reduce the burden on animal shelters. In addition to companion animals, microchips are increasingly used in livestock management to track health records, breeding data, and movement history. Technological advancements have also made microchips more functional, with modern chips now integrating temperature-sensing capabilities, allowing veterinarians to monitor animal health remotely. The rise of pet insurance policies has further contributed to the demand for microchips, as many insurers require permanent identification for coverage eligibility. With growing awareness of responsible pet ownership and enhanced regulatory frameworks supporting pet microchipping, the market is experiencing substantial growth worldwide.What Technological Advancements Are Transforming Veterinary Microchips?

Technological innovations have significantly improved the functionality and reliability of veterinary microchips, making them more than just identification tools. One of the most notable advancements is the integration of temperature-monitoring sensors in microchips, allowing veterinarians to track an animal's body temperature without the need for invasive procedures. These smart microchips enable early detection of health issues such as infections, fevers, and metabolic disorders, improving overall animal welfare. Additionally, newer RFID-based microchips offer enhanced data storage capabilities, allowing for the recording of vaccination history, medical conditions, and treatment records. Some advanced microchips are now compatible with smartphone applications, enabling pet owners to access real-time data and receive alerts in case their pet is lost or taken to a veterinary facility. Another breakthrough is the development of GPS-enabled microchips, which provide precise location tracking, although these are currently less common due to power requirements and cost constraints. The emergence of blockchain-based pet identification systems is also gaining traction, ensuring secure and tamper-proof animal identification records. As these technologies continue to evolve, veterinary microchips are becoming an integral part of animal healthcare and security systems, enhancing pet safety and livestock management worldwide.What Challenges Are Hindering the Veterinary Microchip Market?

Despite their growing adoption, veterinary microchips face several challenges that impact market expansion. One of the key issues is the lack of universal microchip standardization, as different regions and manufacturers use varying frequencies and database systems, making it difficult to ensure seamless interoperability. This can create problems when lost pets cross international borders or are taken to shelters that use incompatible scanners. Another challenge is consumer skepticism regarding the safety of microchips, with concerns about potential health risks, such as tumors or infections at the implantation site, despite scientific evidence supporting their safety. Additionally, microchips rely on pet owners keeping their registration information updated, which is often neglected, leading to difficulties in reuniting lost pets with their families. The cost of microchip implantation, while relatively low, can still be a deterrent in developing regions where pet ownership rates are rising but disposable incomes remain limited. In the livestock sector, microchip adoption is sometimes hindered by the preference for traditional ear tags or tattoos, which are perceived as more cost-effective, although they are less reliable than microchips. Addressing these challenges requires greater standardization, public awareness campaigns, and incentives for pet owners and livestock farmers to adopt microchipping as a primary identification method.What Are the Key Growth Drivers of the Veterinary Microchips Market?

The growth in the veterinary microchips market is driven by several factors, including increasing pet adoption rates, stricter pet identification regulations, and advancements in microchip technology. Many countries are implementing mandatory microchipping laws for pets, particularly for dogs and cats, as part of responsible pet ownership initiatives. This regulatory push has significantly boosted microchip adoption, particularly in North America and Europe. Additionally, the rising number of pet theft cases has heightened demand for secure identification methods, as microchips provide an undeniable link between an animal and its owner. The expansion of pet insurance policies that require microchip identification for claims processing has further encouraged pet owners to invest in this technology. In the livestock sector, microchips are increasingly used for disease tracking and food safety compliance, ensuring better traceability in the supply chain. The development of multifunctional microchips with integrated health monitoring features is also driving demand, as these chips provide veterinarians and pet owners with valuable real-time data. As smart pet care solutions continue to gain traction, veterinary microchips are expected to become an indispensable component of modern animal identification and healthcare systems, ensuring continued market growth in the years ahead.Report Scope

The report analyzes the Veterinary Microchips market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Animal Type (Dogs, Cats, Horses, Others); Scanner Type (134.2 KHz, 125 KHz, 128 KHz); Distribution Channel (Veterinary Hospitals / Clinics, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Some of the 44 companies featured in this Veterinary Microchips market report include -

- 24Petwatch

- AKC Reunite

- Animal ID

- AVID Identification Systems, Inc.

- BeKind PetFind

- Bio Medic Data Systems, Inc.

- Biomark, Inc.

- BuddyID™

- Datamars

- Digital Angel Corporation

- EIDAP

- Fi

- Global Pet Security

- HomeAgain

- Microchip4Solutions Inc.

- Nanochip ID Inc.

- National Microchip Registration

- Peeva

- Pet Data

- PetKey

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dogs segment, which is expected to reach US$576.8 Million by 2030 with a CAGR of a 8.4%. The Cats segment is also set to grow at 11.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $206.3 Million in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $217.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Veterinary Microchips Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Veterinary Microchips Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Veterinary Microchips Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bayer Animal Health, Bimeda, Boehringer Ingelheim, Ceva Santé Animale, Chanelle Pharma Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 44 Featured):

- 24Petwatch

- AKC Reunite

- Animal ID

- AVID Identification Systems, Inc.

- BeKind PetFind

- Bio Medic Data Systems, Inc.

- Biomark, Inc.

- BuddyID™

- Datamars

- Digital Angel Corporation

- EIDAP

- Fi

- Global Pet Security

- HomeAgain

- Microchip4Solutions Inc.

- Nanochip ID Inc.

- National Microchip Registration

- Peeva

- Pet Data

- PetKey

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 24Petwatch

- AKC Reunite

- Animal ID

- AVID Identification Systems, Inc.

- BeKind PetFind

- Bio Medic Data Systems, Inc.

- Biomark, Inc.

- BuddyID™

- Datamars

- Digital Angel Corporation

- EIDAP

- Fi

- Global Pet Security

- HomeAgain

- Microchip4Solutions Inc.

- Nanochip ID Inc.

- National Microchip Registration

- Peeva

- Pet Data

- PetKey

Table Information

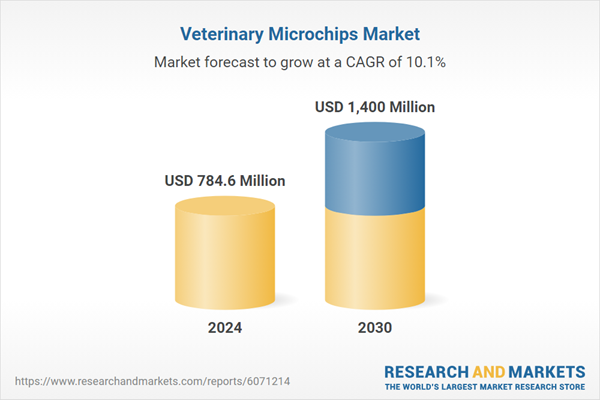

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 784.6 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |