The growing implementation of mandatory microchipping laws by governments and support from regulatory bodies has further accelerated adoption. Additionally, innovation in chip design-including improved biocompatibility, miniaturization, and enhanced data capabilities-is making the technology more appealing to veterinarians and pet owners. This shift is supported by increasing disposable income, especially in emerging markets, and a strong pet humanization trend, encouraging people to invest more in animal welfare.

The microchips and implanters segment generated USD 467 million in 2024, This dominance stems from a combination of policy mandates, increased consumer awareness, and accessible pricing. Veterinary clinics, shelters, and livestock operations increasingly favor modern microchip solutions due to their ease of use and reliability. Technological upgrades, including longer durability and seamless integration with animal tracking databases, accelerate adoption.

The companion animals segment held a 66% share in 2024, driven by the adoption of dogs, cats, and small animals as household pets has increased microchipping, particularly in urban and suburban areas. Households are more willing to invest in pet identification, driven by a combination of emotional attachment and a growing ecosystem of pet care products. Spending on pets continues to rise, with safety and traceability becoming top priorities for owners.

North America Veterinary Microchips Market held a 41.7% share in 2024. The region continues to benefit from a deep-rooted culture of pet ownership, with a high percentage of households including companion animals. This strong adoption trend is supported by a growing inclination toward preventive healthcare and safety measures. The market's strength is further amplified by a robust veterinary services network and advanced pet healthcare technologies, which make microchipping widely accessible across both urban and rural areas.

To expand their market presence, companies like Dipole RFID, PetLink, Wuxi Fofia Technology, Trovan, and Virbac Corporation are leveraging strategic alliances, product innovation, and distribution expansion. These firms are investing in next-gen chip technology, improving interoperability with digital pet records, and collaborating with veterinary networks. Many are introducing user-friendly microchip systems and cost-effective solutions to penetrate underserved regions while ensuring compliance with regulatory standards and supporting responsible pet ownership.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Veterinary Microchips market report include:- Avid Identification Systems

- Dipole RFID

- Elanco Animal Health

- HomeAgain (Merck Animal Health)

- ID Tech

- Microchip4Solutions

- PetLink (Datamars)

- Pet-ID Microchips

- Peeva

- Trovan

- Virbac Corporation

- Wuxi Fofia Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | May 2025 |

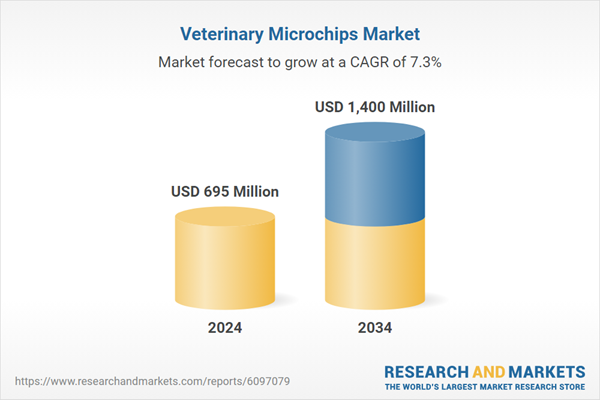

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 695 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |