Global Endoscopy Visualization Systems Market - Key Trends & Drivers Summarized

How Are Visualization Technologies Transforming the Standard of Endoscopic Care?

The global endoscopy visualization systems market is rapidly advancing as visualization becomes the cornerstone of precision-driven, minimally invasive surgery. Comprising high-definition cameras, video processors, light sources, monitors, image enhancement software, and recording systems, visualization platforms serve as the surgeon’ s eyes during diagnostic and therapeutic procedures. As endoscopic procedures grow in complexity and scope across gastroenterology, pulmonology, gynecology, urology, and ENT, demand is intensifying for systems that deliver real-time clarity, improved contrast, and enhanced anatomical detail.Technological upgrades - including 4K UHD imaging, 3D visualization, digital chromoendoscopy, fluorescence-guided imaging, and near-infrared (NIR) technology - are transforming both procedure quality and clinical decision-making. These systems not only improve the accuracy of diagnosis and tissue characterization but also support delicate therapeutic maneuvers in submucosal dissection, biliary interventions, or interventional endoscopy. Surgeons now rely on smart visualization tools not just for seeing but for assessing, differentiating, and acting - turning visualization systems into active decision-support platforms. As such, healthcare providers are prioritizing the replacement of legacy systems with advanced visualization suites that offer greater depth perception, data integration, and interoperability with OR ecosystems.

Why Is Visualization Now a Strategic Priority in Hospital Procurement?

Endoscopic visualization systems have become critical assets in the capital planning of hospitals and specialty clinics, not only for their clinical importance but also for their impact on procedural throughput, surgical outcomes, and surgeon satisfaction. Facilities are investing in modular, scalable platforms that can be adapted across multiple specialties and procedural environments - from high-volume GI suites to hybrid ORs. Features such as adjustable light intensity, auto-focus lenses, real-time image optimization, and user-configurable presets are enabling surgeons to achieve optimal visualization with minimal manual adjustment, improving workflow efficiency and reducing fatigue.In addition, the adoption of visualization systems is being accelerated by their compatibility with robotic surgery platforms and artificial intelligence (AI) tools. Real-time overlay of tissue markers, auto-detection of anomalies, and AI-powered image enhancement are driving better lesion identification and reducing variability between operators. These innovations are also helping hospitals comply with value-based care models by improving diagnostic yield, reducing complication rates, and enabling faster recovery. In procurement terms, decision-makers are increasingly favoring all-in-one platforms with flexible configurations, multi-procedure adaptability, and long-term upgrade paths - ensuring capital efficiency and future-readiness in a competitive medtech landscape.

How Are OEMs Using Innovation to Differentiate and Expand Market Share?

Innovation in endoscopy visualization systems is becoming more iterative and integrated, with OEMs striving to deliver smarter, lighter, and more intuitive platforms that meet the demands of today’ s complex procedures. The market is seeing a surge in technologies such as adaptive lighting, spectral imaging, and anti-fog lens technology - all designed to maintain image integrity in challenging environments. Meanwhile, portable and cart-based systems are being introduced for point-of-care usage in ambulatory surgical centers, emergency rooms, and field hospitals. These compact systems offer 4K-level clarity without the need for full OR integration, opening new segments and accelerating adoption in resource-constrained settings.Furthermore, companies are embedding smart software into their systems to support image capture, video archiving, and secure sharing with electronic health record (EHR) systems. This is especially valuable in multi-specialty centers and teaching hospitals, where procedural documentation and performance analytics are essential. Cloud-based platforms and wireless transmission capabilities are also enabling remote proctoring, real-time second opinions, and cross-site collaboration. As competition intensifies, the ability to deliver complete visualization ecosystems - not just imaging hardware - is becoming a key strategic differentiator for manufacturers seeking global footprint expansion and long-term customer loyalty.

What Forces Are Driving Global Growth Across Facility Types and Specialties?

The growth in the endoscopy visualization systems market is driven by several factors tied directly to clinical expansion, specialty-based imaging demands, and the digital transformation of surgical environments. The rise in chronic gastrointestinal, pulmonary, and urological conditions is increasing the volume and complexity of endoscopic procedures worldwide. Advanced therapeutic techniques such as ESD, POEM, and endoscopic sleeve gastroplasty (ESG) require high-fidelity imaging for sub-millimeter precision, making visualization systems essential rather than optional. Hospitals and tertiary care centers are investing heavily in next-generation platforms to support these high-value interventions and attract top surgical talent.Technological adoption is also being fueled by the expansion of ambulatory surgical centers (ASCs), which require compact, cost-effective visualization systems with fast turnaround and cross-specialty utility. Additionally, emerging economies in Asia-Pacific, Latin America, and Africa are prioritizing digital healthcare infrastructure - including high-definition endoscopy suites - as part of long-term healthcare reform and public-private partnership initiatives. Regulatory bodies are increasingly mandating digital archiving, procedural documentation, and system interoperability, further driving demand for integrated visualization solutions.

From academic hospitals deploying AI-powered imaging platforms to rural clinics equipping portable endoscopy carts, the growth trajectory of visualization systems is being shaped by their ability to deliver clarity, compatibility, and clinical confidence. With ongoing innovation and global procedural demand on the rise, endoscopy visualization systems are positioned as one of the most strategically valuable and technologically dynamic components of the surgical value chain.

Report Scope

The report analyzes the Endoscopy Visualization Systems market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Endoscopy Visualization Systems, Endoscopy Visualization Component); Resolution (4K, UHD); End-Use (Hospitals, Outpatient Facilities).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Endoscopy Visualization Systems segment, which is expected to reach US$22.8 Billion by 2030 with a CAGR of a 4%. The Endoscopy Visualization Component segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.1 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $6.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Endoscopy Visualization Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Endoscopy Visualization Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Endoscopy Visualization Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ambu A/S, Applied Medical, Arthrex, Inc., B. Braun Melsungen AG, Boston Scientific Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Endoscopy Visualization Systems market report include:

- Agfa HealthCare NV

- Ambu A/S

- Arthrex, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cantel Medical Corp.

- CapsoVision, Inc.

- Carl Zeiss AG

- ChemImage Corporation

- CONMED Corporation

- Cook Medical

- ERBE Elektromedizin GmbH

- Fortimedix Surgical B.V.

- Fujifilm Holdings Corporation

- HOYA Corporation

- Intuitive Surgical, Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Laborie Medical Technologies Inc.

- Medtronic plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agfa HealthCare NV

- Ambu A/S

- Arthrex, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cantel Medical Corp.

- CapsoVision, Inc.

- Carl Zeiss AG

- ChemImage Corporation

- CONMED Corporation

- Cook Medical

- ERBE Elektromedizin GmbH

- Fortimedix Surgical B.V.

- Fujifilm Holdings Corporation

- HOYA Corporation

- Intuitive Surgical, Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Laborie Medical Technologies Inc.

- Medtronic plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 448 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

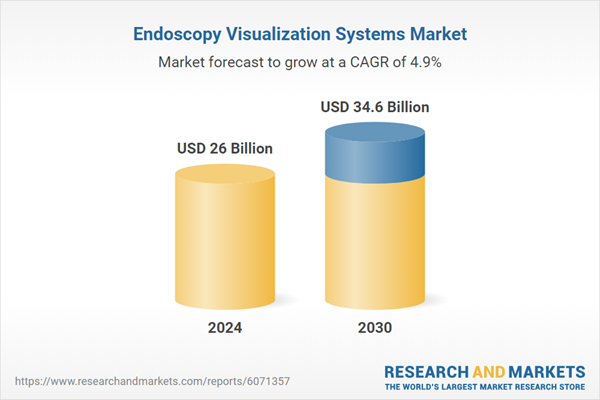

| Estimated Market Value ( USD | $ 26 Billion |

| Forecasted Market Value ( USD | $ 34.6 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |