Global Commercial Wires and Cables Market - Key Trends & Drivers Summarized

Why Is the Demand for Commercial Wires and Cables Increasing? Understanding the Growing Need for Reliable Electrical Infrastructure

The global commercial wires and cables market has experienced significant growth due to the rising demand for advanced electrical infrastructure across various industries, including commercial buildings, data centers, transportation networks, and industrial facilities. As businesses expand their operations and integrate high-performance electrical and telecommunication systems, the need for reliable, high-capacity wiring solutions has intensified. Commercial buildings require extensive electrical cabling to support lighting, HVAC systems, security systems, and power distribution networks, while the telecommunications sector relies on fiber-optic cables to facilitate high-speed data transmission. Additionally, the rapid growth of smart cities and renewable energy projects has further fueled the demand for advanced cabling solutions. The push toward energy-efficient electrical systems and improved safety standards has also led to the adoption of fire-resistant, low-smoke, and eco-friendly cable materials. With the ongoing expansion of digital infrastructure and the increasing electrification of commercial spaces, the wires and cables market continues to play a crucial role in powering modern business environments.How Are Technological Advancements Enhancing Commercial Wires and Cables? Exploring Innovations in Electrical Connectivity

Recent advancements in material science, manufacturing processes, and connectivity technologies have significantly improved the performance, durability, and efficiency of commercial wires and cables. The development of high-voltage and ultra-high-voltage cables has enabled the transmission of electricity over longer distances with minimal losses, making them ideal for large-scale commercial and industrial applications. The introduction of fire-resistant and halogen-free cables has enhanced safety in commercial buildings by reducing the risk of electrical fires and toxic emissions. Additionally, the adoption of smart cables embedded with sensors and IoT-enabled monitoring systems has enabled real-time diagnostics and predictive maintenance, improving the efficiency and reliability of electrical networks. Fiber-optic cable technology has also evolved, supporting faster and more secure data transmission in commercial and telecommunication infrastructures. Furthermore, advancements in superconducting cables and wireless power transmission are paving the way for next-generation electrical connectivity solutions. As businesses continue to prioritize energy efficiency, digitalization, and safety, innovative cabling solutions are expected to redefine the commercial wiring landscape.What Challenges Are Affecting the Growth of the Commercial Wires and Cables Market? Addressing Supply Chain and Regulatory Barriers

Despite the rising demand for commercial wiring solutions, the market faces several challenges, including fluctuating raw material costs, supply chain disruptions, and stringent regulatory requirements. The prices of essential materials such as copper and aluminum, which are widely used in electrical cables, are highly volatile, impacting production costs and profitability for manufacturers. Additionally, the global semiconductor shortage and logistics constraints have disrupted the supply of essential components, causing delays in manufacturing and installation projects. Compliance with regional and international safety standards poses another challenge, as businesses must ensure that their wiring solutions meet fire resistance, electromagnetic compatibility, and environmental impact regulations. The growing shift toward wireless connectivity in certain applications has also introduced competition for traditional cable systems. Addressing these challenges will require enhanced supply chain resilience, continuous innovation in material efficiency, and regulatory alignment to streamline product certifications and market adoption.What’ s Driving the Growth of the Commercial Wires and Cables Market? Identifying Key Expansion Factors

The growth in the commercial wires and cables market is driven by several factors, including the increasing adoption of smart grid technology, rising investments in renewable energy projects, and expanding commercial infrastructure development. The deployment of smart grids has created demand for advanced power transmission and distribution cables that can support real-time energy management and automation. Additionally, the rapid expansion of solar and wind energy projects has driven the need for specialized cables that can withstand harsh environmental conditions while efficiently transmitting power from renewable sources. The ongoing development of commercial buildings, airports, and transportation networks has further fueled demand for high-performance electrical wiring systems. The transition to 5G and high-speed internet infrastructure has also accelerated the need for fiber-optic cables, enhancing connectivity in business districts and data centers. With continued advancements in cable technology, increased investments in sustainable energy, and the growing electrification of commercial spaces, the commercial wires and cables market is expected to witness strong and sustained growth, shaping the future of electrical connectivity worldwide.Report Scope

The report analyzes the Commercial Wires and Cables market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Coaxial Cables/Electronic Wires, Fiber Optics Cables, Telecom and Data Cables, Signal and Control Cables, Other Products); Voltage (Medium Voltage, Low Voltage).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Coaxial Cables / Electronic Wires segment, which is expected to reach US$65.6 Billion by 2030 with a CAGR of a 8.1%. The Fiber Optics Cables segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25.8 Billion in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $30.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Wires and Cables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Wires and Cables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Wires and Cables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval, Andritz AG, Clean Marine AS, CR Ocean Engineering, Ducon Technologies Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Commercial Wires and Cables market report include:

- Amphenol Corporation

- Belden Inc.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Encore Wire Corporation

- Finolex Cables Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- General Cable (acquired by Prysmian Group)

- Hengtong Group

- KEI Industries Limited

- Leoni AG

- LS Cable & System Ltd.

- Nexans S.A.

- Polycab India Limited

- Prysmian Group

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- ZTT Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amphenol Corporation

- Belden Inc.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Encore Wire Corporation

- Finolex Cables Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- General Cable (acquired by Prysmian Group)

- Hengtong Group

- KEI Industries Limited

- Leoni AG

- LS Cable & System Ltd.

- Nexans S.A.

- Polycab India Limited

- Prysmian Group

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- ZTT Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | February 2026 |

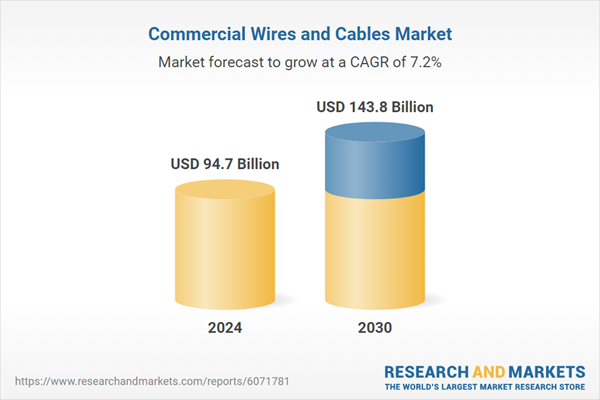

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 94.7 Billion |

| Forecasted Market Value ( USD | $ 143.8 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |