Global Automotive Wires and Cables Market: Key Trends & Drivers Summarized

How Are Modern Vehicle Architectures Transforming Wiring and Cabling Systems?

The rapid evolution of vehicle technology is profoundly reshaping the design, functionality, and complexity of automotive wires and cables. As vehicles transition from mechanical machines to electronic and software-driven platforms, the demand for sophisticated electrical distribution systems has grown exponentially. Wiring harnesses are no longer just passive carriers of power; they are now central to managing a multitude of electronic functions, from powertrain control and infotainment to lighting, sensors, and safety systems. Modern vehicles, particularly electric and hybrid models, require extensive wiring networks to support high-voltage battery systems, onboard chargers, regenerative braking, and energy management modules. This increase in wiring density has led to a push for lightweight, high-performance materials to reduce overall vehicle weight and improve energy efficiency. Automakers are adopting aluminum and other advanced conductors as alternatives to traditional copper, aiming to strike a balance between performance and cost. Heat resistance, electromagnetic shielding, and flexibility are also critical considerations, particularly in high-temperature zones like engine compartments and near battery packs. The shift to modular and scalable electronic architectures further necessitates adaptable cable designs that can be configured for various models and trims. Additionally, the emergence of zonal architecture, which consolidates control units and reduces wire length, is driving a rethinking of traditional cabling layouts. Suppliers are investing in the development of smart wiring systems that integrate sensors directly into the cables, enabling real-time diagnostics and fault detection. These advancements indicate that automotive wires and cables are no longer just supporting components but have become essential elements in the electronic nervous system of the modern vehicle.What Regulatory Pressures and Safety Standards Are Influencing Cable Design?

Automotive wires and cables are subject to increasingly stringent regulatory and safety standards, which are shaping material selection, manufacturing processes, and system design. Governments and safety agencies across North America, Europe, and Asia have established rigorous guidelines to ensure that wiring systems meet fire resistance, thermal stability, and electromagnetic compatibility requirements. These standards are particularly important as vehicles become more electrified and connected, raising the stakes for potential electrical faults, signal interference, or fire hazards. Regulations such as the ISO 6722 and SAE J1128 specify parameters for conductor construction, insulation materials, and performance under extreme environmental conditions. Compliance with these standards is not only necessary for certification but also crucial for gaining consumer trust and maintaining vehicle reliability. Safety mandates for electric vehicles have introduced new criteria for high-voltage cables, including insulation resistance, shielding effectiveness, and color coding to prevent misconnection. In addition to performance-based regulations, environmental standards like the Restriction of Hazardous Substances (RoHS) and End-of-Life Vehicle (ELV) directives are pressuring manufacturers to eliminate toxic materials such as lead, mercury, and certain flame retardants from cable formulations. These environmental considerations are driving a shift toward halogen-free, recyclable, and bio-based cable insulation materials. The rise in onboard electronics has also heightened concerns around electromagnetic interference, prompting the need for better shielding and grounding solutions. Regulatory expectations are evolving continuously, with new emphasis on cybersecurity, particularly for cables that carry data between control modules. To meet these multifaceted demands, manufacturers must balance safety, sustainability, and performance without compromising cost efficiency, making regulatory compliance a key driver of innovation in the automotive wire and cable market.How Is Electrification Influencing the Structure and Demand for Automotive Cabling?

The global shift toward electric and hybrid vehicles is having a transformative impact on the automotive wires and cables market, both in terms of volume and technical complexity. Unlike conventional vehicles that rely primarily on low-voltage systems, electric vehicles require intricate cabling architectures that support high-voltage power distribution alongside standard 12V systems. This dual-voltage requirement has led to the proliferation of specialized cable types, including high-voltage power cables, shielded signal cables, and thermal management wiring. High-voltage cables must be capable of withstanding thousands of charging cycles, extreme temperature variations, and mechanical stress without compromising conductivity or insulation integrity. As battery sizes increase to support greater driving range, so does the need for thicker and more thermally resilient cabling, particularly in connections between the battery pack, inverter, and motor. Electric vehicles also require dedicated wiring for onboard chargers, DC-DC converters, and battery management systems, adding further layers to the electrical design. Moreover, the trend toward faster charging speeds is driving the adoption of cables that can handle high current loads without overheating, which in turn demands improved materials and advanced cooling techniques. Lightweight cabling remains a priority, as the overall vehicle mass affects battery range and efficiency. Innovations such as flat and ribbon-style cables, along with braided wire configurations, are being explored to optimize space and flexibility within tight vehicle enclosures. Additionally, the increasing integration of sensors and actuators for electric drivetrain control is expanding the role of signal-carrying wires, which must operate reliably in electronically noisy environments. These requirements are significantly expanding the market for automotive cables, making electrification a central catalyst in the evolution of wiring systems.Which Market Forces Are Driving the Expansion of Automotive Wire and Cable Solutions?

The growth in the automotive wires and cables market is driven by several intersecting trends linked to vehicle electrification, connectivity, digitalization, and evolving mobility models. One of the primary drivers is the increasing demand for advanced driver-assistance systems and infotainment features, both of which require dense, high-bandwidth wiring to support real-time data exchange and control signals. As vehicles become more software-defined, the number of sensors, cameras, radar units, and electronic control units continues to grow, necessitating complex networks of power and signal cables. The transition to connected and autonomous vehicles is also placing pressure on cable infrastructure to deliver faster data rates, higher reliability, and robust shielding against electromagnetic interference. In parallel, the rise of smart manufacturing practices and modular vehicle platforms is encouraging automakers to standardize cable assemblies that can be used across multiple vehicle lines, increasing economies of scale. Consumer expectations for vehicle customization, digital features, and seamless connectivity are further pushing manufacturers to develop flexible cabling solutions that support multiple configurations without redesigning entire harnesses. Cost and weight optimization remain important, especially as OEMs seek to improve fuel economy and electric vehicle range without sacrificing performance. The growing popularity of shared mobility and fleet-based transport services is also influencing wiring system design, as these vehicles tend to operate longer hours and require highly durable and easily serviceable electrical components. On the supply side, wire and cable manufacturers are investing in automated production technologies, advanced material science, and digital twins to meet quality and scalability demands. These market forces collectively underscore the vital role of wires and cables in shaping the future of mobility, driving sustained demand for innovation, reliability, and integration.Scope of the Report

The report analyzes the Automotive Wires and Cables market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Copper Core, Aluminum Core, Other Products); Vehicle (Light Vehicles, Commercial Vehicles); Voltage (Low-Voltage, High-Voltage); Propulsion (ICE Propulsion, EV Propulsion).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Copper Core segment, which is expected to reach US$9.5 Billion by 2030 with a CAGR of a 4.0%. The Aluminum Core segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.8 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Wires and Cables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Wires and Cables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Wires and Cables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aptiv PLC, Coficab Group, Coroplast Fritz Müller GmbH, Draka (Part of Prysmian Group), Furukawa Electric Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Automotive Wires and Cables market report include:

- Aptiv PLC

- Coficab Group

- Coroplast Fritz Müller GmbH

- Draka (Part of Prysmian Group)

- Furukawa Electric Co., Ltd.

- General Cable (Prysmian Group)

- Hengtong Group

- Hitachi Metals, Ltd.

- Hyundai Electric & Energy Systems

- Jiangsu Etern Company Limited

- Lear Corporation

- Leoni AG

- Nexans S.A.

- PKC Group (Motherson Group)

- Precision Cable Manufacturing LLC

- Sumitomo Electric Industries Ltd.

- TYC Genera

- W. L. Gore & Associates, Inc.

- Yazaki Corporation

- Yura Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aptiv PLC

- Coficab Group

- Coroplast Fritz Müller GmbH

- Draka (Part of Prysmian Group)

- Furukawa Electric Co., Ltd.

- General Cable (Prysmian Group)

- Hengtong Group

- Hitachi Metals, Ltd.

- Hyundai Electric & Energy Systems

- Jiangsu Etern Company Limited

- Lear Corporation

- Leoni AG

- Nexans S.A.

- PKC Group (Motherson Group)

- Precision Cable Manufacturing LLC

- Sumitomo Electric Industries Ltd.

- TYC Genera

- W. L. Gore & Associates, Inc.

- Yazaki Corporation

- Yura Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 464 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

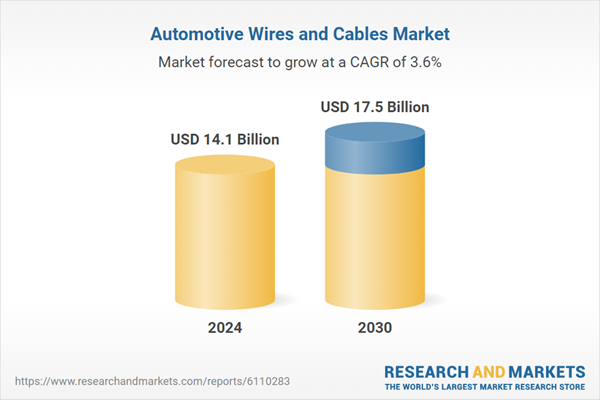

| Estimated Market Value ( USD | $ 14.1 Billion |

| Forecasted Market Value ( USD | $ 17.5 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |