Speak directly to the analyst to clarify any post sales queries you may have.

A strategic orientation to CubeSat evolution that frames technological maturation, stakeholder dynamics, and operational imperatives for decision-makers

The CubeSat landscape has matured from an academic curiosity to a strategic element within civil, commercial, and defense space programs, demanding a concise introduction that frames technological progress, stakeholder dynamics, and operational imperatives. This executive summary opens with an orientation to the contemporary ecosystem in which modularity, rapid iteration, and commoditization converge with rising expectations for mission reliability and regulatory compliance. While the original ethos of CubeSats emphasized low-cost access to space and hands-on education, today’s initiatives bridge laboratory prototypes and productionized flight systems, with greater emphasis on repeatable manufacturing, mission assurance, and end-to-end data services.This introduction highlights the broad set of actors shaping the sector: universities and research institutes driving experimentation and workforce development; commercial firms pursuing imagery, connectivity, and data analytics; government agencies deploying smallsats for environmental monitoring and reconnaissance; and nonprofit entities focused on STEM outreach and disaster response. It also acknowledges how technological enablers such as standardized bus architectures, modular payload interfaces, and improved ground segment automation have shifted expectations for deployability and lifecycle management. These trends are not isolated; they interact with supply chain architectures, export control regimes, and emerging tariff landscapes that together influence procurement choices and program risk.

In placing CubeSat developments into strategic context, this introduction emphasizes the need for cross-functional coordination across engineering, procurement, legal, and mission operations. As programs transition from single-mission prototypes to constellation-scale services or recurring university flights, decision-makers must reconcile trade-offs between responsiveness, cost discipline, and resilience against geopolitical and component-level disruptions. The opening thus sets the stage for deeper analysis across transformative trends, tariff impacts, segmentation insights, regional differentiation, corporate strategies, and actionable recommendations that follow.

How miniaturization, standardization, and distributed constellation strategies are redefining mission design, supply chains, and regulatory priorities across the CubeSat ecosystem

The CubeSat sector is experiencing transformative shifts that are reshaping how missions are conceived, executed, and sustained across economic and institutional boundaries. Advances in subsystem miniaturization and commercial off-the-shelf integration have enabled ever more capable payloads to ride on smaller platforms, while parallel progress in onboard computing and software-defined radios has permitted mission functions to be reallocated in orbit through software updates. At the same time, trends in standardization-both in mechanical form factors and electrical interfaces-have accelerated supply chain specialization and allowed new entrants to build upon interoperable building blocks rather than reinventing core subsystems.Another major inflection is the proliferation of distributed architectures and mesh-like constellations that rely on coordinated inter-satellite links and automated ground station networks. As constellations scale, emphasis shifts from individual satellite performance toward system-level considerations such as crosslink latency, distributed tasking, and aggregate data throughput. Complementing these technical shifts are growing investments in end-to-end mission assurance, where in-orbit validation and component-level testing reduce operational surprises. Propulsion and attitude control technologies are moving from niche options to mission enablers, expanding the operational envelope for smallsats into more complex orbits and controlled de-orbiting scenarios.

Regulatory and commercialization dynamics are evolving in tandem. Policymakers are refining debris mitigation rules, frequency allocations, and export control frameworks, which in turn influence design choices and supplier selection. Commercial models are also shifting from one-off missions and academic demonstrations toward recurring service offerings, satellite-as-a-service propositions, and vertical integration with analytics and downstream data monetization. These combined shifts demand that organizations adopt flexible procurement strategies, robust supplier ecosystems, and clear governance models to capture the strategic upside while managing operational and compliance risk.

Assessment of how 2025 tariff measures have reshaped procurement strategies, supplier localization, and supply chain resilience for small satellite programs

The introduction of United States tariffs in 2025 has generated a complex set of downstream effects across supply chains, procurement practices, and program planning for CubeSat stakeholders. Tariff adjustments have altered the relative economics of certain components and subsystems, prompting engineering and sourcing teams to reassess supplier footprints and to prioritize supply chain resilience. In practice, organizations are responding by identifying functionally equivalent components from alternative geographies, increasing qualified supplier lists, and accelerating qualification cycles to avoid single-sourced vulnerabilities.Beyond immediate sourcing shifts, the tariff environment has also amplified attention to lifecycle costs and to the logistics of cross-border manufacturing. For hardware integrators and platform providers, the tariff regime has raised the salience of local content strategies, localized assembly, and nearshoring for critical subsystems such as flight computers, power systems including batteries and solar panels, and RF transceivers. In parallel, firms are placing greater emphasis on contract clauses that hedge against tariff volatility, including indexed pricing and contingency inventories for long-lead items.

Operationally, mission planners have had to account for longer procurement lead times for certain parts and for potential compliance requirements tied to export controls and dual-use technologies. This has affected program timelines and has pushed some organizations toward more modular architectures that allow late-stage substitution of components without broad requalification. From a strategic perspective, the tariff landscape has made partnerships and vertical integration more attractive for entities seeking to secure predictable access to critical components and to retain control over quality and schedule. Consequently, risk-aware managers are balancing the short-term pressures of cost and availability with longer-term investments in supplier development, second-sourcing, and component-level validation to minimize program disruption.

Integrated segmentation insights mapping application, end-user, unit size, orbital regime, platform subsystems, and propulsion trade-offs that drive design and commercial strategy

A granular segmentation analysis reveals differentiated demands and technical requirements across application domains, user cohorts, spacecraft classes, orbital regimes, platform components, and propulsion choices, each shaping design priorities and commercial models in distinct ways. Based on application, communication missions emphasize sub-band selection and link budgets that vary significantly across S-Band allocations for data relay and telemetry, UHF profiles optimized for short-range communication, VHF uses for amateur radio engagement, and X-Band options that support inter-satellite links and satellite internet services. Earth observation missions differentiate by sensor modality, where hyperspectral imaging targets environmental monitoring and mineral exploration, multispectral sensors prioritize agricultural monitoring, mineral exploration, and vegetation mapping, and optical and radar imaging meet bespoke requirements for spatial resolution and revisit cadence. Education missions are oriented toward training programs and university missions, the latter often implemented as hands-on CubeSat workshops, while scientific research payloads address biological experiments such as cell growth studies, physics experiments focused on microgravity effects, and space environment monitoring. Technology demonstrations center on component testing and in-orbit validation, with emphasis on solar panel validation within component testing streams.Considering end users, academic actors-comprising universities and research institutes that produce scientific publications-typically prioritize low-cost platforms, ease of integration, and educational impact. Commercial customers including data analytics firms, earth observation providers, and telecom operators emphasize repeatability, data quality, and service-level agreements; among these, data analytics firms apply satellite-derived inputs to agriculture analytics and consumer insights, imagery service providers monetize processed imagery, and telecom operators pursue satellite internet services. Government entities include civil agencies focused on environmental monitoring as well as defense programs oriented toward reconnaissance, while nonprofits engage through educational foundations driving STEM outreach and NGOs using smallsat data for disaster response.

Unit size choices present a spectrum of trade-offs: 1U through 6U platforms offer different payload capacity, power budgets, and launch accommodation, while platforms larger than 6U-such as 12U and 16U configurations-enable more complex instrumentation and higher-capability communication payloads. Orbit selection further constrains design, with deep space and interplanetary missions imposing radiation and autonomy requirements, GEO offering stationary orbits for persistent coverage, LEO variants including equatorial, polar, and sun-synchronous orbits affecting revisit and illumination profiles, and MEO navigation orbits dictating precision timing and radiation hardness considerations.

From a platform component perspective, bus subsystems such as onboard computers and power systems-where onboard computing often encompasses flight software and power incorporates batteries and solar panels-drive margin and redundancy planning; ground station elements like antennas and tracking software, including parabolic dishes and automated control systems, shape data latency and operational cadence; payloads span communication payload elements like transceivers and instruments including camera modules and spectrometers; and software services cover data processing via analytics platforms and mission control through command and control systems. Finally, propulsion system selection ranges from chemical options with bi-propellant and mono-propellant variants to cold gas approaches using nitrogen and electric systems such as Hall effect thrusters, while many missions elect to launch without propulsion, each choice affecting delta-v budgets, lifetime, and decommissioning strategies.

Taken together, these segmentation dimensions form an interconnected design space where decisions in one domain-such as choosing a 3U versus a 6U platform-have cascading implications for power budgeting, payload selection, ground segment needs, and regulatory compliance. Consequently, mission architects and commercial strategists must evaluate segmentation trade-offs holistically to align technical choices with user expectations and business models.

Regional differentiation in supply chains, regulatory frameworks, and industrial capabilities that determines strategic priorities and partnership models for CubeSat programs

Regional dynamics materially influence technology adoption patterns, industrial capabilities, regulatory frameworks, and customer demand across the CubeSat ecosystem. In the Americas, a mature mix of academic capability, commercial entrepreneurship, and robust government contracting infrastructure supports rapid prototyping, iterative mission cycles, and a strong downstream market for data analytics and satellite services. This region benefits from concentrated supplier ecosystems for flight hardware and software, an active launch services market, and established regulatory institutions that enable public-private collaboration, but it also contends with export control regimes and tariff dynamics that shape sourcing and international partnerships.Europe, the Middle East & Africa present a heterogeneous environment in which advanced research centers, national space agencies, and emerging commercial players coexist. This region places a premium on regulatory harmonization, spectrum coordination, and orbital sustainability standards, while its industrial base supports specialized components, niche payload expertise, and growing commercial earth observation capabilities. Collaboration frameworks across national borders and a focus on environmental monitoring use cases create opportunities for consortium-based missions and public-good applications, though market fragmentation and differing procurement models can complicate scalability.

Asia-Pacific is characterized by rapid capability expansion, strong manufacturing capacity, and aggressive investment into satellite communications and imagery services. This region is notable for integrating manufacturing scale with lower-cost production, enabling nearshoring and component diversification for global programs. In addition, several national and regional initiatives prioritize constellation deployment and commercial services, resulting in heightened demand for repeatable platforms, ground infrastructure, and analytics pipelines. Nevertheless, tensions around trade policy, export controls, and tariff measures can introduce uncertainty for multinational supply chains, motivating firms to pursue geographically diversified sourcing strategies and localized assembly to ensure continuity of operations.

Across all regions, differences in launch access, regulatory clarity, and commercial ecosystems create distinct opportunity sets. Effective regional strategies therefore balance local partnerships, compliance planning, and targeted investments to capitalize on regional strengths while insulating programs from geopolitical and supply-side shocks.

How strategic specialization, vertical integration, and cross-industry partnerships shape competitive advantage and resilience among small satellite companies

Competitive dynamics among companies operating in the CubeSat domain reveal a spectrum of strategies ranging from vertical integration and platform specialization to service-oriented models and strategic partnerships. Some organizations focus on refining the core bus, developing robust onboard computers, power systems, and flight software to offer turnkey platforms that reduce integration risk for downstream customers. Others concentrate on payload development, offering high-value imaging modules, spectrometers, or advanced communication payloads that can be integrated into multiple bus architectures. Still others occupy the services layer, converting raw telemetry and imagery into actionable analytics and subscription services for agriculture, environmental monitoring, and telecommunications.Partnership structures are central to scaling capabilities, with hardware vendors collaborating with ground segment providers and analytics firms to deliver end-to-end service propositions. Strategic joint ventures and supplier development programs emerge as pragmatic responses to tariff and export-control pressures, enabling firms to localize production, secure supply chains, and preserve access to critical technologies. Startups often differentiate through rapid iteration, open-source toolchains, and innovative testing approaches, while more established players lean on production discipline, certification experience, and government contracting relationships to defend sustained revenue streams.

Investment patterns also influence competitive positioning. Companies that allocate resources to in-orbit validation, rigorous environmental testing, and formalized quality systems are better positioned to serve customers with demanding assurance requirements. Conversely, firms that concentrate on low-cost, rapid-turn educational missions preserve important market segments but may struggle to compete where reliability and long-term service commitments matter. Overall, an effective company strategy blends technical excellence, resilient supply chain design, and clear customer value propositions to navigate a landscape where mission requirements and regulatory conditions are continuously evolving.

Practical strategic actions for leaders to harden supply chains, adopt modular architectures, and align compliance and commercial strategies for sustained program resilience

Industry leaders must act decisively to translate insights into operational measures that secure supply chains, accelerate product-market fit, and protect mission continuity in the face of geopolitical and regulatory change. First, organizations should prioritize supplier diversification and qualification programs that reduce dependence on single-source components, with particular focus on flight-critical subsystems such as flight computers, power storage and generation, and RF transceivers. Near-term actions can include establishing secondary suppliers, creating modular interfaces that allow late-stage component swaps, and investing in strategic inventory for long-lead items to smooth production schedules.Second, program managers should adopt modular system architectures and standardized interfaces that enable incremental technology insertion and mitigate requalification costs. By designing payload and bus interfaces that support plug-and-play substitutions, teams can maintain schedule momentum even when individual component availability is disrupted. Third, teams should invest in robust compliance and export-control expertise to ensure that international partnerships and procurement strategies align with evolving tariff and regulatory landscapes. This includes scenario planning for tariff contingencies, contractual protections, and proactive engagement with regulatory authorities where appropriate.

Fourth, commercial organizations should develop vertically aligned service propositions that combine hardware, ground infrastructure, and analytics to capture higher-value revenue streams and to retain customers through integrated offerings. Investing in mission assurance and in-orbit validation pathways bolsters credibility with government and commercial customers who demand predictable performance. Finally, leaders should foster cross-functional collaboration across engineering, procurement, legal, and commercial units to accelerate decision-making, institutionalize lessons from past disruptions, and embed resilience into program governance. Collectively, these measures enable organizations to reduce operational fragility, seize strategic opportunities, and sustain growth trajectories in an increasingly complex environment.

A multi-method research framework combining primary interviews, secondary technical sources, and rigorous triangulation to validate CubeSat sector insights and limitations

The research underpinning this executive summary synthesizes multi-method approaches designed to ensure robustness, triangulation, and transparency in insight generation. Primary research consists of structured interviews with technical leaders, procurement managers, and program directors across academia, commercial firms, government agencies, and nonprofit organizations, complemented by practitioner workshops and debriefs to validate emergent themes. Secondary research draws on technical literature, regulatory filings, patent disclosures, and publicly available program documentation to contextualize technological trends and to corroborate first-hand accounts.Analytical steps include systematic segmentation mapping across application domains, end users, unit sizes, orbital regimes, platform components, and propulsion systems to reveal cross-cutting design constraints and commercial implications. Data triangulation procedures reconcile qualitative interview findings with secondary evidence to identify consistent patterns and to surface areas of divergence for further inquiry. Quality assurance protocols encompass cross-review by domain specialists, verification of technical claims against engineering documentation, and sensitivity checks to ensure that conclusions are not overly reliant on any single data source.

Ethical considerations and limitations are explicitly acknowledged: proprietary program details and classified projects are excluded from analysis, and anonymization procedures were applied to participant quotes and organizational references where requested. The methodology is designed to be reproducible and audit-ready, with a documented chain of evidence for key assertions and a clear account of assumptions guiding interpretive judgments. Stakeholders seeking deeper methodological transparency can request the methods appendix and interview protocols to assess alignment with their internal standards and to inform independent validation efforts.

Synthesis of technical, operational, and strategic imperatives that guide stakeholders toward resilient CubeSat deployment and long-term value creation

In conclusion, CubeSats have progressed into a strategic domain where technical innovation, supply chain design, regulatory navigation, and commercial model evolution intersect. The sector’s momentum is driven by advances in miniaturization, modular design, and software-defined capabilities that expand mission possibilities across communications, earth observation, education, research, and technology validation. However, new variables such as tariff measures, export-control complexities, and the demands of constellation-scale operations require organizations to recalibrate procurement, engineering, and partnership strategies to maintain operational continuity and to unlock long-term value.Decision-makers must therefore balance rapid innovation with disciplined program management: prioritize resilient supplier networks, embrace modularity to reduce requalification costs, and invest in mission assurance to meet the expectations of institutional customers. Regional dynamics further underscore the need for tailored approaches that reflect local industrial strengths and regulatory contexts. Companies that combine technical rigor with strategic foresight-aligning product roadmaps to customer needs while embedding compliance, quality assurance, and contingency planning-will be best positioned to lead in this evolving landscape.

Ultimately, the transition from experimental missions to scalable services will depend on the sector’s ability to institutionalize best practices in engineering, procurement, and governance. By acting now to shore up supply chains, standardize interfaces, and broaden commercial offerings, stakeholders can both mitigate near-term disruptions and create the foundation for durable growth and mission impact.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China CubeSat Market

Companies Mentioned

The key companies profiled in this CubeSat market report include:- AAC Clyde Space AB

- Astrocast SA

- Berlin Space Technologies GmbH

- Blue Canyon Technologies, Inc. by Raytheon Technologies

- Busek Co. Inc.

- CU Aerospace

- DHV TECNOLOGIA ESPACIAL AVANZADA MALAGUEÑA, S. L.

- EnduroSat

- G.A.U.S.S. Srl

- GomSpace A/S

- Innovative Solutions in Space B.V.

- Lockheed Martin Corporation.

- NanoAvionics UAB

- OHB SE

- Planet Labs PBC

- Sierra Nevada Corporation

- Spire Global, Inc.

- Surrey Satellite Technology Limited

- Terran Orbital Corporation

- The Boeing Company

- Tyvak Nano-Satellite Systems, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2026 |

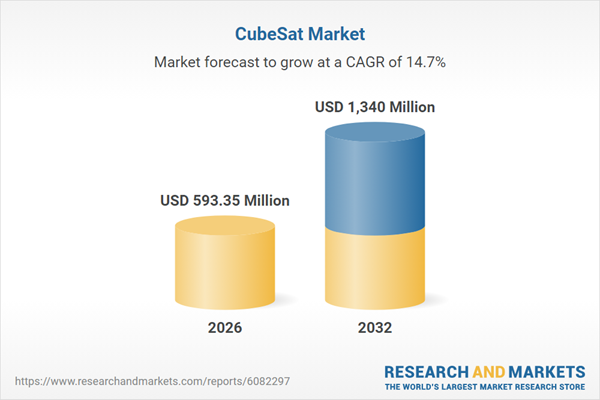

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 593.35 Million |

| Forecasted Market Value ( USD | $ 1340 Million |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |