Speak directly to the analyst to clarify any post sales queries you may have.

Pioneering Thermoses Applications and Consumer Expectations Fueling Unprecedented Demand in Versatile Temperature Management Solutions Across Diverse End Uses

The thermoses market is witnessing unprecedented momentum as consumers and businesses alike seek reliable solutions for temperature retention across various environments. Shifts in lifestyle dynamics, workplace cultures, and outdoor recreational habits have driven heightened demand for high-performance thermal containers. As a result, manufacturers are challenged to combine advanced insulation technologies with ergonomic design and sustainable materials to meet evolving expectations.In response to this scenario, stakeholder priorities have expanded beyond basic utility to encompass brand experience, customization, and environmental responsibility. Leading companies are increasingly investing in research and development to introduce thinner yet more effective insulation layers that optimize portability without compromising durability. At the same time, end users are demonstrating a willingness to pay a premium for products that align with broader wellness and eco-conscious values.

Looking ahead, the interplay of consumer empowerment, technological innovation, and regulatory pressures will determine the pace and shape of future market developments. As organizations navigate this dynamic landscape, understanding foundational drivers and emerging trends is critical for formulating strategies that capture new growth opportunities and reinforce brand differentiation.

Transformative Shifts in Thermoses Manufacturing, Consumer Engagement Models, and Sustainability Imperatives Reshaping Industry Dynamics

Recent years have seen the thermoses industry undergo transformative shifts driven by advances in material science, manufacturing processes, and consumer engagement models. One of the most significant changes involves the integration of smart features such as temperature monitoring sensors and connected mobile applications, enabling users to manage and track their beverages and food items remotely. These innovations are redefining user interaction by blending convenience with precision control.Parallel to technological enhancements, sustainability considerations are reshaping product development priorities. Manufacturers are exploring bio-based plastics, recyclable stainless steel alloys, and low-energy production techniques to mitigate environmental impact. This shift reflects growing consumer demand for transparent supply chains and minimal waste footprints, prompting strategic alliances between material suppliers and design houses. Consequently, the market landscape is becoming more collaborative and innovation-driven.

Moreover, digital customization platforms are empowering end users to personalize thermoses through color choices, engraving services, and modular accessories. This trend is fostering direct-to-consumer relationships, enabling brands to gather real-time feedback and iterate faster. As a result, market participants are transitioning from traditional mass production models toward agile, consumer-centric approaches that deliver differentiated value propositions.

Evaluating the Cumulative Effects of United States Tariffs on Import Costs Supply Chain Resilience and Competitive Pricing Strategies

The implementation of new U.S. tariffs in 2025 has introduced a complex set of challenges that reverberate throughout the thermoses supply chain. Import duties applied to certain metal components and finished goods have elevated landed costs for manufacturers relying on global sourcing, compelling them to revisit procurement strategies. Consequently, procurement teams are actively exploring nearshoring and vertical integration to buffer against tariff-induced price pressures.In parallel, distribution partners have begun renegotiating contractual terms to offset margin contractions, leading to adjustments in pricing strategies across both online and offline channels. These developments have underscored the importance of supply chain resilience and cost transparency. As a result, leading organizations are accelerating digital transformation initiatives to gain end-to-end visibility and optimize logistics networks in real time.

Looking forward, the cumulative impact of tariff policies will hinge on the industry's ability to adapt through strategic supplier diversification and process automation. Companies that invest in advanced manufacturing technologies and cultivate closer relationships with regional partners are likely to mitigate exposure to geopolitical volatility. This proactive stance will be essential in preserving competitive pricing while maintaining product quality and delivery performance.

In-Depth Segmentation Perspectives Revealing Product Types Materials Capacities Technologies Shapes Channels Applications and Industry Use Cases

An in-depth segmentation analysis reveals the breadth of the thermoses market, encompassing diverse product types, materials, and end-use requirements. When examining product type, the market encompasses air insulated, foam insulated, single-wall, and vacuum insulated offerings, with the latter subdivided into double-wall vacuum and single-wall vacuum models. Material choices range from ceramic and glass to plastic and stainless steel, each presenting unique benefits in terms of durability, thermal retention, and consumer perception.Capacity considerations further diversify the landscape, spanning volumes up to 500 milliliters through increments of 500 milliliters to one liter, one to two liters, and sizes above two liters. Technological differentiation emerges through electric and manual options, appealing to both high-tech aficionados and users seeking simplicity. Shape profiles include bottles, cylinders, flasks, jugs, and tumblers, catering to aesthetic preferences and functional requirements.

Distribution channels bifurcate into offline retail-comprising departmental stores, specialty shops, and supermarkets and hypermarkets-and online retail via brand websites and e-commerce platforms. Applications extend from cold and hot beverages to food storage, medical contexts, and outdoor and travel uses. End-user industries span commercial environments such as cafes, hotels, and restaurants; household settings; industrial operations; and institutional contexts including offices and schools. This layered segmentation provides a strategic framework for identifying niche opportunities and tailoring value propositions.

Strategic Regional Insights Highlighting Americas Europe Middle East Africa and Asia Pacific Growth Drivers and Market Nuances

Regional dynamics exert a profound influence on the thermoses market, shaped by cultural preferences, economic conditions, and infrastructure development. In the Americas, a convergence of outdoor lifestyle trends and health awareness drives demand for rugged, high-performance thermal containers suitable for adventure sports and daily routines. Meanwhile, premiumization is on the rise as consumers gravitate toward artisanal and eco-friendly designs.Across Europe, the Middle East and Africa, evolving urbanization patterns and green regulatory frameworks are propelling innovation in materials and waste reduction. Market participants are leveraging local craftsmanship and sustainable sourcing to differentiate their offerings. In regions characterized by extreme climates, thermoses serve dual roles in beverage transportation and field operations, reinforcing their utility in both commercial and household segments.

In the Asia-Pacific arena, rapid economic growth and expanding distribution networks underpin escalating demand across multiple applications. Digital adoption is particularly pronounced, with e-commerce platforms facilitating direct consumer outreach and enabling smaller brands to establish a foothold quickly. Additionally, integration with lifestyle influencers and social media campaigns is accelerating brand visibility, making the region a hotbed for disruptive market entrants.

Key Industry Players Driving Innovation Growth and Collaborations in the Thermoses Market Ecosystem Across Global and Regional Levels

The competitive landscape of the thermoses market is marked by a combination of established global brands and agile regional players. Industry veterans such as Stanley and Thermos LLC continue to defend their market positions through continuous product innovation and robust distribution networks. These companies emphasize heritage branding while adapting to modern consumer demands with eco-friendly materials and smart features.Meanwhile, premium specialty brands like Zojirushi and Hydro Flask are expanding their portfolios to include customized accessories and limited-edition designs, thereby reinforcing brand loyalty and command higher price points. Agile start-ups and local manufacturers are leveraging digital marketing and direct-to-consumer models to challenge incumbents in niche segments, such as medical-grade containers and multipurpose food storage solutions.

Collaborations and strategic alliances are increasingly common as market participants seek to combine complementary strengths. Joint ventures with material science companies and partnerships with logistics providers enable faster product trials and more efficient global distribution. This ecosystem approach is fostering an environment where innovation and speed-to-market become critical competitive differentiators.

Actionable Strategic Recommendations Empowering Industry Leaders to Optimize Growth and Navigate Competitive Thermoses Market Challenges Effectively

To thrive in an increasingly competitive environment, industry leaders should focus on integrating sustainability into core value propositions from design through end-of-life. Prioritizing recyclable materials and circular economy principles not only mitigates regulatory risks but also resonates with eco-conscious consumers. At the same time, leveraging advanced manufacturing techniques such as additive manufacturing can shorten development cycles and reduce material waste.Strategic investments in digital platforms are crucial for enhancing customer engagement and operational efficiency. Companies should deploy predictive analytics to anticipate demand fluctuations and optimize inventory placement across distribution networks. In parallel, personalized marketing campaigns driven by consumer data can strengthen brand affinity and encourage repeat purchases.

Furthermore, fostering cross-functional collaborations with suppliers, technology partners, and research institutions will catalyze breakthrough innovations. By establishing open innovation ecosystems, organizations can accelerate the development of next-generation insulation materials and smart features. Ultimately, a balanced approach that aligns cost management, technological advancement, and sustainability will position industry leaders for robust long-term growth.

Comprehensive Research Methodology Integrating Primary Interviews Secondary Research and Rigorous Validation for Thermoses Market Analysis

This analysis draws upon a comprehensive research methodology designed to ensure depth, accuracy, and actionable insights. Primary research was conducted through structured interviews with manufacturers, distributors, and key opinion leaders, providing firsthand perspectives on emerging trends and operational challenges. These engagements were complemented by detailed surveys capturing qualitative and quantitative data on consumer behavior and purchasing drivers.Secondary research encompassed an exhaustive review of industry publications, regulatory filings, and trade association reports. Publicly available financial disclosures and company presentations were analyzed to map competitive strategies and investment priorities. Market trends were further validated through cross-referencing third-party logistics data and customs statistics to track supply chain flows and tariff impacts.

Research findings underwent rigorous validation through triangulation, ensuring that insights are corroborated by multiple data sources. Analytical frameworks such as SWOT and Porter's Five Forces were applied to assess market attractiveness and competitive intensity. This multilayered approach provides stakeholders with a robust foundation for strategic decision-making grounded in empirical evidence and expert interpretation.

Conclusive Reflections on Thermoses Market Trajectories Highlighting Core Insights Strategic Imperatives and Future Outlook

In concluding this executive summary, it is clear that the thermoses market stands at the intersection of technological innovation, sustainability imperatives, and shifting consumer lifestyles. Insulation advancements and smart integrations are redefining product expectations, while tariff dynamics and regional nuances introduce both challenges and opportunities. Companies that proactively adapt their sourcing strategies and embrace digital transformation will strengthen their resilience in volatile environments.Segmentation insights underscore the importance of tailoring product offerings across multiple dimensions-from capacity and shape to distribution channels and end-use applications. Regional intelligence reveals distinct growth drivers, highlighting the need for localized strategies that resonate with market-specific preferences. Key players are leveraging collaborations and premiumization to secure leadership positions, setting the stage for an increasingly competitive ecosystem.

Ultimately, strategic agility, combined with a commitment to environmental stewardship and customer-centricity, will determine which organizations emerge as frontrunners. By capitalizing on emerging trends and leveraging data-driven insights, industry participants can unlock new avenues for innovation and sustained growth in the global thermoses market.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Air Insulated

- Foam Insulated

- Single-wall

- Vacuum Insulated

- Double Wall Vacuum

- Single Wall Vacuum

- Material

- Ceramic

- Glass

- Plastic

- Stainless Steel

- Capacity

- 1 - 2 Liters

- 500 ml - 1 Liter

- Above 2 Liters

- Up to 500 ml

- Technology

- Electric

- Manual

- Shape

- Bottle

- Cylinder

- Flask

- Jug

- Tumbler

- Distribution Channel

- Offline Retail

- Departmental Stores

- Specialty Stores

- Supermarkets & Hypermarkets

- Online Retail

- Brand Websites

- E-commerce

- Offline Retail

- Application

- Cold Beverages

- Food Storage

- Hot Beverages

- Medical

- Outdoor & Travel

- End-User Industry

- Commercial

- Cafes

- Hotels

- Restaurants

- Household

- Industrial

- Institutional

- Offices

- Schools

- Commercial

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Anhui Fugaung Life Technology Co. Ltd.

- Crown Manufacturing Corporation

- EMSA

- Eternal

- Haers Vacuum Containers Co., Ltd.

- Helen of Troy Limited

- Icy Hot Hydration Inc.

- Intercultural S.A.

- ISOSTEEL Deutschland GmbH

- KINTO Co., Ltd.

- Klean Kanteen, Inc.

- Laken Productos Deportivos S.A.

- Lifetime Brands, Inc.

- Midea Group

- Nanlong Group Co. Ltd.

- Newell Rubbermaid Inc.

- Nippon Sanso Holdings Group

- Panasonic Corporation

- PT Thermos Indonesia Trading

- Thermos L.L.C.

- Tiger Corporation

- ZHE JIANG HAERS VACUUM CONTAINERS Co. Ltd.

- Zojirushi Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Thermoses market report include:- Anhui Fugaung Life Technology Co. Ltd.

- Crown Manufacturing Corporation

- EMSA

- Eternal

- Haers Vacuum Containers Co., Ltd.

- Helen of Troy Limited

- Icy Hot Hydration Inc.

- Intercultural S.A.

- ISOSTEEL Deutschland GmbH

- KINTO Co., Ltd.

- Klean Kanteen, Inc.

- Laken Productos Deportivos S.A.

- Lifetime Brands, Inc.

- Midea Group

- Nanlong Group Co. Ltd.

- Newell Rubbermaid Inc.

- Nippon Sanso Holdings Group

- Panasonic Corporation

- PT Thermos Indonesia Trading

- Thermos L.L.C.

- Tiger Corporation

- ZHE JIANG HAERS VACUUM CONTAINERS Co. Ltd.

- Zojirushi Corporation

Table Information

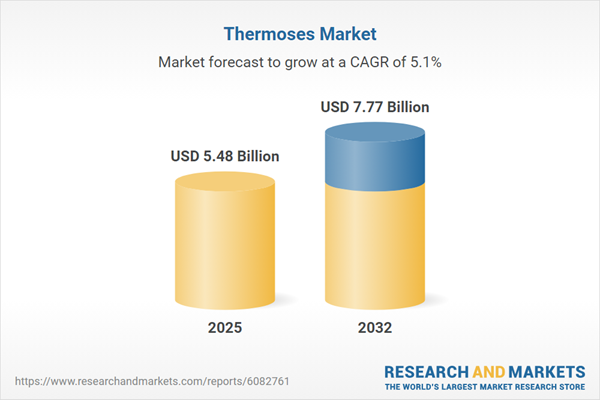

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 5.48 Billion |

| Forecasted Market Value ( USD | $ 7.77 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |