Global Inactivated Vaccines Market - Key Trends & Drivers Summarized

How Do Inactivated Vaccines Maintain Their Relevance in a Rapidly Evolving Immunization Landscape?

Inactivated vaccines, which contain pathogens that have been killed through chemical or physical processes, continue to serve as a cornerstone of global immunization efforts due to their robust safety profile and broad applicability. Unlike live-attenuated vaccines, inactivated formulations pose no risk of reversion to virulence, making them especially critical for immunocompromised individuals, the elderly, and pregnant women. These vaccines are widely used for diseases such as hepatitis A, rabies, polio (IPV), Japanese encephalitis, and influenza, with emerging relevance in pandemic preparedness scenarios.Their non-replicating nature means booster doses are often required, yet this trade-off is balanced by their ability to induce strong humoral immune responses with well-understood safety parameters. Governments and global health agencies continue to prioritize inactivated vaccines in their procurement strategies, particularly in regions where cold chain stability, regulatory acceptance, and public trust in vaccine safety are high priorities. Moreover, the role of inactivated vaccines in combination formulations - particularly in pediatric immunization schedules - is reinforcing their relevance across global markets.

What Technological Innovations Are Reshaping the Development and Delivery of Inactivated Vaccines?

A wave of innovation is enhancing the scalability, purity, and immunogenicity of inactivated vaccine platforms. Cell culture-based production methods, such as Vero and MDCK cell lines, are replacing traditional egg-based and animal-derived substrates, resulting in safer and more consistent manufacturing. These platforms are particularly useful for producing vaccines against polio, influenza, and rabies. Moreover, novel adjuvants like aluminum salts, MF59, and AS03 are being incorporated to amplify immune responses and reduce the number of required doses.Another critical advancement is the development of thermostable and lyophilized formulations, which are designed to maintain potency in high-temperature or low-resource settings. This is especially important in rural regions of Africa and Southeast Asia where cold chain logistics are difficult to maintain. In addition, digital tracking systems and smart packaging technologies are being integrated to ensure proper storage, traceability, and usage compliance. These improvements are not only optimizing vaccine logistics but also supporting global mass immunization campaigns, particularly during emergencies like pandemics or sudden disease outbreaks.

Which Disease Targets and Geographies Are Fueling Demand for Inactivated Vaccines?

Demand for inactivated vaccines is particularly strong in pediatric immunization programs and in infectious disease control initiatives across Asia-Pacific, Latin America, and parts of Africa. IPV is increasingly replacing oral polio vaccines as countries move into the final stages of polio eradication, while inactivated rabies vaccines are crucial in managing post-exposure prophylaxis in endemic countries. Seasonal influenza vaccination, which often relies on inactivated quadrivalent formulations, remains a major growth segment in North America and Europe, especially in aging populations and those with chronic diseases.Emerging infectious threats such as COVID-19 have also reignited global interest in inactivated vaccine platforms. Several COVID-19 vaccines developed using traditional inactivation methods have been deployed at scale in countries like China, India, and the UAE, showcasing the speed and scalability of this platform in crisis response. Additionally, zoonotic threats such as avian influenza and tick-borne encephalitis are further driving the development and deployment of inactivated vaccines for both human and veterinary applications. Public-private partnerships are supporting local manufacturing in lower-income nations, ensuring more equitable access to these vaccines across geographic and economic divides.

The Growth in the Inactivated Vaccines Market Is Driven by Several Factors…

It is driven by the increasing global focus on vaccine safety, particularly for use in vulnerable populations and immunocompromised individuals. Technological advancements in cell culture production and adjuvant development are improving the efficiency, potency, and scalability of inactivated vaccines, making them more suitable for both routine and emergency immunization campaigns. The rising prevalence of zoonotic diseases and emerging pandemics is also accelerating demand for flexible and rapid-response vaccine platforms, in which inactivated vaccines have proven critical.Additionally, policy shifts such as the transition from OPV to IPV in polio-endemic and transitioning countries are expanding the adoption base of inactivated formulations. Government-supported programs in rabies control, hepatitis A prevention, and pandemic influenza preparedness are further bolstering market growth, supported by Gavi, WHO, and regional health alliances. Increasing uptake of combination pediatric vaccines, including IPV and other inactivated components, is streamlining immunization schedules and improving compliance. The expansion of vaccine manufacturing infrastructure in developing regions, supported by technology transfer and international funding, is helping to reduce production costs and improve global supply security - further fueling the sustained growth of the inactivated vaccines market.

Report Scope

The report analyzes the Inactivated Vaccines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Vaccine Type (Viral Vaccine Type, Bacterial Vaccine Type); Inactivation Method (Solvent Detergent Method, Radiation Method, pH Concentration, Other Inactivation Methods); Administration Route (Oral, Subcutaneous, Intravenous); End-User (Hospitals End-User, Specialty Clinics End-User, Homecare Settings End-User, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Viral Vaccine segment, which is expected to reach US$35.3 Billion by 2030 with a CAGR of a 5.3%. The Bacterial Vaccine segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.3 Billion in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $11.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Inactivated Vaccines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Inactivated Vaccines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Inactivated Vaccines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bavarian Nordic A/S, Bharat Biotech International Ltd., Biological E Limited, BIO-MED Pvt. Ltd., Boehringer Ingelheim International GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Inactivated Vaccines market report include:

- Astellas Pharma Inc.

- Bavarian Nordic A/S

- Bharat Biotech International Ltd.

- Biological E Limited

- Boehringer Ingelheim International GmbH

- CanSino Biologics Inc.

- CSL Limited

- Daiichi Sankyo Company, Limited

- Emergent BioSolutions Inc.

- GlaxoSmithKline plc

- Hualan Biological Engineering Inc.

- Inovio Pharmaceuticals, Inc.

- Johnson & Johnson Services Inc.

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Novartis AG

- Novavax, Inc.

- Pfizer Inc.

- Sanofi Pasteur

- Serum Institute of India Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Astellas Pharma Inc.

- Bavarian Nordic A/S

- Bharat Biotech International Ltd.

- Biological E Limited

- Boehringer Ingelheim International GmbH

- CanSino Biologics Inc.

- CSL Limited

- Daiichi Sankyo Company, Limited

- Emergent BioSolutions Inc.

- GlaxoSmithKline plc

- Hualan Biological Engineering Inc.

- Inovio Pharmaceuticals, Inc.

- Johnson & Johnson Services Inc.

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Novartis AG

- Novavax, Inc.

- Pfizer Inc.

- Sanofi Pasteur

- Serum Institute of India Pvt. Ltd.

Table Information

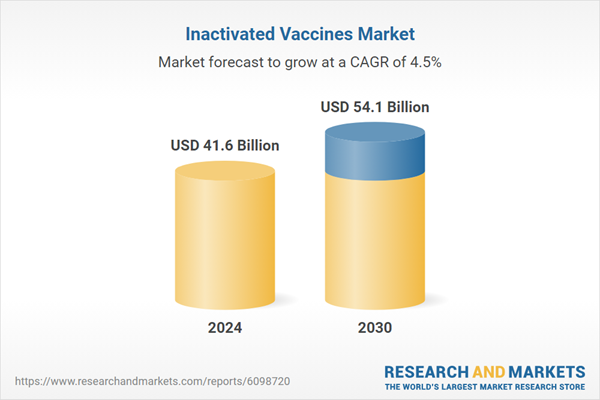

| Report Attribute | Details |

|---|---|

| No. of Pages | 468 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 41.6 Billion |

| Forecasted Market Value ( USD | $ 54.1 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |