Global “Renewable / Bio Jet Fuel” Market - Key Trends & Drivers Summarized

Why Is Renewable Jet Fuel Critical to Decarbonizing Global Aviation?

Renewable or bio jet fuel - commonly known as sustainable aviation fuel (SAF) - is emerging as the aviation sector's most viable path to achieving long-term climate goals. As aviation contributes roughly 2-3% of global CO2 emissions, reducing its carbon footprint is imperative to meet global climate commitments. Bio jet fuels, produced from feedstocks such as used cooking oil, animal fats, and agricultural waste, can reduce lifecycle emissions by up to 80% compared to conventional kerosene-based jet fuels. They are compatible with existing aircraft and infrastructure, making them a 'drop-in' solution requiring no major hardware changes. Airlines, regulators, and environmental groups increasingly view SAF as essential to achieving net-zero emissions by 2050.How Are Production Technologies and Feedstock Innovations Advancing the Market?

Technological advancements in biofuel refining and feedstock processing are critical to expanding SAF availability and affordability. Processes like HEFA (hydroprocessed esters and fatty acids), FT (Fischer-Tropsch), and ATJ (alcohol-to-jet) are being optimized to scale commercial output. New feedstock sources, such as algae and municipal solid waste, are being explored for their high yield and sustainability potential. Innovation in carbon capture and synthetic fuel technologies - often labeled as 'power-to-liquid' - is also gaining momentum. These breakthroughs are reducing production costs and increasing the energy density and performance consistency of SAF. Strategic collaborations between oil majors, tech firms, and airlines are accelerating the construction of bio-refineries and integrated SAF supply chains.Which Stakeholders Are Driving the Demand for Bio Jet Fuel Worldwide?

Airlines are at the forefront of SAF adoption, driven by environmental goals, fuel diversification strategies, and mounting regulatory pressure. Major carriers such as United, Lufthansa, and British Airways are entering long-term SAF procurement agreements to hedge against future carbon costs. Governments and regulatory bodies in the EU, U.S., and Asia are rolling out SAF blending mandates, tax incentives, and grants to boost market viability. Airport authorities, aircraft manufacturers, and logistics firms are also investing in SAF infrastructure and partnerships. Even corporate buyers, particularly in tech and finance, are supporting SAF purchases as part of their broader Scope 3 emissions reduction strategies. This multi-stakeholder momentum is vital to scale SAF adoption and reduce its cost premium.The Growth in the Renewable / Bio Jet Fuel Market Is Driven by Decarbonization Mandates, Blending Targets, and Aviation Sector Partnerships

The renewable jet fuel market is expanding due to a confluence of regulatory, technological, and corporate drivers. First, global climate mandates and net-zero aviation targets are pushing governments to implement SAF blending requirements and support SAF development through grants and policy frameworks. Second, airlines are proactively seeking low-emission fuel alternatives to meet carbon offset obligations and future-proof their operations. Third, advances in bio-refining technologies and expansion of feedstock availability are making SAF more scalable and cost-competitive. Fourth, strategic alliances between fuel producers, airlines, and governments are creating a cohesive ecosystem to support SAF growth. Lastly, increasing investor interest in green aviation and ESG metrics is reinforcing capital flows into SAF ventures, making renewable jet fuel a key growth frontier in global energy transition strategies.Report Scope

The report analyzes the Renewable / Bio Jet Fuel market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Conversion Pathways (Fischer-Tropsch Synthetic Paraffinic Kerosene, Hydroprocessed Esters & Fatty Acids, Synthetic Iso-paraffin from Fermented Hydroprocessed Sugar, Alcohol to Jet SPK); Feedstock (Agriculture Crops, Aquaculture Crops, Energy Crops, Multiple Solid Waste, Other Feedstocks).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fischer-Tropsch Synthetic Paraffinic Kerosene segment, which is expected to reach US$194.4 Billion by 2030 with a CAGR of a 16.2%. The Hydroprocessed Esters & Fatty Acids segment is also set to grow at 16.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $44.9 Billion in 2024, and China, forecasted to grow at an impressive 16.4% CAGR to reach $68.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Renewable / Bio Jet Fuel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Renewable / Bio Jet Fuel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Renewable / Bio Jet Fuel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Ablative Solutions, Inc., Biotronik SE & Co. KG, Boston Scientific Corporation, Cardiosonic Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Renewable / Bio Jet Fuel market report include:

- Airbus SE

- Alder Fuels

- BP p.l.c.

- Chevron Corporation

- DG Fuels

- Enerkem Inc.

- Eni S.p.A.

- ExxonMobil Corporation

- Gevo, Inc.

- LanzaJet, Inc.

- Neste Corporation

- OMV Aktiengesellschaft

- Repsol S.A.

- Shell plc

- Sinopec Corp.

- SkyNRG B.V.

- TotalEnergies SE

- Valero Energy Corporation

- Velocys plc

- World Energy, LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus SE

- Alder Fuels

- BP p.l.c.

- Chevron Corporation

- DG Fuels

- Enerkem Inc.

- Eni S.p.A.

- ExxonMobil Corporation

- Gevo, Inc.

- LanzaJet, Inc.

- Neste Corporation

- OMV Aktiengesellschaft

- Repsol S.A.

- Shell plc

- Sinopec Corp.

- SkyNRG B.V.

- TotalEnergies SE

- Valero Energy Corporation

- Velocys plc

- World Energy, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

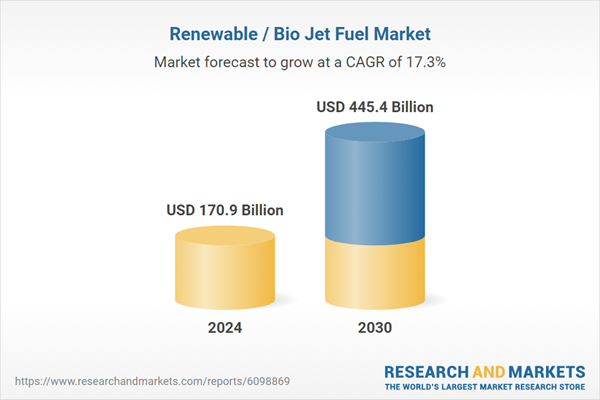

| Estimated Market Value ( USD | $ 170.9 Billion |

| Forecasted Market Value ( USD | $ 445.4 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | Global |