Global Clean Development Mechanism (CDM) Market - Key Trends & Drivers Summarized

Why Was the Clean Development Mechanism Introduced and How Has It Shaped Carbon Finance?

The Clean Development Mechanism (CDM) was established under the Kyoto Protocol as a market-based tool to facilitate greenhouse gas (GHG) emission reductions in developing countries while enabling industrialized nations to meet their climate commitments more cost-effectively. By allowing Annex I countries to invest in emission reduction projects abroad and earn Certified Emission Reductions (CERs), the CDM catalyzed cross-border climate finance, technology transfer, and sustainable development during its operational peak. At its height, the mechanism supported over 8,000 projects in more than 100 countries, spanning renewable energy, methane capture, energy efficiency, and reforestation.CDM's dual-purpose structure - combining climate mitigation with socio-economic benefits in host countries - made it a central component of the global carbon market throughout the 2000s. It created standardized methodologies for monitoring, reporting, and verification (MRV), which laid the foundation for broader carbon credit systems and compliance frameworks. Despite evolving regulatory debates, the CDM remains the most geographically diverse and institutionally mature emissions offset program, with an established infrastructure and historical data critical to the development of successor mechanisms under the Paris Agreement.

How Has the Market for CDM Credits Evolved Post-Kyoto and in the Context of the Paris Agreement?

Following the conclusion of the first commitment period of the Kyoto Protocol and the shift toward a more decentralized climate governance model under the Paris Agreement, the relevance of CDM has undergone major transitions. Demand for CERs declined significantly as new compliance regimes emerged and some countries imposed restrictions on the use of CDM credits. However, a renewed interest in voluntary and pre-2020 emission reduction claims - particularly in net-zero strategies and Article 6 pilot initiatives - has revived select segments of the CDM market.Some host countries are positioning their CDM project portfolios as legacy assets that can be transitioned or referenced in Article 6.4 mechanisms under the Paris Agreement. Additionally, corporations seeking to meet interim decarbonization targets are selectively purchasing high-quality CERs tied to sustainable development outcomes. While the formal future of CDM credits in international carbon markets remains under negotiation, secondary demand is emerging from entities valuing the historical environmental integrity and developmental co-benefits associated with verified CDM projects.

Which Sectors and Project Types Have Been Most Prominent Under the CDM Framework?

Renewable energy projects - including wind, hydro, biomass, and solar - have dominated CDM activity, particularly in China, India, and Brazil. These projects account for the majority of issued CERs and have played a pivotal role in improving energy access, reducing fossil fuel dependency, and promoting infrastructure development in host countries. Methane capture from landfills, coal mines, and wastewater treatment facilities has also featured prominently due to its high global warming potential and measurable climate impact.Energy efficiency, fuel switching, and industrial gas abatement projects (e.g., HFC-23 and N2O destruction) have yielded large volumes of CERs while often delivering immediate emissions reductions at relatively low cost. In recent years, attention has expanded toward afforestation/reforestation and programmatic CDM initiatives that aggregate multiple small-scale projects under a unified methodology. These efforts have deepened stakeholder engagement and broadened the social impact of climate finance, particularly in low-income and rural regions.

What Challenges and Criticisms Have Affected CDM Credibility and Market Functionality?

Despite its early success, the CDM has faced criticism related to additionality, baseline inflation, and uneven distribution of project benefits. Concerns have been raised over whether all projects truly represent emissions reductions that would not have occurred in the absence of CDM funding. Moreover, a concentration of projects in large emerging economies has prompted questions about equitable geographic representation and whether the mechanism has effectively supported least developed countries (LDCs).Market volatility and regulatory uncertainty - especially during the transition from the Kyoto to the Paris regime - have further undermined investor confidence and affected long-term viability of some CDM projects. Falling CER prices, limited secondary market liquidity, and the lack of demand in post-Kyoto compliance markets have led to project abandonment and underutilization of validated emissions reduction infrastructure. These dynamics have reinforced the need for robust governance, transparent methodologies, and clearer integration pathways into emerging climate finance frameworks.

Can the Clean Development Mechanism Evolve or Transition Into a Viable Tool Under the Paris Agreement's Article 6 Framework?

With Article 6 of the Paris Agreement introducing new carbon market mechanisms focused on cooperation and sustainable development, the future of the CDM is at a crossroads. There is growing debate over whether CDM infrastructure, methodologies, and project registries can be transitioned to support Article 6.4 activities or whether an entirely new system should be built from the ground up. For countries and corporations seeking continuity, leveraging existing CDM assets offers a pragmatic bridge toward broader carbon market alignment.Ultimately, the global carbon finance community must determine whether the CDM's legacy assets, institutional expertise, and project pipeline can be adapted to meet more rigorous transparency, accountability, and environmental integrity standards under the Paris framework. The defining question is: Can the Clean Development Mechanism be effectively modernized or integrated into next-generation carbon markets - serving as a transitional architecture that bridges historical mitigation with future ambition in a globally equitable and environmentally robust manner?

Report Scope

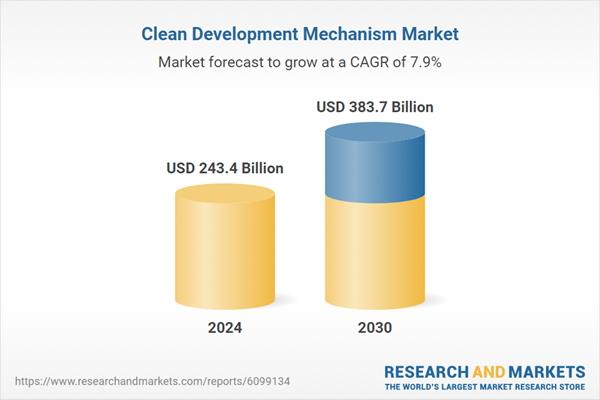

The report analyzes the Clean Development Mechanism market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Project Type (Renewable Energy, Energy Efficiency, Reforestation, Other Project Types); End-Use (Power & Energy, Manufacturing, Waste Management, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Renewable Energy Project segment, which is expected to reach US$176.5 Billion by 2030 with a CAGR of a 6%. The Energy Efficiency Project segment is also set to grow at 10.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $64 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $61.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clean Development Mechanism Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clean Development Mechanism Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clean Development Mechanism Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Beijing Lys Chemicals Co., Ltd., Berjé Inc., Central Drug House (CDH), Citrusvil S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Clean Development Mechanism market report include:

- AENOR International S.A.U

- Carbon Asset Management Sweden AB

- Carbon Check (India) Pvt. Ltd.

- CDM Smith Inc.

- City Developments Limited (CDL)

- CO2balance Ltd.

- Deloitte

- EcoSecurities

- Ernst & Young (EY)

- Gold Standard Foundation

- KPMG

- Marubeni Corporation

- Natural Capital Partners

- ONGC (Oil and Natural Gas Corporation)

- PricewaterhouseCoopers (PwC)

- RINA S.p.A.

- SouthSouthNorth

- TÜV SÜD South Asia Pvt. Ltd.

- Verra

- World Bank

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AENOR International S.A.U

- Carbon Asset Management Sweden AB

- Carbon Check (India) Pvt. Ltd.

- CDM Smith Inc.

- City Developments Limited (CDL)

- CO2balance Ltd.

- Deloitte

- EcoSecurities

- Ernst & Young (EY)

- Gold Standard Foundation

- KPMG

- Marubeni Corporation

- Natural Capital Partners

- ONGC (Oil and Natural Gas Corporation)

- PricewaterhouseCoopers (PwC)

- RINA S.p.A.

- SouthSouthNorth

- TÜV SÜD South Asia Pvt. Ltd.

- Verra

- World Bank

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 243.4 Billion |

| Forecasted Market Value ( USD | $ 383.7 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |