Global Personalized Cancer Medicines Market - Key Trends & Drivers Summarized

Why Is Personalized Cancer Medicine Redefining Therapeutic Pathways in Modern Oncology?

Personalized cancer medicine - also referred to as precision oncology - is revolutionizing cancer treatment by aligning therapeutic strategies with a patient's genetic profile, tumor molecular characteristics, and immune landscape. Unlike conventional one-size-fits-all chemotherapy, personalized therapies target specific mutations, biomarkers, or pathways that drive tumor growth. This approach improves efficacy, reduces adverse effects, and enables more durable responses, particularly in treatment-resistant or rare cancer subtypes. The emergence of genomic sequencing, biomarker discovery, and companion diagnostics has made precision medicine a practical and increasingly accessible reality.Oncology's transition toward personalization is being driven by the success of targeted therapies (e.g., EGFR, BRAF, ALK inhibitors), immune checkpoint inhibitors guided by PD-L1 expression, and next-generation treatments like CAR-T and TCR-T therapies. Liquid biopsies, circulating tumor DNA (ctDNA) assays, and AI-assisted diagnostic platforms are enabling real-time tumor monitoring and therapy customization. This patient-centric model is shifting clinical paradigms - from tumor location to molecular subtype - transforming clinical trial designs, drug pipelines, and regulatory frameworks around the world.

How Are Genomic Technologies and Biomarker-Based Diagnostics Enabling Precision Therapies?

The backbone of personalized cancer medicine lies in high-throughput genomic profiling, which identifies actionable mutations and guides targeted intervention. Technologies such as next-generation sequencing (NGS), whole-exome sequencing, RNA expression profiling, and proteomic analysis are being used to stratify patients for optimal therapy matching. These platforms are routinely applied in clinical settings to test for mutations in genes like BRCA1/2, KRAS, HER2, and NTRK - informing drug selection or trial eligibility.Companion diagnostics are playing a critical role in co-developing and validating therapies in tandem with targeted biomarker identification. AI and machine learning tools are being deployed to parse multi-omic data, identify rare mutation signatures, and simulate drug response. Moreover, real-time tumor profiling through liquid biopsy is enabling non-invasive monitoring of treatment response and early detection of resistance mechanisms. These technologies are reducing diagnostic delays, optimizing outcomes, and contributing to the emergence of adaptive therapy regimens in oncology.

Which Cancer Types and Healthcare Systems Are Leading in Precision Oncology Adoption?

Precision oncology is being adopted most aggressively in cancers with high mutational burden and well-characterized biomarkers. Lung cancer, melanoma, breast cancer, colorectal cancer, and hematologic malignancies (e.g., leukemia, lymphoma, multiple myeloma) are the most studied and treated using personalized approaches. Pediatric oncology, brain tumors, and rare cancers are also seeing breakthroughs through genome-guided treatments and repurposed targeted agents.North America dominates in adoption due to advanced genomic infrastructure, payer coverage of molecular diagnostics, and strong biotech-pharma integration. Europe follows closely with national genome projects and centralized cancer registries supporting precision treatment pathways. Asia-Pacific, particularly China and Japan, is rapidly scaling genomic testing and personalized therapy access through public-private partnerships and oncology innovation hubs. Low- and middle-income countries are beginning to integrate precision oncology into cancer control strategies through regional centers of excellence, international collaborations, and funding from global health organizations.

What Is Driving Long-Term Growth and Strategic Innovation in Personalized Cancer Medicines?

The growth in the personalized cancer medicines market is driven by the convergence of genomic science, data analytics, regulatory evolution, and unmet clinical needs. As cancer becomes the leading cause of death in many countries, the demand for therapies that offer higher specificity, improved survival rates, and reduced systemic toxicity is growing. Payers and regulators are increasingly supporting biomarker-linked reimbursement, while biopharma companies are reorienting pipelines around genetically defined subgroups.Strategically, investment is flowing into biomarker discovery, multi-omic data integration, and AI-based treatment planning tools. Collaborative ecosystems involving academic medical centers, genomic labs, startups, and global pharma are accelerating innovation in drug development and trial design. “Basket” and “umbrella” trials, real-world evidence (RWE) integration, and adaptive licensing models are enabling faster, data-rich product approvals. As oncology moves from population-based protocols to highly individualized treatment strategies, personalized cancer medicines will define the next frontier of therapeutic precision, patient empowerment, and oncology care transformation.

Report Scope

The report analyzes the Personalized Cancer Medicines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Personalized Medicine Diagnostics, Personalized Medicine Therapeutics); End-Use (Hospitals & Clinics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Personalized Medicine Diagnostics segment, which is expected to reach US$258 Billion by 2030 with a CAGR of a 12.2%. The Personalized Medicine Therapeutics segment is also set to grow at 8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $58.6 Billion in 2024, and China, forecasted to grow at an impressive 14.6% CAGR to reach $82 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Personalized Cancer Medicines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Personalized Cancer Medicines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Personalized Cancer Medicines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIG, Akko, Allianz, Assurant, Asurion and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Personalized Cancer Medicines market report include:

- AC Immune

- Agenus

- AstraZeneca

- BioNTech

- Bristol Myers Squibb

- Caris Life Sciences

- Epigene Labs

- Foundation Medicine

- Gilead Sciences

- Immatics

- Merck & Co.

- Myriad Genetics

- Novartis

- Pfizer

- Precision Medicine Group

- Regeneron Pharmaceuticals

- Roche

- SimBioSys

- Tempus AI

- Umoja Biopharma

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AC Immune

- Agenus

- AstraZeneca

- BioNTech

- Bristol Myers Squibb

- Caris Life Sciences

- Epigene Labs

- Foundation Medicine

- Gilead Sciences

- Immatics

- Merck & Co.

- Myriad Genetics

- Novartis

- Pfizer

- Precision Medicine Group

- Regeneron Pharmaceuticals

- Roche

- SimBioSys

- Tempus AI

- Umoja Biopharma

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 267 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

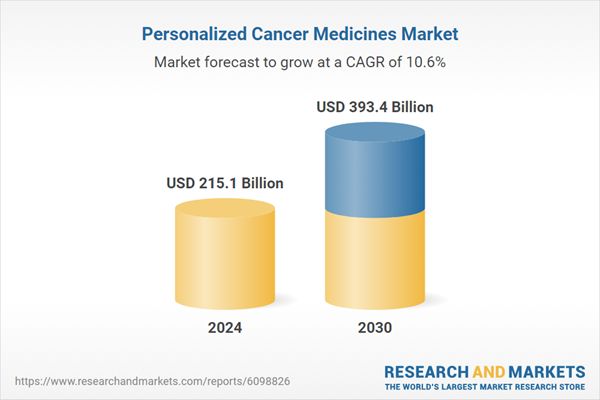

| Estimated Market Value ( USD | $ 215.1 Billion |

| Forecasted Market Value ( USD | $ 393.4 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |