Global Enterprise Communication Infrastructure Market - Key Trends & Drivers Summarized

Is the Digital Transformation Wave Reshaping Enterprise Communication Infrastructures?

The relentless surge in digital transformation across industries has acted as a significant catalyst in the evolution of enterprise communication infrastructures. As organizations pivot toward hybrid work environments, the demand for seamless, scalable, and secure communication systems has skyrocketed. Traditional telephony and siloed communication tools are giving way to unified communication and collaboration (UC&C) platforms that integrate voice, video, messaging, and file sharing into a single interface. This shift is not merely technological; it is strategic, enabling faster decision-making, real-time collaboration, and operational efficiency. Advanced cloud-based communication infrastructures, supported by APIs and software-defined architectures, are becoming the norm as they offer flexibility and rapid scalability. Businesses are investing in platform-as-a-service (PaaS) and communication-platform-as-a-service (CPaaS) models to customize and embed communication capabilities into workflows. Notably, the adoption of 5G and edge computing is amplifying the capabilities of enterprise communication systems, reducing latency and supporting real-time data processing. Enterprises are also integrating artificial intelligence (AI) for features like intelligent call routing, sentiment analysis, and automated transcriptions. These developments are not limited to large corporations - small and medium enterprises (SMEs) are actively transitioning to cloud-native systems to remain competitive. Moreover, the integration of Internet of Things (IoT) into enterprise networks has introduced new channels and complexity to communication ecosystems, prompting investments in robust infrastructure that can support both device-to-device and human-to-device communication.Can Security and Compliance Keep Pace with Next-Gen Communication Systems?

As communication infrastructures become more complex and interconnected, the challenges around data security, regulatory compliance, and identity management are intensifying. Enterprises handling sensitive customer data, intellectual property, and financial information are under constant pressure to ensure communication networks are fortified against cyber threats. With the rise of BYOD (Bring Your Own Device) policies and remote work, the security perimeter has expanded, necessitating more advanced and multi-layered security protocols. End-to-end encryption, Zero Trust architectures, and secure access service edge (SASE) models are being increasingly adopted to safeguard data flow within communication frameworks. Additionally, global regulatory environments - such as GDPR in Europe, HIPAA in the U.S., and region-specific data sovereignty laws - are influencing infrastructure design and vendor selection. Enterprises must now select solutions that offer built-in compliance mechanisms, auditing capabilities, and transparent data handling practices. Identity and access management (IAM) systems, especially those integrated with multi-factor authentication (MFA), are no longer optional - they are critical for preventing unauthorized access and ensuring traceability. As the lines blur between communication tools and business applications, the need to maintain compliance while providing a user-friendly experience becomes a balancing act. Vendors are responding with secure-by-design platforms that enable enterprises to scale communication capabilities without compromising integrity. The increasing incidence of sophisticated cyberattacks targeting communication platforms is reinforcing the need for proactive threat detection, continuous monitoring, and AI-driven anomaly detection, making security a key driver of infrastructure upgrades.How Are Industry-Specific Demands Shaping Communication Strategies?

Enterprise communication infrastructure is no longer a one-size-fits-all solution - it is becoming highly tailored to meet industry-specific requirements. In healthcare, for instance, HIPAA-compliant communication tools that enable secure video consultations and real-time data sharing between clinicians are essential. In finance, encrypted messaging and audit trails are critical to maintain trust and regulatory adherence. Meanwhile, in manufacturing and logistics, real-time communication between field staff, control centers, and supply chain partners is crucial for operations continuity. This level of specialization is fostering a trend toward modular communication platforms that can be easily customized for different business verticals. Enterprises in customer-centric industries like retail and hospitality are also leveraging omnichannel communication strategies - spanning chatbots, social media, and live agents - to enhance customer engagement and satisfaction. The education sector has seen a massive pivot to video conferencing and collaborative platforms that support hybrid learning models, demanding high bandwidth and secure access. In the public sector, communication systems are being modernized to support smart city initiatives and e-governance platforms. Furthermore, multilingual capabilities, accessibility features, and integration with enterprise resource planning (ERP) and customer relationship management (CRM) systems are being emphasized across industries. This verticalization of communication infrastructure is also spurring the growth of industry-specific vendors and niche solutions that address regulatory, operational, and user experience nuances unique to each domain.What's Powering the Momentum Behind the Market's Rapid Growth?

The growth in the enterprise communication infrastructure market is driven by several factors linked directly to technological advancements, evolving end-user needs, and shifting organizational dynamics. The rapid adoption of cloud-based solutions has emerged as a key enabler, allowing businesses to deploy scalable, cost-efficient communication platforms without heavy capital expenditure. The acceleration of remote and hybrid workforces globally has created sustained demand for tools that facilitate real-time collaboration, cross-geography communication, and team productivity. The proliferation of smart devices and sensors in the workplace has expanded communication touchpoints, necessitating infrastructures that can handle diverse data types and traffic volumes. End-users now demand seamless, omni-device communication experiences, prompting enterprises to invest in integrated solutions that unify messaging, video, and voice under a single framework. In parallel, generational shifts in the workforce - with digital-native employees expecting intuitive, mobile-first tools - are influencing IT purchase decisions. The rise of vertical-specific compliance requirements is pushing industries to adopt customized, secure platforms tailored to their regulatory environments. Moreover, strategic digital initiatives - like automation, AI-driven analytics, and IoT integration - are being built on communication infrastructures that can support rapid data exchange and intelligent interaction. The market is also being propelled by growing investments from both governments and private players in smart city infrastructure, 5G networks, and edge computing capabilities. Together, these trends are creating a robust ecosystem where communication infrastructure is not just a utility - but a strategic asset powering business innovation, resilience, and growth.Report Scope

The report analyzes the Enterprise Communication Infrastructure market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Public, Private, Hybrid); Deployment (On-Premise, Cloud); End-User (IT & Telecom, BFSI, Manufacturing, Healthcare, Retail, Government, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Public Sector segment, which is expected to reach US$135.4 Billion by 2030 with a CAGR of a 15.7%. The Private Sector segment is also set to grow at 17.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $27.8 Billion in 2024, and China, forecasted to grow at an impressive 21.6% CAGR to reach $55.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Enterprise Communication Infrastructure Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Enterprise Communication Infrastructure Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Enterprise Communication Infrastructure Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aboitiz Power Corporation, AltaRock Energy, Inc., Ansaldo Energia S.p.A., BESTEC GmbH, Calpine Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Enterprise Communication Infrastructure market report include:

- *astTECS

- Alcatel-Lucent Enterprise

- Arista Networks, Inc.

- AT&T Inc.

- Avaya LLC

- Cisco Systems, Inc.

- Crown Castle Inc.

- DXC Technology

- Ericsson AB

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Lumen Technologies, Inc.

- Microsoft Corporation

- NEC Corporation

- Orange S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- ZTE Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- *astTECS

- Alcatel-Lucent Enterprise

- Arista Networks, Inc.

- AT&T Inc.

- Avaya LLC

- Cisco Systems, Inc.

- Crown Castle Inc.

- DXC Technology

- Ericsson AB

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Lumen Technologies, Inc.

- Microsoft Corporation

- NEC Corporation

- Orange S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

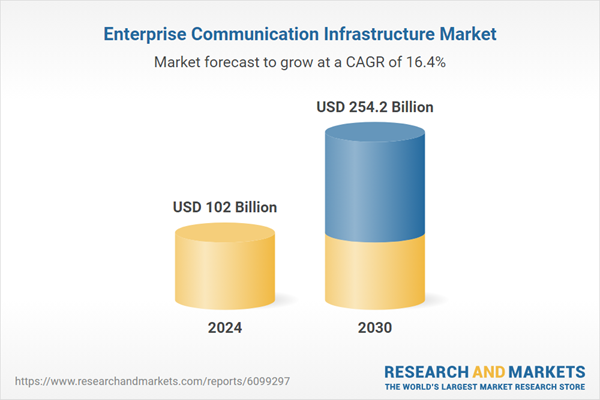

| Estimated Market Value ( USD | $ 102 Billion |

| Forecasted Market Value ( USD | $ 254.2 Billion |

| Compound Annual Growth Rate | 16.4% |

| Regions Covered | Global |